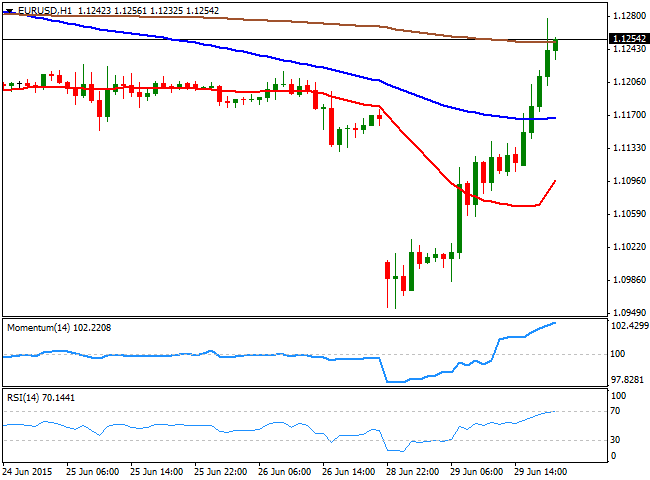

EUR/USD Current price: 1.1245

View Live Chart for the EUR/USD

The EUR/USD pair staged a massive comeback this Monday, surging up to 1.1276 intraday, after trading as low as 1.0954 during the early Asian hours. The recovery of the common currency began during European hours, as the SNB was active in the markets, with governor Jordan explicitly saying that they were intervening to prevent CHF strength. But the rally extended beyond the wildest estimation during the American afternoon, with no actual catalyst beyond it, and despite Greece will not pay the €1.6 billion due to the IMF on Tuesday, entering in default. Also, hopes that a deal is still possible are supporting some EUR demand after Dijsselbloem said that the door for negotiations is still open. Junker addressed directly to the people of Greece, asking them to vote "yes" and therefore, vote for the EUR.

The short term technical picture shows that the price holds at an almost one week high, with the 1 hour chart showing that the technical indicators are beginning to look exhausted in extreme overbought levels, whilst the rally stalled around its 200 SMA. In the 4 hours chart the bias is higher, as the technical indicators maintain their bullish slopes after crossing their mid-lines towards the upside, while the 20 SMA is turning higher around the 1.1160 region. Renewed buying interest beyond 1.1290, should lead to an upward continuation towards the 1.1400 level this Tuesday.

Support levels: 1.1234 1.1200 1.1160

Resistance levels: 1.1290 1.1340 1.1380

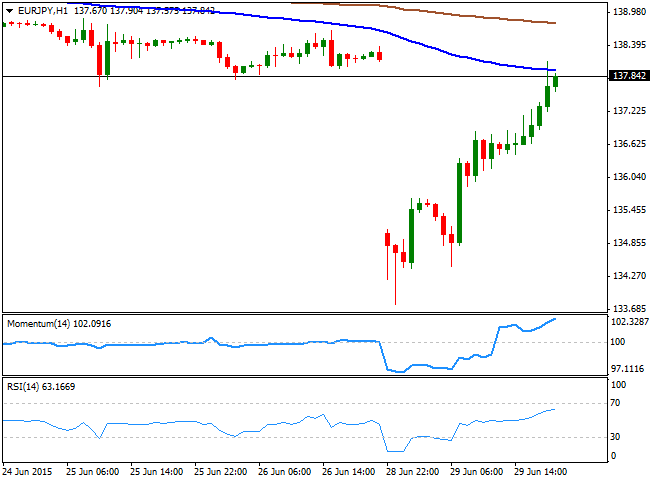

EUR/JPY Current price: 137.84

View Live Chart for the EUR/JPY

The EUR/JPY has recovered all of the ground lost, filling the almost 300 pips gaps of its weekly opening, in the American afternoon. Despite the Japanese yen traded generally higher against most of its rivals, EUR demand imposed itself in the cross. The pair surged to an intraday high of 138.13, where the hourly chart shows the 100 SMA capping the upside. The 200 SMA in the same chart stands around 138.80, whilst the technical indicators are barely decelerating near overbought territory. In the 4 hours chart, the technical indicators are heading higher, but still in negative territory, extending their recovery from extreme oversold territory. The immediate resistance comes at 138.20, with a recovery above it probably maintaining the bid tone in the pair for the rest of the day.

Support levels: 137.50 136.90 136.40

Resistance levels: 138.20 138.80 139.40

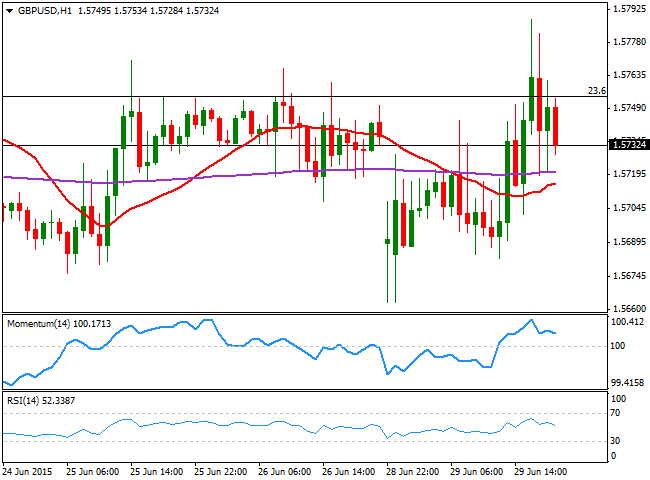

GBP/USD Current price: 1.5732

View Live Chart for the GBP/USD

The GBP/USD pair has posted a limited advance intraday up to 1.5788, failing, however, to sustain gains above the 1.5750 price zone, a strong Fibonacci level that has attracted selling interest for most of the last week. Earlier in the day, the UK released its mortgage approvals figures for May that unexpectedly fell from the 14-month high posted last April. The decline was attributed to higher prices as a result of a continuing shortage of properties for sale. The news weighed on the Pound earlier in the day, but the GBP/USD held within a familiar range for most of the day, trading between Fibonacci levels. Technically, the 1 hour chart shows that the price is now retreating towards a flat 20 SMA around 1.5710, whilst the technical indicators have turned lower in positive territory. In the 4 hours chart, the neutral stance prevails, as the price continues to hover around the 20 SMA, whilst the technical indicators are unable to move far from their mid-lines. The key support for the upcoming sessions stands at 1.5645, the 38.2% retracement of the latest daily bullish run.

Support levels: 1.5695 1.5645 1.5610

Resistance levels: 1.5750 1.5795 1.5830

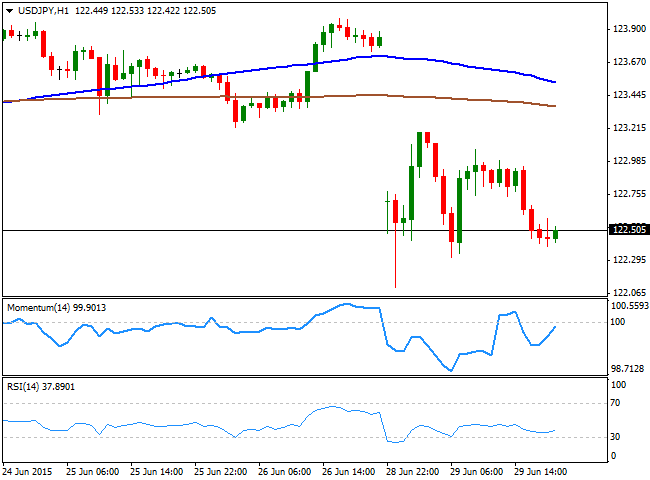

USD/JPY Current price: 122.50

View Live Chart for the USD/JPY

The USD/JPY pair trades around its daily opening, having recovered up to 123.18 intraday, around 65 pips short of closing the weekly opening gap. The Japanese yen resumed its strength after the release of US housing figures, as Pending Home sales for May grew less than expected, reaching 0.9% against the forecast of a 1.2% advance. Having been as low as 122.10 during the previous Asian session, the pair is poised to remain under pressure, as stocks around the world fell sharply. The 1 hour chart shows that the price stands around 100 pips below its 100 and 200 SMAs, whilst the technical indicators are posting some tepid recoveries, but remain in negative territory. In the 4 hours chart, the technical indicators maintain their strong bearish slopes well into negative territory, whilst the intraday recovery was not enough for the price to establish above its 200 SMA, all of which supports the dominant bearish trend.

Support levels: 122.45 122.00 121.60

Resistance levels: 122.90 123.30 123.75

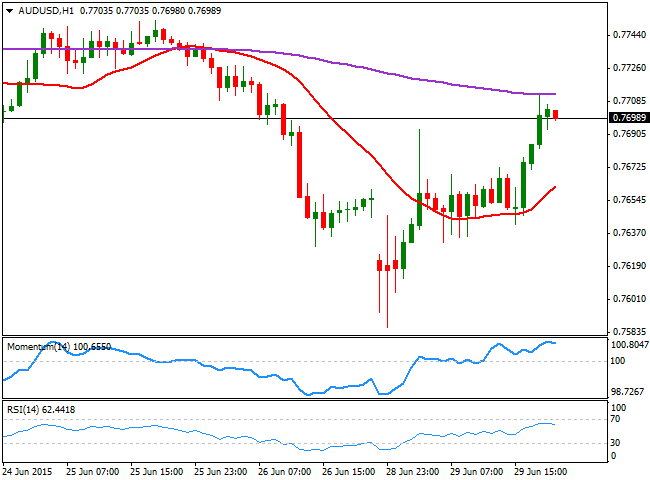

AUD/USD Current price: 0.7705

View Live Chart for the AUD/USD

The Australian dollar was among the daily winners, surging against the greenback up to 0.7711 and trading around the 0.7700 figure by the US close. On Saturday, the Chinese Central Bank, the PBoC, cut rates for fourth time in seven months, in a desperate attempt to boost the local economy, supporting Aussie's strength. The 1 hour chart shows that the price stands well above a bullish 20 SMA, currently in the 0.7650 region, whilst the technical indicators are turning slightly lower in positive territory. In the 4 hours chart however, the upside seems limited as the price hovers around a mild bearish 20 SMA a few pips below the current level, whilst the technical indicators have turned south below their mid-lines, after correcting oversold readings reached earlier in the week. A downward acceleration below the 0.7640 level should confirm additional declines for this Tuesday, down to the 0.7530/60 region.

Support levels: 0.7640 0.7590 0.7555

Resistance levels: 0.7720 0.7755 0.7790

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.