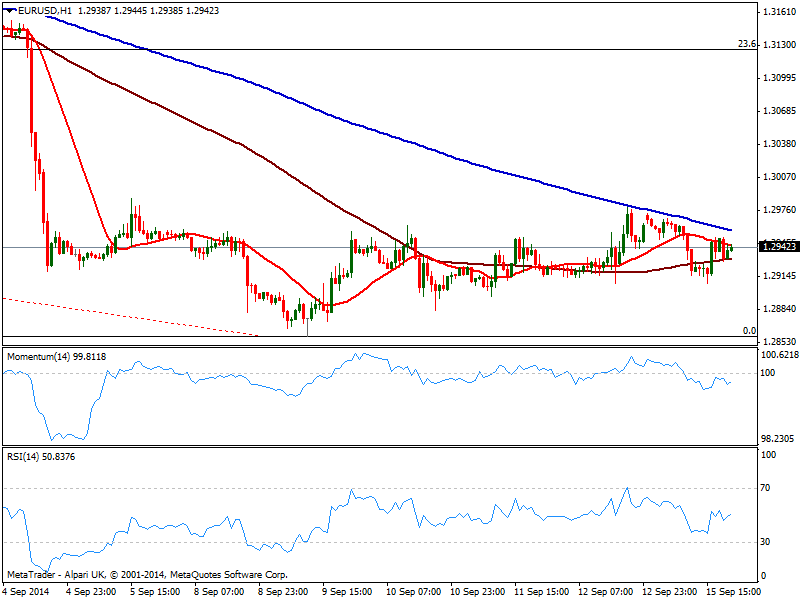

EUR/USD Current price: 1.2942

View Live Chart for the EUR/USD

Back and forth, the EUR/USD traded in the 1.2910/80 range all through this Monday, lead mostly by stocks, rather than data. In Europe the Trade Balance presented a worse than expected surplus of 12.2B, while in the US data came out mixed: New York manufacturing index rose to 27.5 multi years high, but industrial production print a sad -0.1% forcing dollar down after a limited rally against the EUR down to 1.2908.

Technically, the pair has presented little progress over this last 24 hours, with the hourly chart showing price between 100 and 200 SMAs, just 30 pips away from each other, which clearly reflects the lack of directional strength. Indicators stand flat below their midlines, while the 4 hours chart presents a neutral stance, with price moving back and forth around its 20 SMA and indicators stuck around their midlines. Nevertheless, bears maintain full control of the pair, now waiting for more light coming from the FED to decide whether to extend the bearish trend.

Support levels: 1.2910 1.2870 1.2835

Resistance levels: 1.2950 1.2990 1.3045

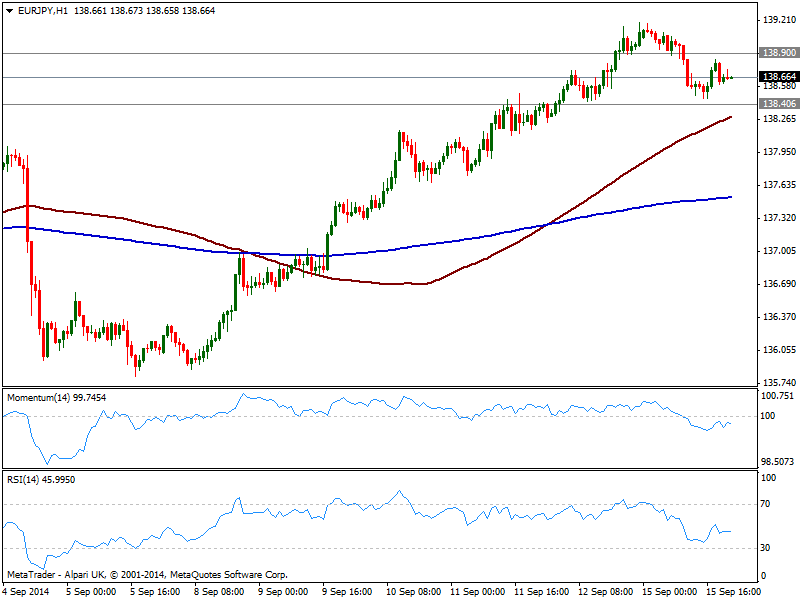

EUR/JPY Current price: 138.66

View Live Chart for the EUR/JPY

Japanese yen gained some ground against most rivals, with the EUR/JPY down to 138.46, where it found short term buyers, albeit trading now below 138.90 immediate resistance. The 1 hour chart shows 100 SMA advancing below current price, a few pips below 138.40 immediate static support, with indicators turning lower below their midlines. In the 4 hours chart momentum heads lower but holds above 100 while RSI regained the upside above 50, limiting chances of further slides. At this point, price needs to recover above mentioned resistance to be able to regain previous positive tone, yet if 138.40 gives up, the bearish potential will increase eyeing an approach to the 137.60/70 price zone.

Support levels: 138.40 138.00 137.65

Resistance levels: 138.90 139.30 139.70

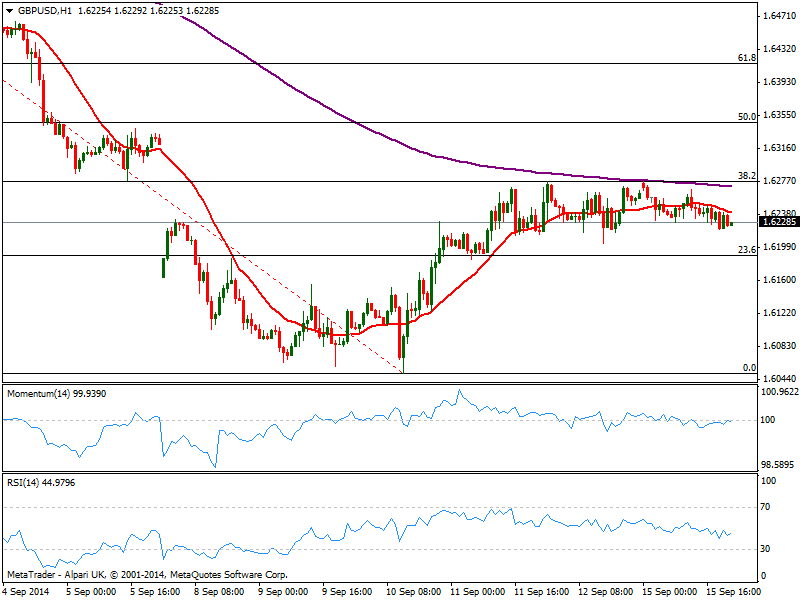

GBP/USD Current price: 1.6228

View Live Chart for the GBP/USD

No changes for the GBP/USD that awaits for critical UK data later this week, inflation on Tuesday, employment on Friday, and the Scottish referendum on Thursday. At this point, the pair continues to be trapped between Fibonacci levels of this month bearish run measured from 1.6643 to 1.6067: the 38.2% retracement of such movement caps the upside around 1.6280, while the pair holds above the 23.6% retracement, offering support at 1.6190. The 1 hour chart shows indicators with a mild bearish slope but in neutral territory, while in the 4 hours chart price hovers around a still bullish 20 SMA as indicators crosses its midline to the downside, adding to the bearish case: a break below mentioned 1.6190 however, is required to confirm a more steady intraday decline towards 1.6140/50 price zone.

Support levels: 1.6220 1.6190 1.6150

Resistance levels: 1.6280 1.6320 1.6350

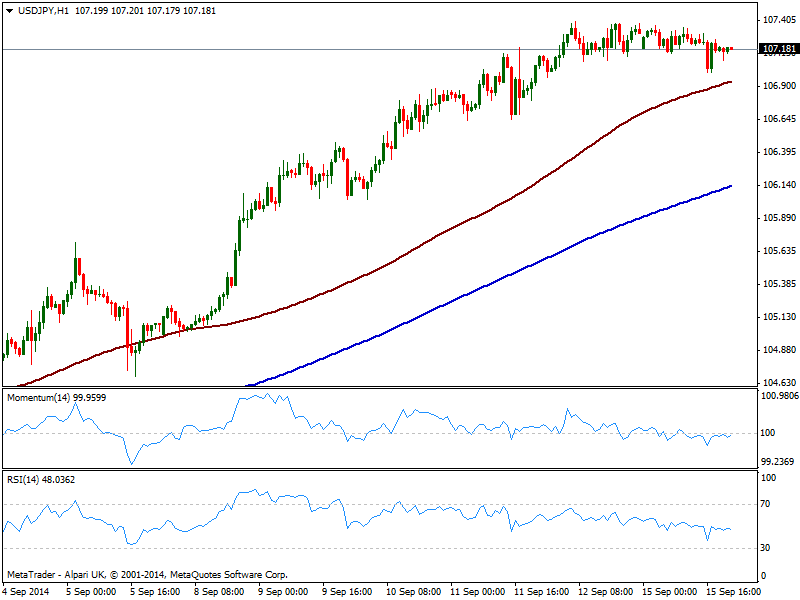

USD/JPY Current price: 107.18

View Live Chart for the USD/JPY

Worse than expected US data sent USD/JPY to an intraday low of 107.00, but the movement was short lived and the pair trades back a few pips below its recent high of 107.38. The tight range however has left the short term picture with a quite neutral stance, as per indicators horizontal around their midlines. 100 SMA stands now at 106.90 acting as first probable intraday support, while 200 SMA is way below at 106.20, the line in the sand in case of a bearish acceleration in the pair, as only below it current bullish trend may suffer. In the 4 hours chart RSI reentered below 70 but momentum regains the upside above 100, which limits chances of a downward move. To the upside, 107.40 is the level to break to see the bullish trend resuming towards 108.00 price zone.

Support levels: 106.80 106.50 106.10

Resistance levels: 107.40 107.90 108.20

AUD/USD Current price: 0.903

View Live Chart of the AUD/USD

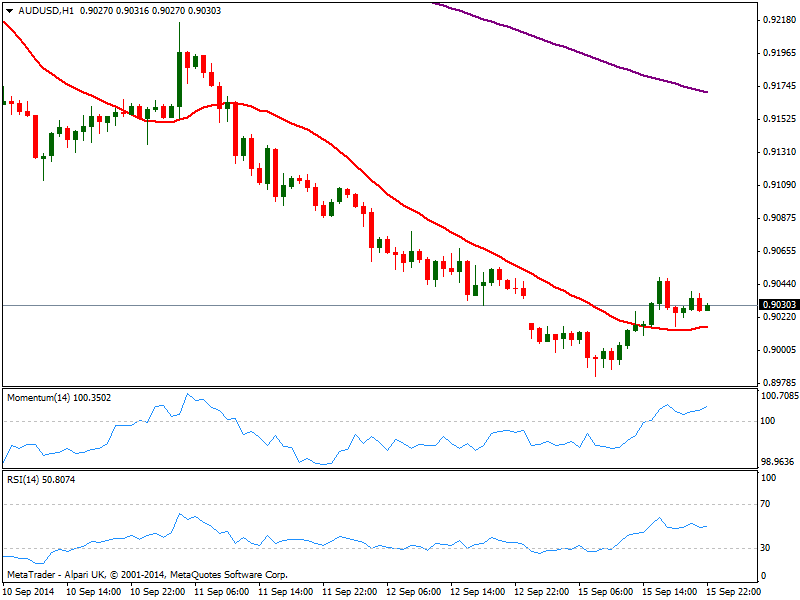

The AUD/USD finally closed the weekly opening gap after falling down to 0.8983, but failed to extend gains beyond 0.9050. The 1 hour chart shows price above its 20 SMA while indicators aim higher in positive territory. The 4 hours chart however, shows a strongly bearish 20 SMA above current price and indicators barely correcting oversold readings, which hardly suggest a steadier recovery. At this point, risk remains to the downside, with another attempt below 0.9000 probably extending to new lows, eyeing 0.8920 as a probable bearish target for this Tuesday.

Support levels: 0.9000 0.8960 0.8920

Resistance levels: 0.9050 0.9075 0.9110

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.