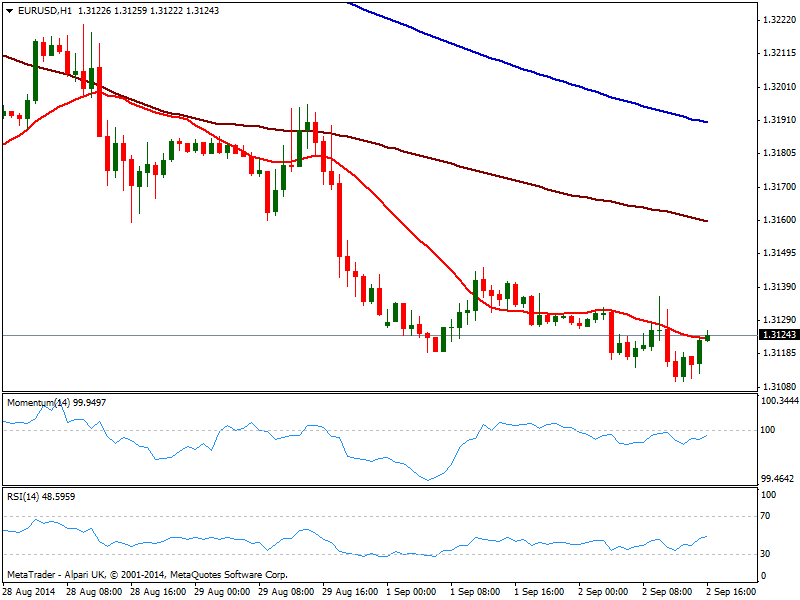

EUR/USD Current price: 1.3124

View Live Chart for the EUR/USD

Majors consolidate near their daily lows ahead of US data, with the greenback standing as the overall daily winner so far today. The EUR/USD bounced some from a daily low of 1.3109 but maintains the bearish tone, as per being capped by its 20 SMA in the 1 hour chart, while indicators stand in negative territory. In the 4 hours chart indicators aim higher from oversold levels, pointing for a limited upward correction while 20 SMA presents a strong bearish slope currently offering intraday resistance around 1.3150. Dollar strength could get a boost from US data to be released shortly, favoring then a break lower towards 1.3050.

Support levels: 1.3105 1.3080 1.3050

Resistance levels: 1.3150 1.3180 1.3215

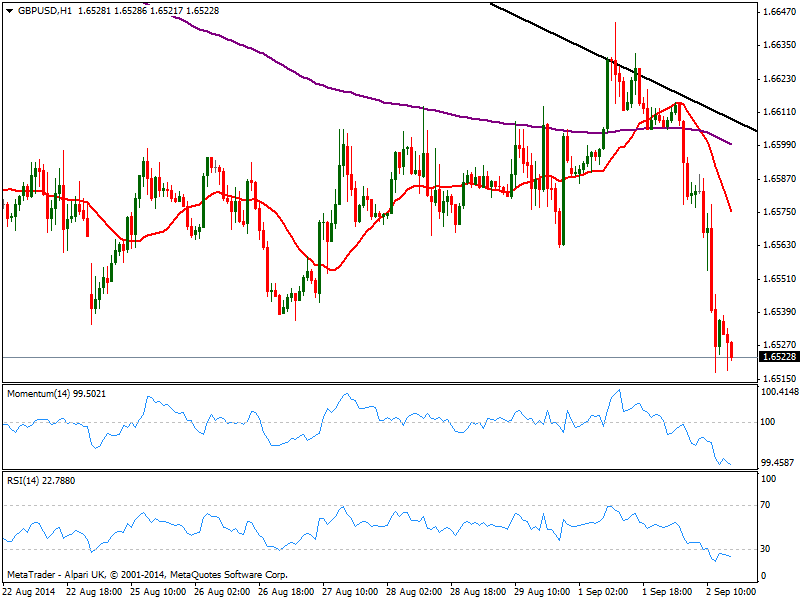

GBP/USD Current price: 1.6522

View Live Chart for the GBP/USD

Pound trades at fresh 6 month low against the greenback, having been unable to recover despite strong UK Construction PMI reading, up to 64. The pair pressures its daily low right below the 1.6520 figure, with the hourly chart showing a strong bearish momentum coming from indicators that continue heading south despite in oversold territory. In the 4 hours chart technical readings also present a bearish bias, pointing for further short term falls as long as sellers now surge on approaches to 1.6540/50 price zone.

Support levels: 1.6510 1.6470 1.6435

Resistance levels: 1.6540 1.6585 1.6620

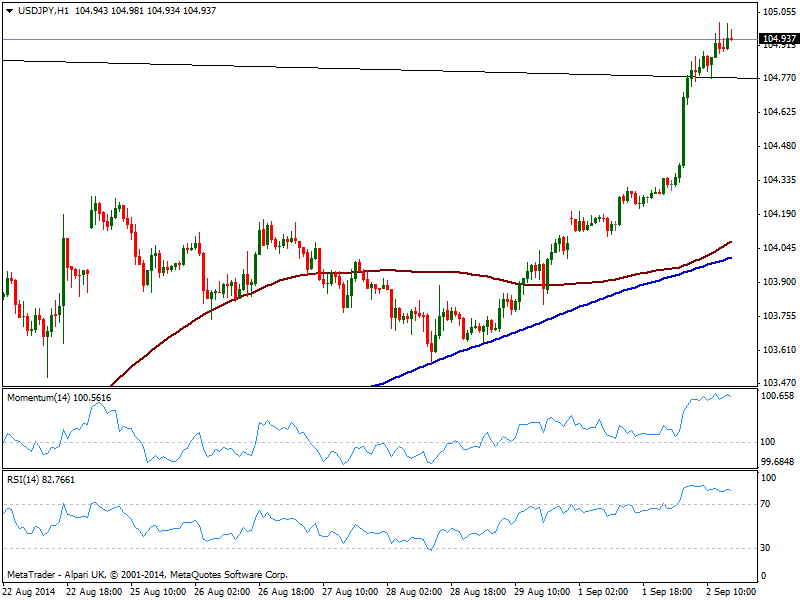

USD/JPY Current price: 104.93

View Live Chart for the USD/JPY

The USD/JPY flirts with the 105.00 level, trading around a long term descendant trend line coming back from 1998. The hourly chart shows indicators barely retracing from extreme overbought readings, but price holding near the highs, suggesting the downward corrective movement will remain limited. In the 4 hours chart moving averages had gained further bullish slope well below current price, while indicators also look exhausted to the upside in extreme overbought levels. Nevertheless, a break above 105.10 should deny the possibility of a downward correction and see the pair extending up to 105.43, this year high.

Support levels: 104.80 104.30 104.00

Resistance levels: 105.10 105.45 105.90

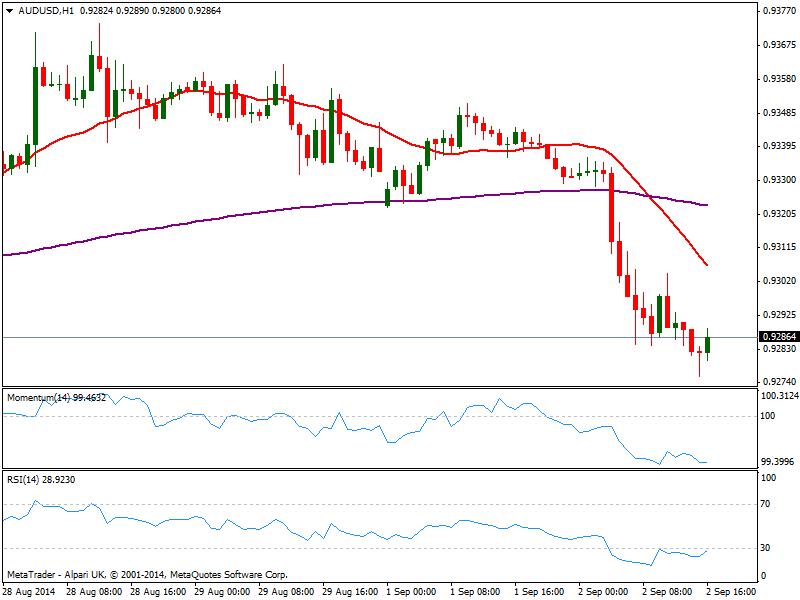

AUD/USD Current price: 0.9286

View Live Chart of the AUD/USD

Aussie lost the 0.9300 level against the dollar, with the pair now steady near its daily low of 0.9275. The hourly chart shows price well below a bearish 20 SMA while indicators stand in oversold territory, far from suggesting a recovery. In the 4 hours chart the technical picture is also bearish, with a break now below 0.9260 required to confirm a new leg down.

Support levels: 0.9260 0.9220 0.9170

Resistance levels: 0.9300 0.9330 0.9370

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.