EUR/USD Current price: 1.0916

View Live Chart for the EUR/USD

The American dollar remained buoyed all through this Thursday, as macroeconomic events continued supporting the US is in its way to raise rates. During the European session, German unemployment unexpectedly rose in July by 9,000 against expectations of a 5K decline, whilst inflation in the country in July resulted at 0.2% both monthly and yearly basis, missing expectations. Also released in the morning, the EU economic sentiment indicator climbed to 104.0 from previous 103.5, on diminishing risk coming from Greece. The US GDP for the Q2 however, was what defined the day, printing in its advanced reading 2.3%. The number was a bit below expected, but far better than the Q1, revised up to 0.6% from previous -0.2%. Alongside with the GDP figure, unemployment claims in the US resulted better than expected, printing 267K for the week ending July 24.

The EUR/USD came under selling pressure with the news, falling down to 1.0892 in the American afternoon, before regaining the 1.0900 level, but maintaining the overall negative tone. The short term technical picture suggest some downward exhaustion, as the technical indicators are losing their downward strength in oversold levels, although the price remains well below a bearish 20 SMA, currently around 1.0950. In the 4 hours chart, the RSI indicator continues to head south near 30, whilst the Momentum indicator stands flat well into negative territory, all of which suggest a limited upward corrective movement before a new leg south.

Support levels: 1.0880 1.0850 1.0810

Resistance levels: 1.0950 1.1000 1.1045

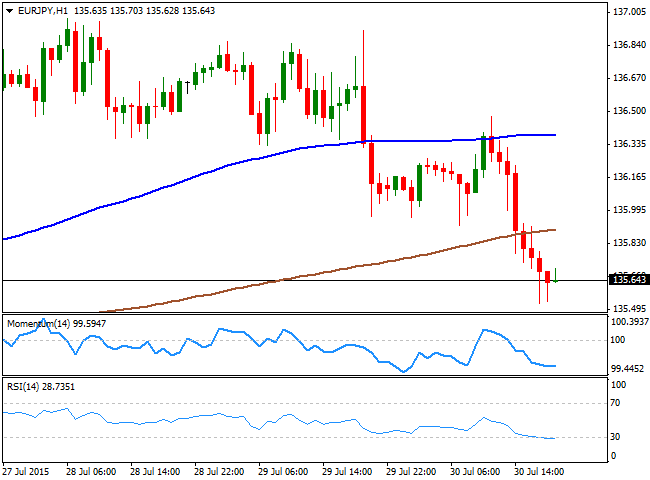

EUR/JPY Current Price: 135.64

View Live Chart for the EUR/JPY

Euro negative tone has sent the EUR/JPY down to a fresh weekly low of 135.52, with the JPY posting a moderate decline against the greenback, amid falling stocks. The EUR/JPY trades near the low by the end of the end, and the 1 hour chart shows that the price was unable to extend beyond the 100 SMA, and finally capitulated, breaking below the 200 SMA now around 135.90 acting as an immediate intraday resistance. In the same chart, the technical indicators have lost their bearish strength, but remain near oversold levels, limiting the possibility of a stronger advance. In the 4 hours chart, the technical indicators head lower below their mid-lines, whilst the price pressures a horizontal 20 SMA, supporting a continued decline on a break through 135.40, the immediate support.

Support levels: 135.40 134.90 134.50

Resistance levels: 135.90 136.60 137.10

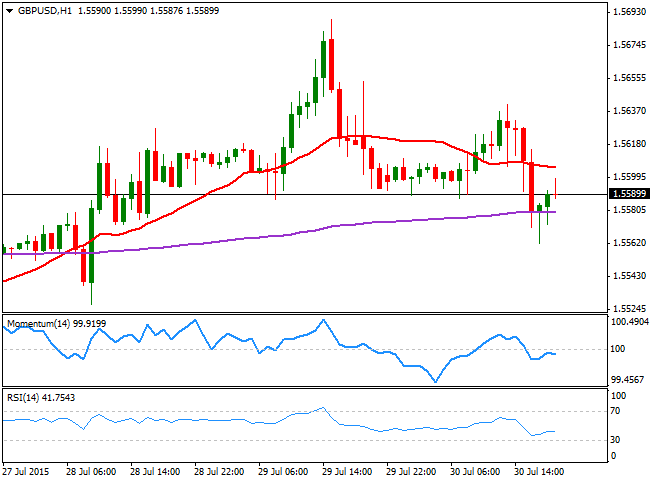

GBP/USD Current price: 1.5592

View Live Chart for the GPB/USD

The GBP/USD pair has shown little progress daily basis, for the most hovering around the 1.5600 level. There was no fundamental data released in the UK, but the Pound refused to give up to dollar's strength. Technically however, the pair continued retreating from the high established earlier this week at 1.5689, posting a lower low and a lower high daily basis, which increases the risk of a continued decline. Short term, the 1 hour chart shows that the price is now developing below a horizontal 20 SMA, whilst the technical indicators lack directional strength in neutral territory. In the 4 hours chart, the price is now a handful of pips below its 20 SMA that maintains a bullish slope, whilst the technical indicators present strong bearish slopes and are about to cross their mid-lies towards the downside. The daily low of 1.5561 converges with the 200 EMA in this last time frame, suggesting a break below it is required to confirm a new leg south.

Support levels: 1.5560 1.5520 1.5485

Resistance levels: 1.5635 1.5670 1.5730

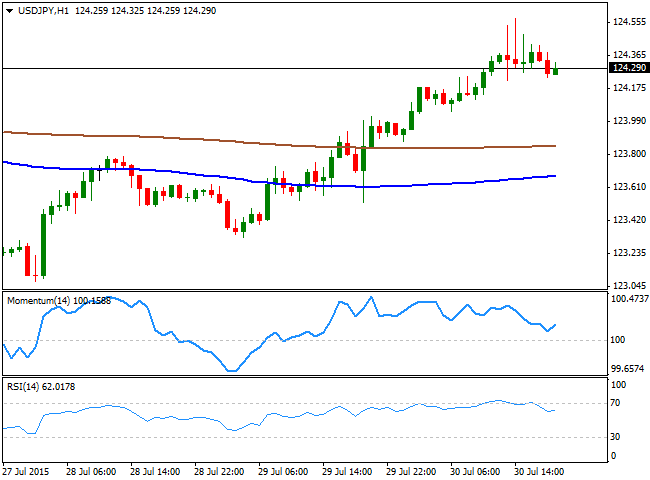

USD/JPY Current price: 124.29

View Live Chart for the USD/JPY

The USD/JPY reached a fresh monthly high of 124.57 on the back of dollar's strong GDP readings, but was unable to run higher and pulled back in the American afternoon, holding, however, above the 124.00 level. During the upcoming session, Japan will release its National and Tokyo inflation figures, but the readings usually have a limited effect in the currency. In the meantime, the short term picture is still bullish, as in the 1 hour chart, the price has advanced far above its 100 and 200 SMAs, whilst the technical indicators are turning north in positive territory, after correcting extreme overbought readings. In the 4 hours chart, the price has extended further above its 100 and 200 SMAs, but the technical indicators are turning south in positive territory, suggesting the pair may extend its retracement over the upcoming hours, back towards the 123.30/70 price zone.

Support levels: 124.10 123.70 123.30

Resistance levels: 124.60 125.00 125.30

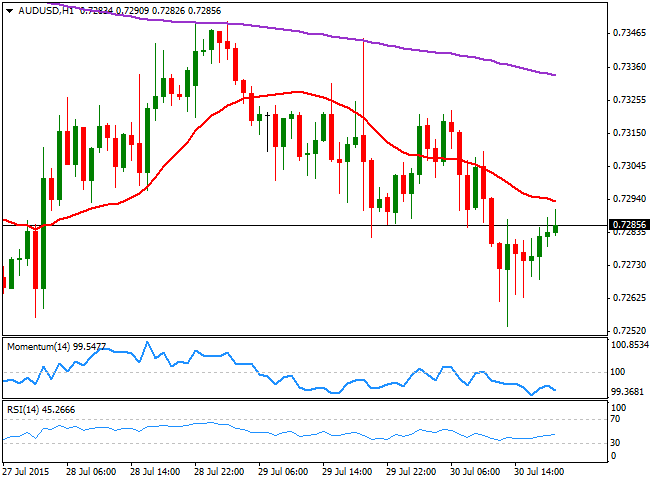

AUD/USD Current price: 0.7285

View Live Chart for the AUD/USD

The AUD/USD pair has posted a fresh multi-year low, a few pips below the previous one at 0.7253, from where it bounced back to the 0.7290, maintaining anyway its dominant bearish trend. Earlier in the day, the commodity currency fell on the back of poor Australian data, as the trend estimate for total dwellings approved fell 1.2% in June, falling for the fourth month in a row. The seasonally adjusted estimate for total dwellings approved fell 8.2% in June following a rise of 2.3% in the previous month, according to the official release. Short term, the 1 hour chart shows that the price continues developing below a bearish 20 SMA whilst the technical indicators resumed their declines below their mid-lines, keeping the risk towards the downside. In the 4 hours chart, the 20 SMA stands flat above the current price, whilst the technical indicators are aiming to recover, but well below their mid-lines, anticipating some range trading before a new directional move.

Support levels: 0.7250 0.7220 0.7185

Resistance levels: 0.7320 0.7350 0.7390

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.