EUR/USD Current price: 1.0999

View Live Chart for the EUR/USD

Given the overwhelming amount and implications of the weekend news on Greece, large gaps are seen across the board at the weekly opening, particularly in EUR and JPY pairs. On Friday, there was a breakout in negotiations between the troubled country and its European counterparts, and PM Alexis Tsipras announced it will call for a referendum on July 5th, on whether Greece should accept austerity demands from international lenders. Furthermore, the ECB announced on Sunday that will keep the emergency liquidity assistance limited to the country, at around €90B, the level decided last Friday. The measure however, was not enough, as Greece ordered its bank to shut Monday, to avoid a financial collapse. The local exchange market, will also remain closed.

Given the overwhelming amount and implications of the weekend news on Greece, large gaps are seen across the board at the weekly opening, particularly in EUR and JPY pairs. On Friday, there was a breakout in negotiations between the troubled country and its European counterparts, and PM Alexis Tsipras announced it will call for a referendum on July 5th, on whether Greece should accept austerity demands from international lenders. Furthermore, the ECB announced on Sunday that will keep the emergency liquidity assistance limited to the country, at around €90B, the level decided last Friday. The measure however, was not enough, as Greece ordered its bank to shut Monday, to avoid a financial collapse. The local exchange market, will also remain closed. The EUR/USD traded as low as 1.0990 early interbank trading, and kick-started the week barely above the 1.1000 level, and with the technical picture distorted amid the over 100 pips downward gap. The strong downward momentum however, may well extend on a break below 1.0995, the 100 DMA, fueling the decline and preventing the pair from filling the gap any time soon. For the upcoming hours, the immediate resistance will be around 1.1050, followed by 1.1120, both strong static resistance levels. Nevertheless, the upside will likely remain limited, with scope to decline down to the 1.0860 region during European hours, before the bleeding finally stops.

Support levels: 1.0995 1.0960 1.0920

Resistance levels: 1.1050 1.1120 1.1160

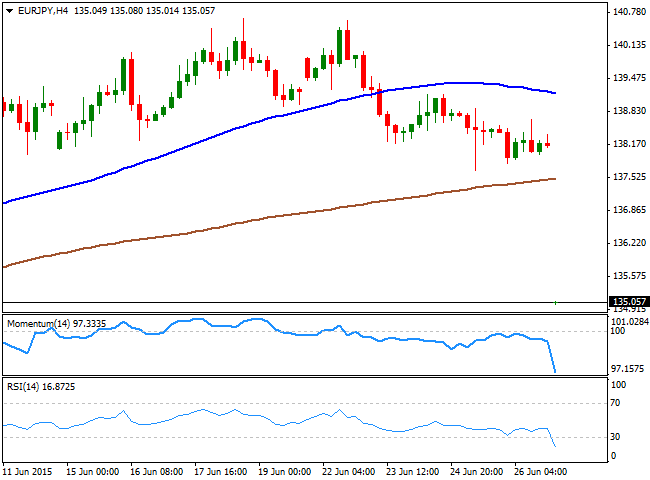

EUR/JPY Current price: 135.05

View Live Chart for the EUR/JPY

The EUR/JPY pair opened the week with an over 350 pips downward gap, in an overwhelming combination of EUR sell-off and demand for safe-haven JPY. The pair trades at fresh monthly lows, and the daily chart shows that it broke below its 200 DMA, whilst the 100 DMA offers now a critical support for the upcoming sessions around 133.10. The former June low at 135.12 comes as the immediate short term resistance for the upcoming hours, although the risk is still towards the downside, with upward movements probably seen as selling opportunities. The pair can go up to 136.45, but chances of filling the gap over the next 24 hours are pretty much null.

Support levels: 134.60 134.20 133.75

Resistance levels: 135.12 135.60 136.10

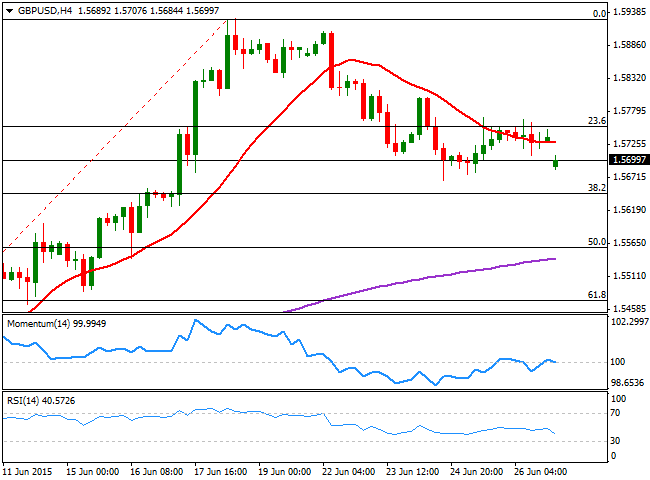

GBP/USD Current price: 1.5699

View Live Chart for the GBP/USD

The British Pound is being dragged lower by broad dollar's demand, with the GBP/USD pair gapping down around 50 pips. The Pound however, has some strength of its own to battle the ongoing risk-lead trade, and the pair is struggling around the 1.5700 level after the opening, having held above last week low of 1.5666. Technically, the 4 hours chart shows a dominant bearish tone, with the price below its 20 SMA and the technical indicators turning lower and entering negative territory, with the price trapped between Fibonacci levels: the 23.6% retracement of the 1.5189/1.5929 rally stands at 1.5753 and has contained the upside for most of the last week, whilst the 38.2% retracement of the same rally is now a critical support level, at 1.5645. It will take a break below this last to confirm a bearish continuation in the pair down to 1.5560, the 50% retracement of the same rally, whilst selling interest will likely surge on approached to the mentioned 1.5750 region.

Support levels: 1.5645 1.5610 1.5560

Resistance levels: 1.5715 1.5750 1.5795

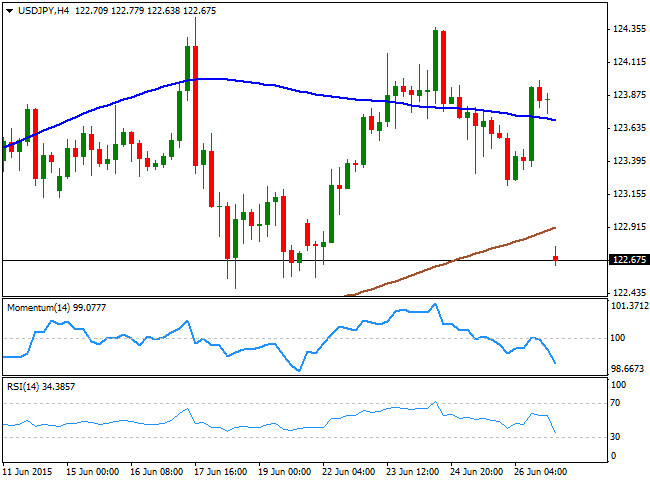

USD/JPY Current price: 122.65

View Live Chart for the USD/JPY

The USD/JPY gapped strongly down on safe-haven demand amid ongoing Grexit fears, with the pair challenging this June low of 122.45 at the opening. The Japanese yen will likely remain buoyed this Monday, as stocks are poised to fall. Later on in the week, the US will release its monthly employment figures in the form of the Nonfarm Payroll report, something that usually has a strong impact on the USD/JPY pair. Nevertheless, this time may be different as market attention will be 100% focused on Greece. In the meantime, the downward potential is quite strong according to the 4 hours chart, as the price stands below its 100 and 200 SMAs, this last providing an immediate resistance around 122.90. A break below the mentioned 122.45 level should fuel the decline as it will likely trigger stops, with the pair probably extending its decline down to 121.05, its 100 DMA over the upcoming sessions.

Support levels: 123.30 122.90 122.45

Resistance levels: 124.10 124.45 124.90

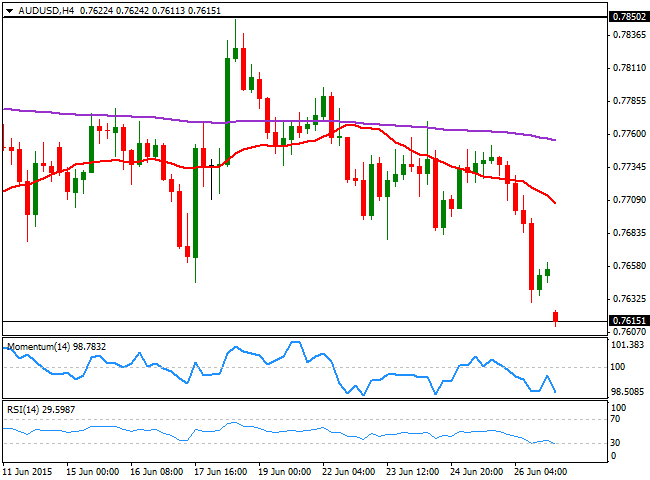

AUD/USD Current price: 0.7613

View Live Chart for the AUD/USD The AUD/USD pair opened with a limited downward gap, as the People’s Bank of China cut interest rates on Saturday, and also lowered the amount of reserves certain banks are required to hold (RRR) in an attempt to underpin the economy. PBoC cut the one-year benchmark lending rate cut by 25 bps to 4.85% and one-year benchmark deposit rate cut by 25 bps to 2.0%. It also cut the reserve requirement ratio (RRR) for banks lending to farm sector and small and medium size enterprises (SMEs) by 50 bps. Chinese stimulus tends to boost Aussie demand, whilst dollar demand on Grexit fears weighs on the antipodean currency. Technically, the 4 hours chart presents a strong bearish tone, with the price getting near the 0.7600 figure and the technical indicators heading sharply lower in negative territory. Should the price extend below 0.7590, chances are of a downward continuation towards 0.7532, this year low posted last April.

The AUD/USD pair opened with a limited downward gap, as the People’s Bank of China cut interest rates on Saturday, and also lowered the amount of reserves certain banks are required to hold (RRR) in an attempt to underpin the economy. PBoC cut the one-year benchmark lending rate cut by 25 bps to 4.85% and one-year benchmark deposit rate cut by 25 bps to 2.0%. It also cut the reserve requirement ratio (RRR) for banks lending to farm sector and small and medium size enterprises (SMEs) by 50 bps. Chinese stimulus tends to boost Aussie demand, whilst dollar demand on Grexit fears weighs on the antipodean currency. Technically, the 4 hours chart presents a strong bearish tone, with the price getting near the 0.7600 figure and the technical indicators heading sharply lower in negative territory. Should the price extend below 0.7590, chances are of a downward continuation towards 0.7532, this year low posted last April. Support levels: 0.7590 0.7555 0.7530

Resistance levels: 0.7640 0.7685 0.7720

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.