EUR/USD Current price: 1.0981

View Live Chart for the EUR/USD

The dollar ended the day generally higher, advancing late in the American afternoon after the latest US Federal Reserve economic policy meeting. The US Central Bank decided by unanimous vote to keep interest rates unchanged at its July’s meeting as widely expected, but offered no hints at the timing of the lift-off in the statement. However, they pledged for a move when they see "some further improvement in the labor market" and that "a range of labor market indicators suggests that underutilization of labor resources has diminished since early this year," suggesting a rate hike in September is still on the table. Earlier in the day US Pending Sales unexpectedly fell in June, down 1.8%, the first drop this year, after a revised 0.6% increase in May.

The EUR/USD pair flirted with the 1.1000 figure after an initial spike up to 1.1078 immediately after the release, breaking towards fresh lows below the critical figure the end of the day. The technical picture favors additional declines as the 1 hour chart shows that the price has accelerated below its 100 SMA whilst the technical indicators have resumed their declines well into negative territory. In the 4 hours chart, the pair is extending below its 20 SMA, whilst the technical indicators have crossed below their mid-lines and maintain strong bearish slopes below their mid-lines, supporting additional declines for this Thursday, with 1.0950 now as the next probable bearish target.

Support levels: 1.0950 1.0920 1.0860

Resistance levels: 1.1010 1.1050 1.1080

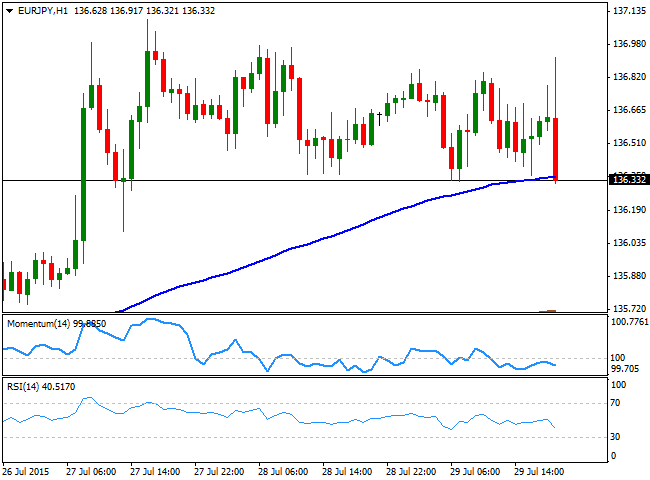

EUR/JPY Current Price: 136.34

View Live Chart for the EUR/JPY

The EUR/JPY resumed its decline after the FOMC statement, with the yen refusing to give up against the greenback and the EUR weakening sharply on the news. The pair fell down to its 100 SMA in the 1 hour chart where it stands, and the technical indicators in the mentioned time frame stand below their mid-lines, with the RSI accelerating its decline around 42 and maintaining the risk towards the downside. In the 4 hours chart, the technical indicators present a mild bearish slope, with the Momentum indicator crossing the 100 level towards the downside with a limited downward strength. Additional declines are likely after the Nikkei opening, with a break below 136.00 favoring a continued decline towards the 134.40 price zone.

Support levels: 136.00 135.55 135.00

Resistance levels: 136.60 137.10 137.60

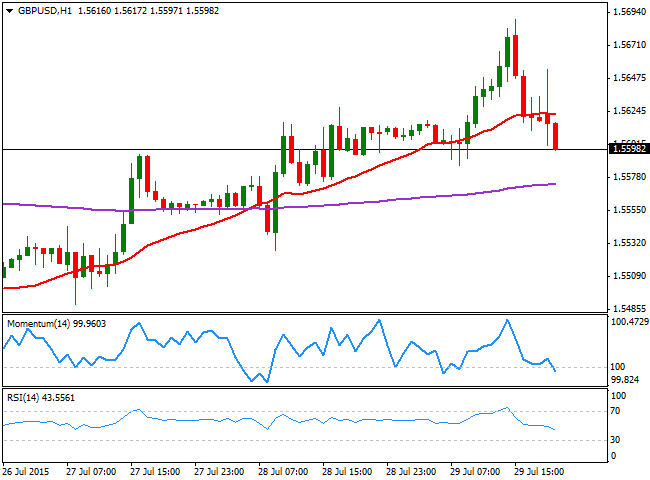

GBP/USD Current price: 1.5598

View Live Chart for the GPB/USD The GBP/USD pair erased all of its intraday gains post-FED, after reaching a fresh 4-week high of 1.5689 earlier in the day. The Pound was buoyed early Europe, after more positive macroeconomic news in the UK. Mortgage approvals rose more than expected in June in a sign of continued momentum in the housing market, climbing to 66,582 from an upwardly revised 64,826 in May, whilst money supply M4, increased by £3.0 billion in June. The pair began retracing before the news, and accelerated its decline afterwards, entering negative territory below the 1.5600 level by the US close. Technically, the hour chart shows that the price is now below its 10 SMA whilst the technical indicators head lower below their mid-lines, supporting additional declines in the upcoming hours. In the 4 hours chart, the downside is still limited as the 20 SMA heads higher around 1.5580 providing an immediate short term support, whilst the technical indicators have turned lower, but remain above their mid-lines.

The GBP/USD pair erased all of its intraday gains post-FED, after reaching a fresh 4-week high of 1.5689 earlier in the day. The Pound was buoyed early Europe, after more positive macroeconomic news in the UK. Mortgage approvals rose more than expected in June in a sign of continued momentum in the housing market, climbing to 66,582 from an upwardly revised 64,826 in May, whilst money supply M4, increased by £3.0 billion in June. The pair began retracing before the news, and accelerated its decline afterwards, entering negative territory below the 1.5600 level by the US close. Technically, the hour chart shows that the price is now below its 10 SMA whilst the technical indicators head lower below their mid-lines, supporting additional declines in the upcoming hours. In the 4 hours chart, the downside is still limited as the 20 SMA heads higher around 1.5580 providing an immediate short term support, whilst the technical indicators have turned lower, but remain above their mid-lines. Support levels: 1.5580 1.5545 1.5500

Resistance levels: 1.5625 1.5670 1.5730

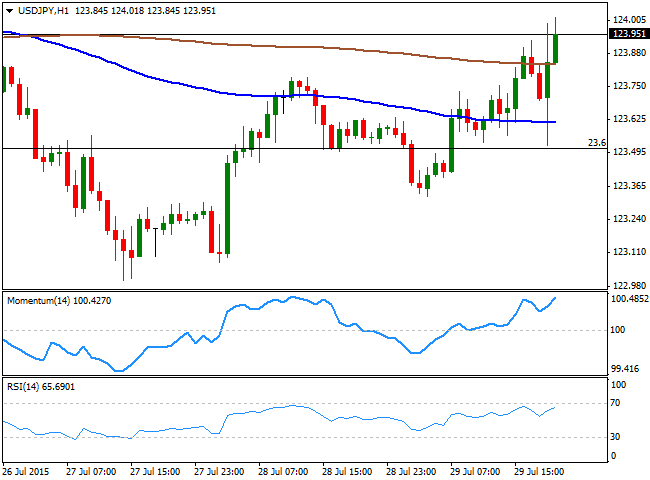

USD/JPY Current price: 123.93

View Live Chart for the USD/JPY

The USD/JPY is being unable to advance beyond the 124.00 figure, despite the strong dollar momentum triggered by the FED, with the pair, however, maintaining a strongly bullish intraday tone. The pair fell down to the 123.50 region with the Japanese yen finding some demand of poor US housing data. As commented several times on previous updates, the 124.00 level has kept attracting selling interest for over 2 months already, with limited spikes above it being quickly reverted, which means some steady gains beyond the highs at 124.45 are required to confirm additional advances. In the meantime, the 1 hour chart shows that the price is now above its 100 and 200 SMAs, whilst the technical indicators head sharply higher near overbought territory, favoring further gains. In the 4 hours chart the technical indicators also present strong upward slopes above their mid-lines, all of which should help in keeping the downside limited.

Support levels: 123.70 123.30 122.90

Resistance levels: 124.20 124.45 124.90

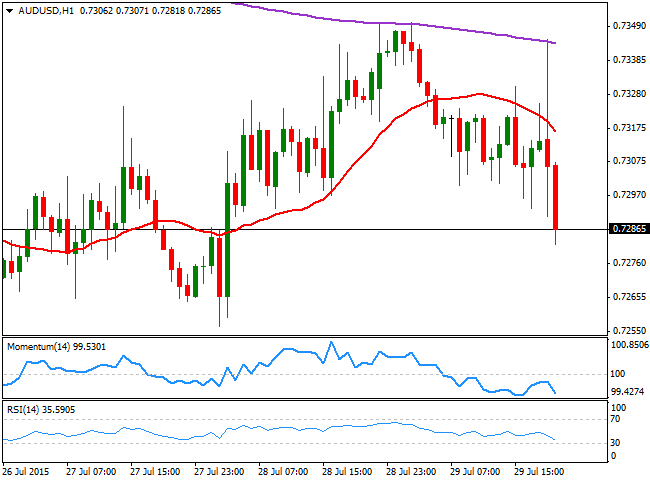

AUD/USD Current price: 0.7285

View Live Chart for the AUD/USD

The Australian dollar approaches its multi-year low against the greenback set earlier this week at 0.7256, retreating from the 0.7340/50 region where selling interest has been capping the upside this week. Australian will release its Building Permits for June, and Exports and Imports data for the second quarter of this 2015, all of them expected well below previous figures, which may accelerate the pair's decline. Technically, the 1 hour chart shows that the price has accelerated south below its 20 MSA, whilst the technical indicators turned sharply lower below their mid-lines and extend to fresh lows, supporting the ongoing bearish tone. In the 4 hours chart, the price is below a flat 20 SMA whilst the technical indicators are crossing their mid-lines towards the downside, supporting the shorter term view. A downward acceleration below 0.7260, the immediate support, should lead to a quick test of the 0.7220/30, later followed by a break below 0.7200.

Support levels: 0.7260 0.7225 0.7185

Resistance levels: 0.7320 0.7350 0.7390

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.