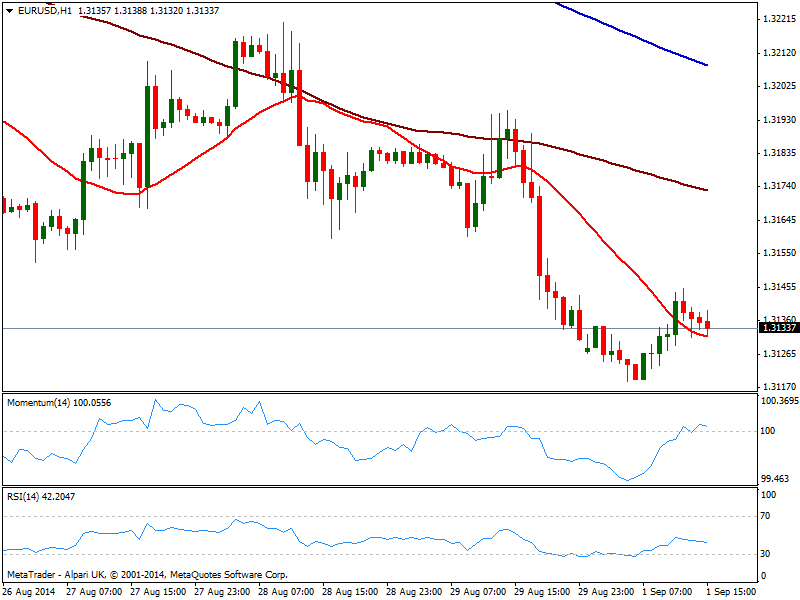

EUR/USD Current price: 1.3133

View Live Chart for the EUR/USD

European currencies saw a temporal respite early Europe, albeit held below critical short term resistances, with the EUR/USD reaching a daily high of 1.3145. With the US closed on Labor Day holiday, there’s not much to expect from the upcoming hours: action will be likely delayed to upcoming Asian session that includes RBA monthly meeting among other Australian readings. In the meantime, the EUR/USD holds midrange having been as low as 1.3119 past Asian session, with the hourly chart maintaining a quite neutral technical stance as per indicators flat around their midlines, and price barely above an also flat 20 SMA. In the 4 hours chart indicators hold well below their midlines, with RSI turning back lower after correcting oversold headings and steady near 30, all of which maintains the risk to the downside.

Support levels: 1.3105 1.3090 1.3050

Resistance levels: 1.3145 1.3180 1.3215

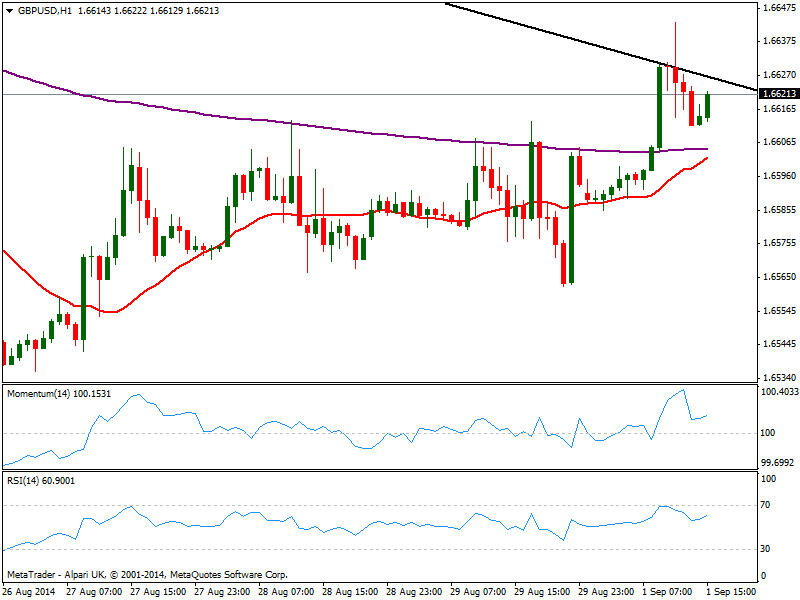

GBP/USD Current price: 1.6621

View Live Chart for the GBP/USD

The GBP/USD advanced up to 1.6643 before worse than expected UK Manufacturing PMI dragged price lower, steadily consolidating now below the daily ascendant trend line coming from this year high today at 1.6630. The hourly chart presents a technical bullish stance, with indicators heading north above their midlines, and 20 SMA gaining upward slope below current price. The 4 hours chart shows also a positive technical tone, yet some steady gains above mentioned 1.6630 level are required to confirm further advances, eyeing then a test of the 1.6670 price zone.

Support levels: 1.6600 1.6570 1.6540

Resistance levels: 1.6630 1.6665 1.6700

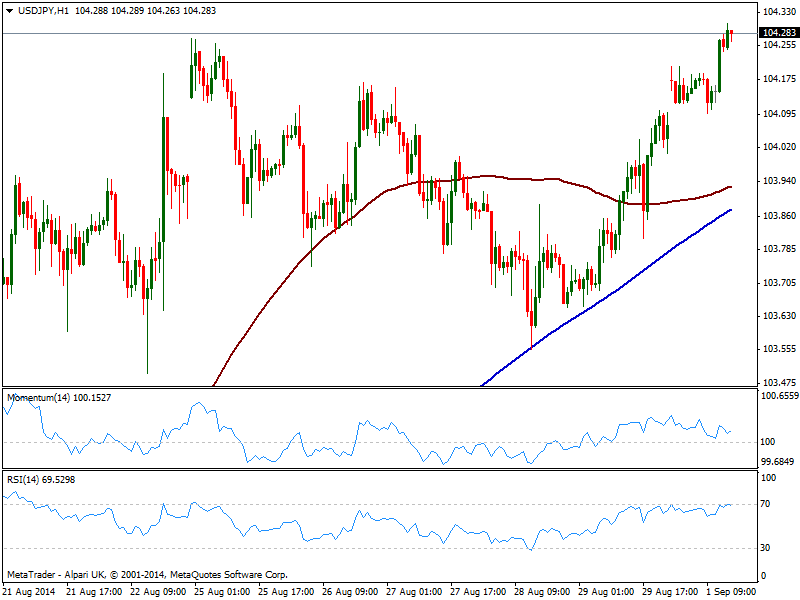

USD/JPY Current price: 104.28

View Live Chart for the USD/JPY

Trading a few pips above August high, the USD/JPY holds near 104.30, maintaining a positive tone in the short term, albeit lacking momentum due to the lack of volume. The hourly chart shows 100 and 200 SMAs a few pips below 104.00 acting as intraday support area, while indicators are in positive territory showing no directional strength. In the 4 hours chart indicators lost upward strength near overbought levels, but remain far from signaling a price retracement.

Support levels: 104.00 103.70 103.35

Resistance levels: 104.30 104.50 104.80

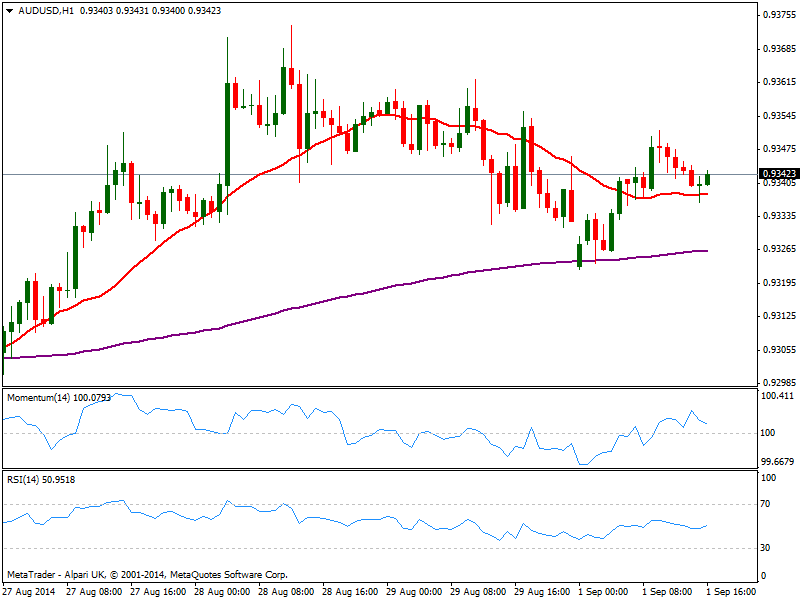

AUD/USD Current price: 0.9342

View Live Chart of the AUD/USD

The AUD/USD advanced some, holding above the 0.9330 level albeit unable to pick up in thin market conditions. The hourly chart presents a neutral technical stance with price above a flat 20 SMA and indicators hovering around their midlines, while the 4 hours chart shows a slightly bearish tone, with price below its 20 SMA and indicators turning lower yet in neutral territory.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9410 0.9450

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.