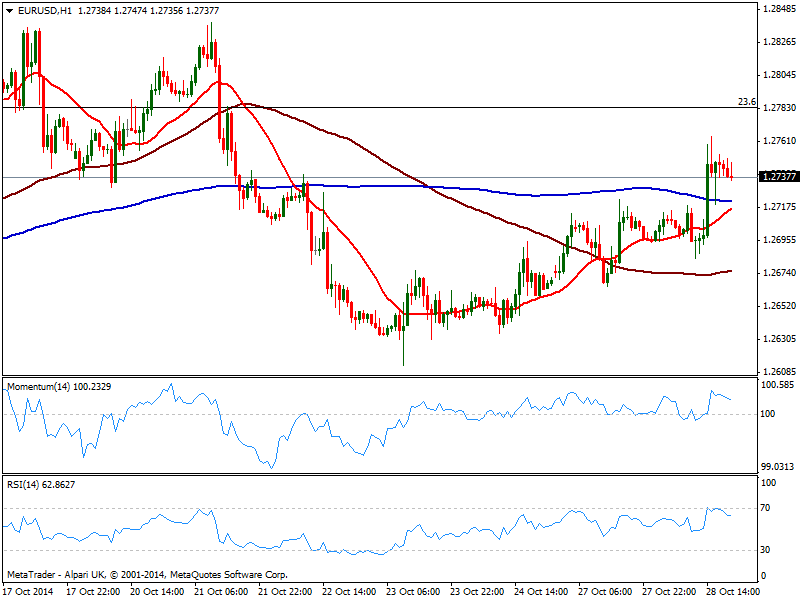

EUR/USD Current price: 1.2737

View Live Chart for the EUR/USD

The EUR/USD stands sidelined ever since Tuesday’s American session with traders holding their breath ahead of the FED. Having regained the 1.2700 figure after the worse than expected US Durable Goods Orders yesterday, the short term picture presents a mild positive tone, with price above 100 and 200 SMAs, and hovering around 20 one, albeit indicators are again flat in neutral territory. In the 4 hours chart price develops above a bullish 20 SMA, while indicators turn lower but hold above their midlines. Things today will be purely data dependant, with a disappointing decision for the FED probably sending the pair up to 1.2790 and above, and a hawkish Central Bank favoring dollar gains towards 1.2660 price zone.

Support levels: 1.2710 1.2660 1.2620

Resistance levels: 1.2790 1.2840 1.2885

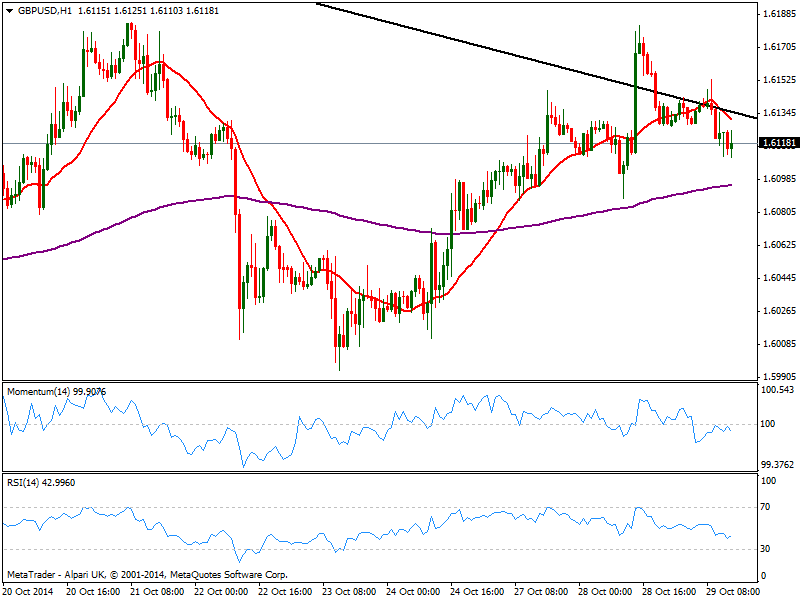

GBP/USD Current price: 1.6118

View Live Chart for the GBP/USD

The GBP/USD trades near its daily low of 1.6110, also flat and sidelined ahead of the news, with the short term picture turning slightly bearish, as the 1 hour chart shows 20 SMA gaining bearish slope above current price, and indicators turning lower into negative territory, albeit lacking strength at the time being. In the 4 hours chart price tested its 20 SMA at 1.6110 while indicators gain bearish slope an approach their midlines from the upside. Yesterday’s high converges with 200 EMA in this last time frame, usually a strong midterm resistance/support, which suggest further declines post FED should signal a bearish continuation from the technical point of view. Renewed buying interest above 1.6145 on the other hand, should see the pair retesting such highs, and even extending higher up to 1.6220 price zone.

Support levels: 1.6090 1.6050 1.6010

Resistance levels: 1.6145 1.6185 1.6220

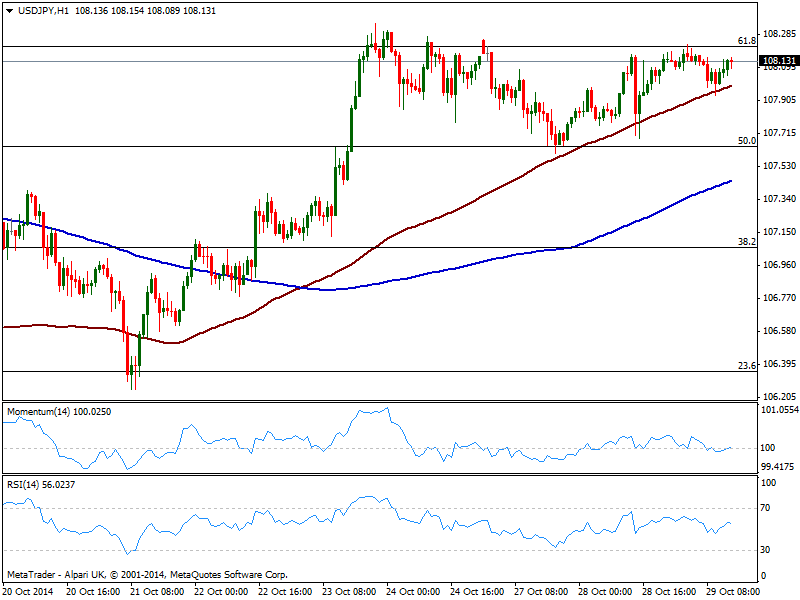

USD/JPY Current price: 108.12

View Live Chart for the USD/JPY

The USD/JPY trades near the top of its latest range, pressuring the 108.20 price zone, 61.8% retracement of the latest bearish run. The 1 hour chart shows price found intraday support in a still bullish 100 SMA currently around 108.00; RSI in the mentioned time frame aims higher above 50, yet momentum stands flat at 100. In the 4 hours chart technical readings present a mild positive tone, yet a strong upward acceleration above mentioned Fibonacci resistance is required to confirm further gains, while the key support for today stands at 107.50/60, 50% retracement of the same rally and the base of the latest range.

Support levels: 108.00 107.55 107.10

Resistance levels: 108.20 108.50 108.90

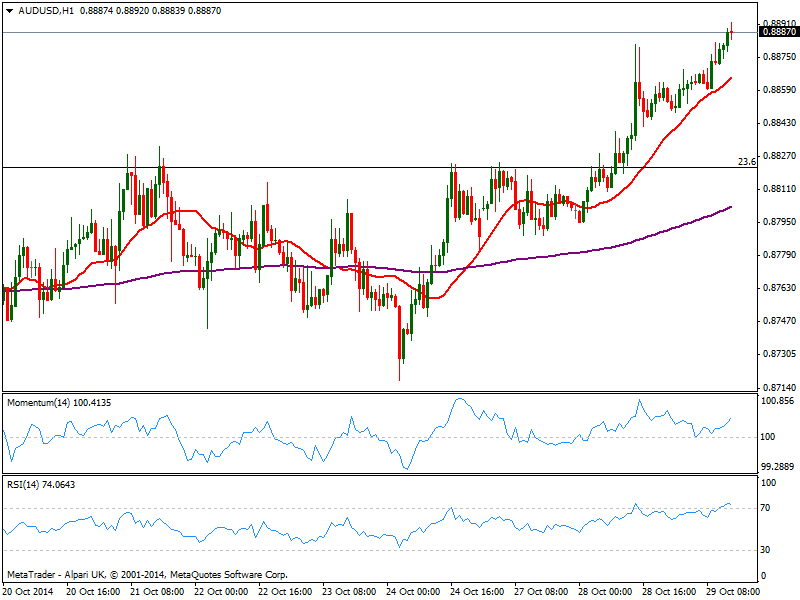

AUD/USD Current price: 0.8886

View Live Chart of the AUD/USD

The AUD/USD continues outperforming, approaching 0.8900 figure and with the 1 hour chart showing a clear positive tone coming from technical readings, with RSI entering overbought territory, but momentum signaling further advances and far from reaching the extremes. In the 4 hours chart technical readings also favor the upside despite showing little strength at the time being, eyeing a test of 0.8930 in the short term, 38.2% retracement of the latest daily bearish run.

Support levels: 0.8820 0.8770 0.8730

Resistance levels: 0.8890 0.8930 0.8970

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.