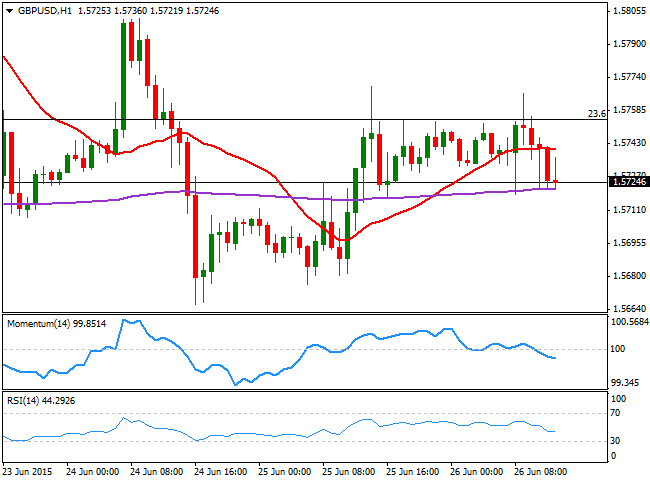

EUR/USD Current price: 1.1204

View Live Chart for the EUR/USD

The EUR/USD pair continues trading around the 1.1200 figure, with traders waiting for upcoming decision on Greece, during the weekend. The EU group will have a meeting this Saturday, to discuss the latest draft of a new bailout proposal. During these last few days, German Chancellor Angela Merkel said that there must be a deal before Monday opening. In the meantime, rumors and talks continue to hit the wires by the hour. The latest one reports that the European Union is preparing an emergency plan if Greek rejects the deal offer on Saturday, and that the proposal is an extension till the end of November.

The technical picture is neutral, with the 1 hour chart showing that the price is barely able to move around a horizontal 20 SMA, whilst the technical indicators hover around their mid-lines. In the 4 hours chart a mild negative tone prevails, although there's nothing indicating selling interest will surge sometime today.

Support levels: 1.1160 1.1120 1.1050

Resistance levels: 1.1245 1.1280 1.1320

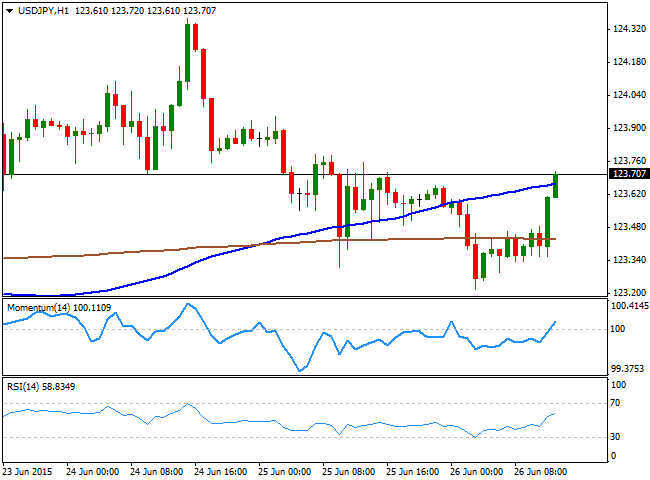

GBP/USD Current price: 1.5723

View Live Chart for the GBP/USD

The British Pound is under mild selling pressure this Friday, with the GBP/USD pair unable to advance the 1.5750 price zone, the 23.6% retracement of its latest bullish run. Nevertheless, the pair holds above the 1.5700 level, and with the 1 hour chart showing that the technical indicators are losing their bearish potential below their mid-lines, whilst the 20 SMA stands flat a few pips above the current price. In the 4 hours chart, the downward potential seems more constructive, with the price unable to establish above a bearish 20 SMA and the Momentum indicator heading sharply lower below the 100 level. At this point, the pair needs to break below the 1.5700 figure to be able to extend its decline down towards the 1.5650 level, 38.2% retracement of the same rally.

Support levels: 1.5700 1.5650 1.5620

Resistance levels: 1.5750 1.5795 1.5840

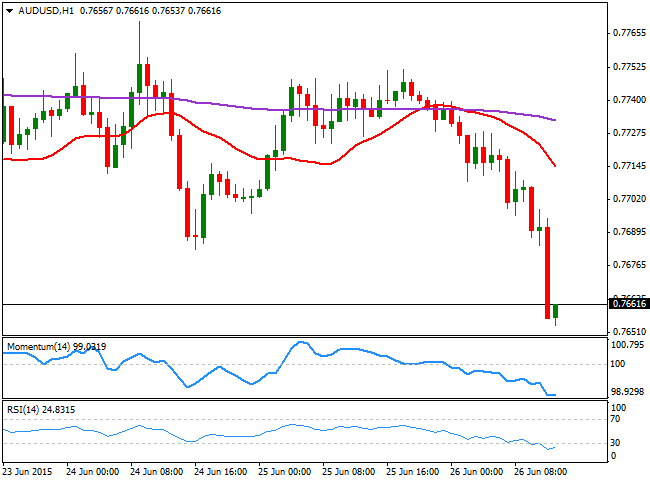

USD/JPY Current price: 123.70

View Live Chart for the USD/JPY

The USD/JPY pair surges ahead of the US opening, and the 1 hour chart shows that an improving upward momentum, as the technical indicators head higher above their mid-lines. In the same chart, the price is advancing above its 100 and 200 SMAs, which means that if the price holds around this region, may continue rising later on in the day. In the 4 hours chart, the price is struggling around its 100 SMA, whist the technical indicators head higher around their mid-lines, supporting the shorter term views. Further advances however, will depend on the ability of the pair to extend beyond 124.10, the immediate resistance.

Support levels: 123.30 122.90 122.45

Resistance levels: 124.10 124.45 124.90

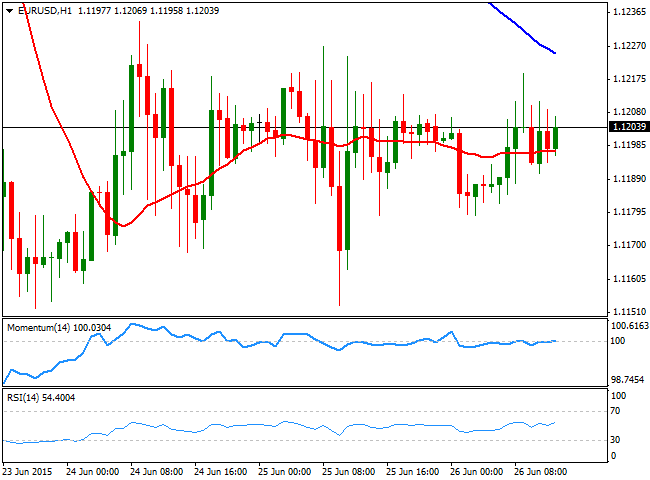

AUD/USD Current price: 0.7660

View Live Chart for the AUD/USD

The AUD/USD pair accelerated its decline after breaking below the 0.7700, triggering stops. The pair reached a fresh weekly low of 0.7653 and trades nearby, with a strong bearish short term tone as the 1 hour chart shows that technical indicators remain in oversold territory, whilst the 20 SMA has turned sharply lower above the current price. In the 4 hours chart, the price has also declined well below its 20 SMA, whilst the technical indicators head sharply lower well below their mid-lines.

Support levels: 0.7640 0.7600 0.7570

Resistance levels: 0.7680 0.7720 0.7760

Recommended Content

Editors’ Picks

AUD/USD defends 0.6400 after Chinese data dump

AUD/USD has found fresh buyers near 0.6400, hanging near YTD lows after strong China's Q1 GDP data. However, the further upside appears elusive amid weak Chinese activity data and sustained US Dollar demand. Focus shifts to US data, Fedspeak.

USD/JPY stands tall near multi-decade high near 154.50

USD/JPY keeps its range near multi-decade highs of 154.45 in the Asian session on Tuesday. The hawkish Fed expectations overshadow the BoJ's uncertain rate outlook and underpin the US Dollar at the Japanese Yen's expense. The pair stands resilient to the Japanese verbal intervention.

Gold: Buyers take a breather below $2,400 amid easing geopolitical tensions

Gold price is catching a breath below $2,400 in Asian trading on Tuesday, having risen over 1% in the US last session even on a solid US Retail Sales report, which powered the US Dollar through the roof. Easing Middle East geopolitical tensions and strong Chinese data could cap Gold's upside.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Israel-Iran military conflict views and takeaways

Iran's retaliatory strike on Israel is an escalation of Middle East tensions, but not necessarily a pre-cursor to broader regional conflict. Events over the past few weeks in the Middle East, more specifically this past weekend, reinforce that the global geopolitical landscape remains tense.