EUR/USD Current price: 1.0907

View Live Chart for the EUR/USD

Wednesday saw major pairs confined to tight ranges as investor's attention was centered in the outcome of the FOMC's meeting. And the US Federal Reserve surprised the markets with quite a hawkish tone, sending the greenback sharply higher across the forex board. The FOMC statement showed that officers acknowledge the latest weak employment figures, but they don't consider it to be a problem as the unemployment rate remains at record lows. Also, the Central Bank dropped the lines referring to international developments, while adding that they will discuss "whether it will be appropriate to raise the target at its next meeting." This is the first time the FED gives such a clear clue on a date, and despite they did not guarantee a rate hike for December, indeed they put it back in the table.The EUR/USD pair plunged over 150 pips in the first hour after the release, falling below the 1.0900 figure for the first time since early August. The extreme movement, however, shows no signs of reversing in the short term, as the 1 hour chart shows that the technical indicators remain in extreme oversold levels, whilst the price has retreated sharply from a bearish 100 DMA. In the 4 hours chart, the technical indicators maintain a strong bearish momentum, with the RSI indicator heading south around 22. The pair may consolidate some and even retreat partially, but the bearish trend is firm in place, now looking for a test of the base of these last months' range at 1.0840.

Support levels: 1.0880 1.0840 1.0800

Resistance levels: 1.0920 1.0960 1.1000

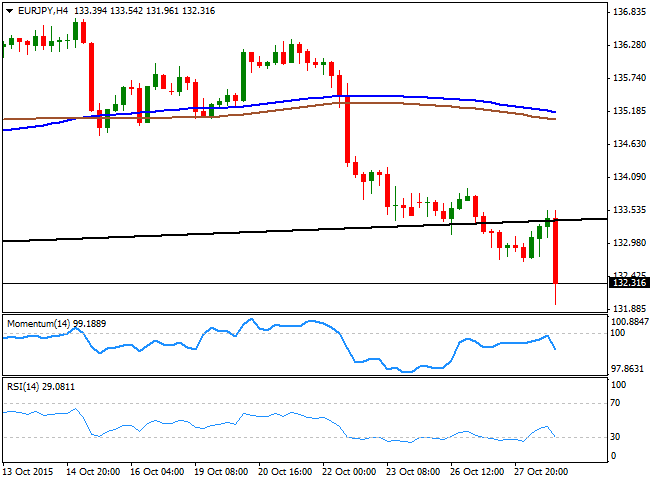

EUR/JPY Current price: 132.28

View Live Chart for the EUR/JPY

The EUR/JPY pair plunged to a fresh low of 131.96 on the back of EUR self weakness, having been unable to bounce sharply and maintaining the negative tone seen yesterday. Earlier in the day, the pair completed a pullback to the base of the symmetrical triangle broken last Tuesday before resuming its slide, further anticipating a bearish continuation. Short term, the 1 hour chart shows that the technical indicators have reached oversold levels, currently consolidating around them, whilst the 100 SMA has extended its decline well above the current level, now nearing the mentioned trend line in the 133.30/40 region. In the 4 hours chart, the technical indicators have been rejected from their mid-lines and present strong bearish slopes below their mid-lines, supporting a continued decline for this Thursday.

Support levels: 131.90 131.50 131.10

Resistance levels: 132.60 133.00 133.40

GBP/USD Current price: 1.5252

View Live Chart for the GPB/USD

The GBP/USD pair traded around the 1.5300 level for most of the European session, with no data released in the UK. The pair even spiked up to 1.5346 midday, but finally capitulated to dollar's momentum, falling down to 1.5247 post FED statement. The Pound's decline, however, has been limited compared to other currencies, given that the BoE is also in the tightening path, which means that any dollar's strength coming from the FED will be less notable in this particular pair. Nevertheless, the 1 hour chart shows that the pair is consolidating a few pips above the mentioned low, with the 20 SMA heading lower well above the current price and the technical indicators barely turning flat in oversold territory. In the 4 hours chart, however, the bearish potential is clearer, given that the price as failed to establish above a bullish 20 SMA, whilst the technical indicators have resumed their declines below their mid-lines.

Support levels: 1.5245 1.5210 1.5170

Resistance levels: 1.5285 1.5320 1.5355

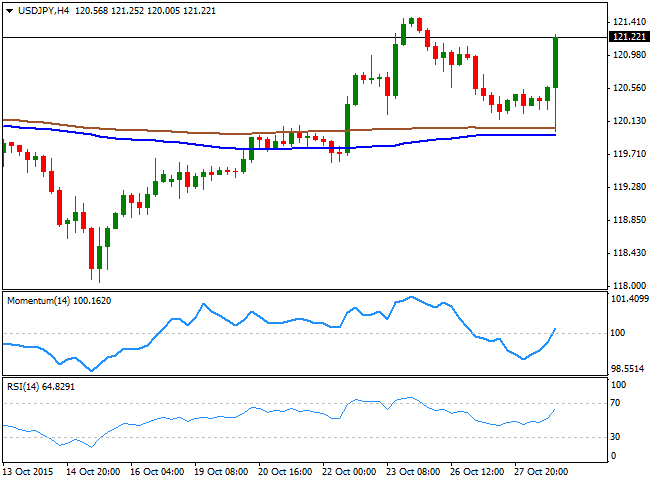

USD/JPY Current price: 121.23

View Live Chart for the USD/JPY

The USD/JPY pair advanced around 100 pips ever since the beginning of the American session, boosted by positive news coming from the US. Even before the FED's hawkish statement, the pair was mildly bullish as the US Trade Balance for September showed the deficit shrank to $58.53B from the previous deficit of $67.19B. The pair holds near its daily high around 121.25 ahead of the Asian session opening, and the 1 hour chart shows that the price accelerated higher through its 100 SMA, whilst the technical indicators have lost their upward strength in overbought levels, where they are now consolidating. In the 4 hours chart, an early dip met buying interest around the 100 and 200 SMAs, both flat in the 119.90/120.00 price zone, whilst the technical indicators head higher after crossing their mid-lines towards the upside, favoring further declines. Nevertheless, the pair can spend the next 24 hours consolidating in a tight range around the current level, ahead of the BOJ's economic policy meeting at the beginning of the upcoming Friday.

Support levels: 121.00 120.70 120.30

Resistance levels: 121.40 121.75 122.10

AUD/USD Current price: 0.7096

View Live Chart for the AUD/USD

The Aussie was hit twice this Wednesday, with the AUD/USD pair plunging below the 0.7100 level, for the first time since October 6th. The pair fell down to 0.711 early in the Asian session, after the release of Australian third quarter inflation readings, much worse-than-expected. Trimmed CPI for the mentioned period came out at 0.3% against previous 0.6% and expectations of 0.5%, leaving the yearly figure at 2.1%, against the expected 2.4%. The pair accelerated its decline following the FOMC statement, reaching a daily low of 0.7080 before bouncing some. Technically, the 1 hour chart shows that the technical indicators are bouncing some from oversold levels, but that the 20 SMA heads sharply lower around 0.7125, providing an immediate short term resistance. In the 4 hours chart, the technical indicators are heading sharply lower, despite being in oversold territory, supporting further declines on a break below the mentioned daily low.

Support levels: 0.7080 0.7035 0.6990

Resistance levels: 0.7125 0.7160 0.7195

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.