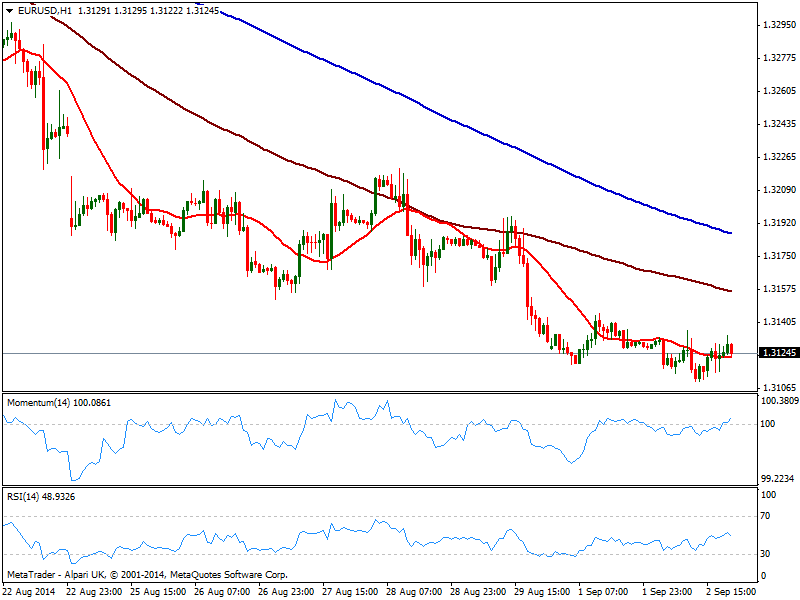

EUR/USD Current price: 1.3124

View Live Chart for the EUR/USD

Dollar has taken the lead again on Tuesday, advancing to multi-month highs against European currencies and the Yen, with commodity currencies also edging lower but within recent ranges. Firmer US data has helped greenback early intraday advance, with the EUR/USD down to 1.3109, barely 4 pips above 1.3105, September 2013 monthly low and immediate support. The lack of follow through however is mostly due to ECB meeting upcoming Thursday, with investors waiting for Mr. Draghi decision to make one on the pair. Nevertheless the bearish tone remains intact, albeit the hourly chart shows a neutral tone due to the limited intraday range. In the 4 hours chart price remains below a bearish 20 SMA in the 1.3140/50 area, while indicators turned flat in negative territory. Some further falls should be expected if 1.3105 is taken, but the slide will likely remain limited ahead of afore mentioned event.

Support levels: 1.3105 1.3080 1.3050

Resistance levels: 1.3145 1.3180 1.3215

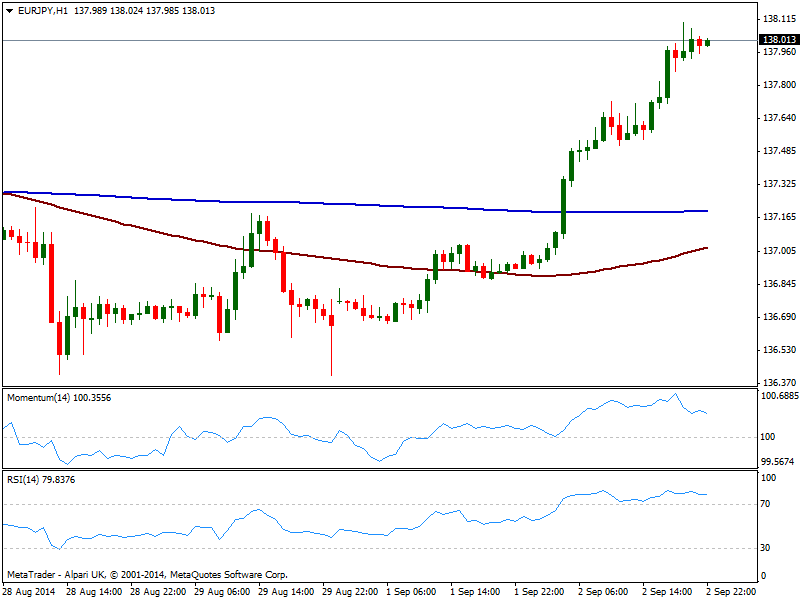

EUR/JPY Current price: 138.01

View Live Chart for the EUR/JPY

Yen weakness outstood across the board with the EUR/JPY strongly up to current 138.00 price zone. Pressuring the high of 138.10, the hourly chart shows that indicators corrected some of the extreme overbought readings reached after the over 100 pips daily rally, but hold well into positive territory, while moving averages remain flat well below current price. In the 4 hours chart, technical readings present a stronger upward momentum while 100 SMA crossed above 200 one both in the 137.00 price zone. A steady advance above current figure should signal a near term bottom , favoring a continued recovery on yen self weakness.

Support levels: 138.00 137.60 137.30

Resistance levels: 138.40 138.80 139.30

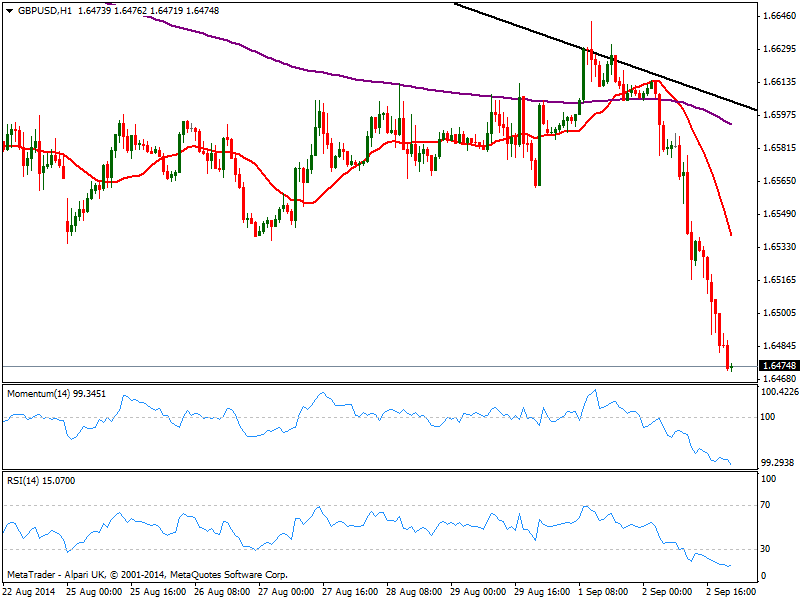

GBP/USD Current price: 1.6522

View Live Chart for the GBP/USD

Pound continued slide starting with the European opening extended all through the American session, with the pair quoting at a fresh 6-month low and about to challenge last March one at 1.6465 ahead of Asian opening. Despite UK Construction PMI surged to levels not seen since January this year, the pair sunk on growing concerns Scotland might actually vote for its independence later this month. Technically, the short term picture shows indicators heading lower in extreme oversold levels, while 20 SMA maintains a strong bearish slope well above current price. In the 4 hours chart momentum remains vertical, while RSI stands at 24.7 both holding to the strong bearish tone. The strong rejection from the daily descendant trend line coming from this year high towards new lows, suggests the bearish trend underway may remain healthy for longer than initially expected, eyeing midterm a test of 1.6250 price zone.

Support levels: 1.6465 1.6435 1.6400

Resistance levels: 1.6510 1.6540 1.6585

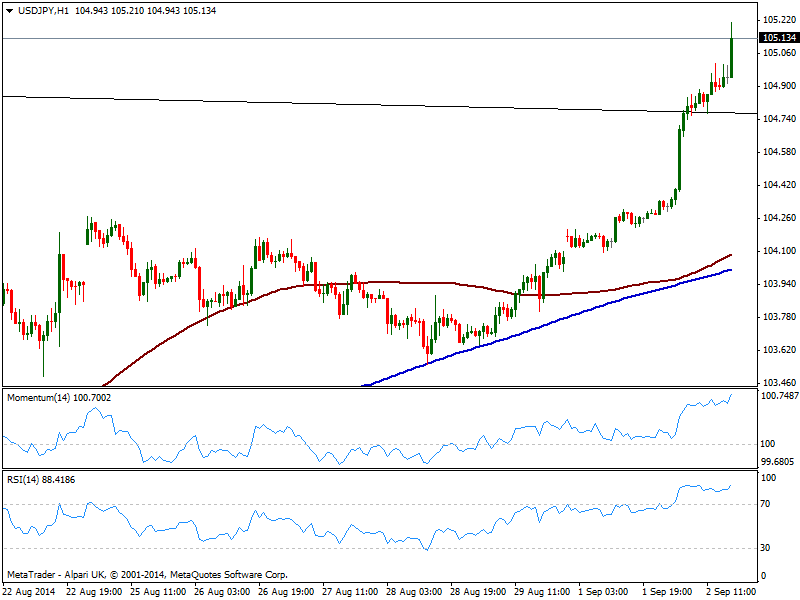

USD/JPY Current price: 105.12

View Live Chart for the USD/JPY

In route to the year high of 105.43 USD/JPY advance was supported by raising US yields that surged 7bp over the last few hours. The pair has so far ignored the extreme overbought readings coming from the hourly indicators that had partially retreated from their highs while price remained firm above the 105.00 mark. In the 4 hours chart indicators stand in extreme overbought territory far from suggesting a downward correction. Nevertheless, a pullback down to 104.80 is possible without really affecting the dominant bullish trend.

Support levels: 104.80 104.30 104.00

Resistance levels: 105.45 105.90 106.30

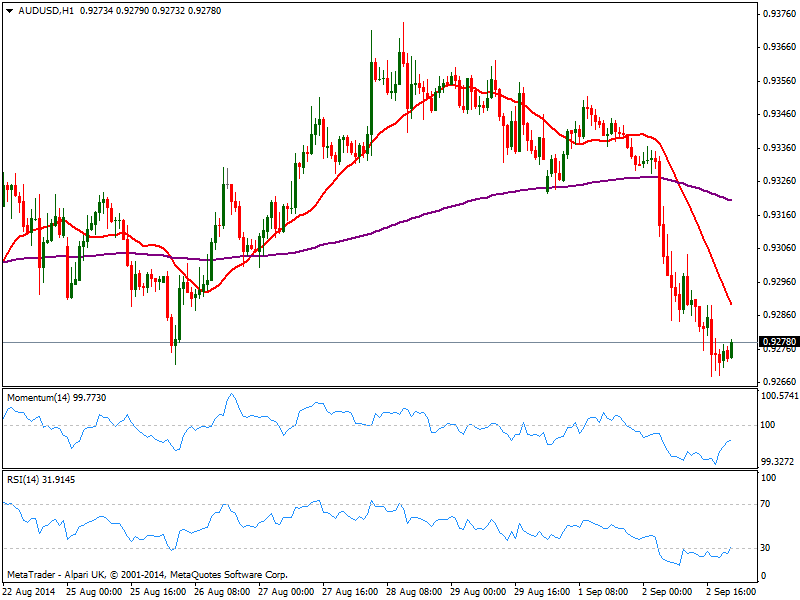

AUD/USD Current price: 0.9277

View Live Chart of the AUD/USD

The AUD/USD stands near its daily low of 0.9267, weighted not only but an on hold RBA, but also by Gold that tumbled to $ 1263/oz. As for the Aussie itself, the currency will have to face local GDP readings in the Asian session, expected to shrink from 3.5% to 3.0% yearly basis. Technically, the hourly chart shows price consolidating near the lows while indicators corrected oversold readings, but the general tone is still strongly bearish. In the 4 hours chart indicators maintain a strong bearish momentum, with a price acceleration below 0.9260 probably signaling further slides over the upcoming sessions.

Support levels: 0.9260 0.9220 0.9170

Resistance levels: 0.9300 0.9330 0.9370

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.