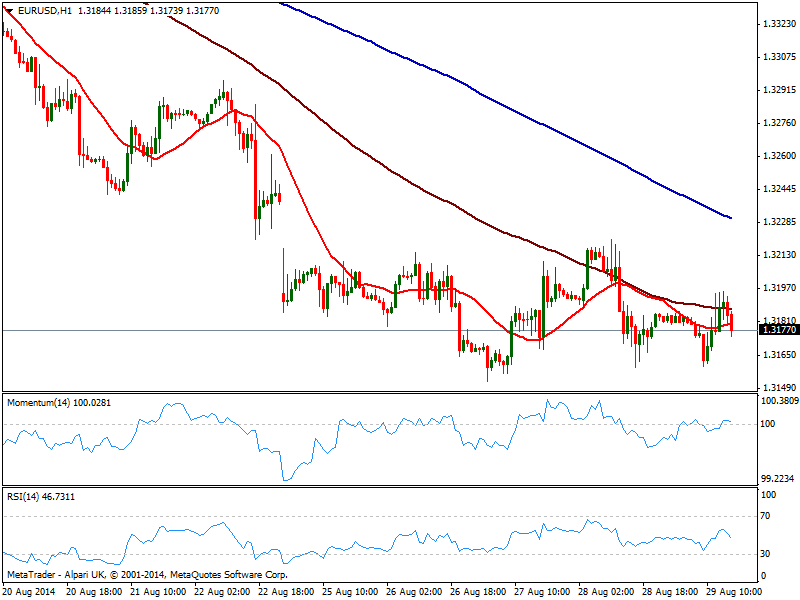

EUR/USD Current price: 1.3184

View Live Chart for the EUR/USD

Back and forth with fundamental news, the pair has once again lacked direction over the past session, trading uneventfully below the 1.3200 level, maintaining a bearish technical stance as per trading a few pips above its year low. Inflation in Europe matched expectations of 0.3% nothing really positive considering it puts the economy one step closer to deflation. Nevertheless, market will probably wait until upcoming ECB meeting on Thursday before taking any serious decision on the pair. At this point, the short term picture is mild bearish, with indicators turning lower around their midlines and price moving below its 20 SMA in the hourly chart. In the 4 hours one price is capped below a flat 20 SMA while momentum grinds higher in positive territory and RSI stands flat below its midline. Unless a price acceleration below 1.3150, the pair will likely maintain its weekly range for the rest of the day.

Support levels: 1.3150 1.3120 1.3090

Resistance levels: 1.3215 1.3240 1.3280

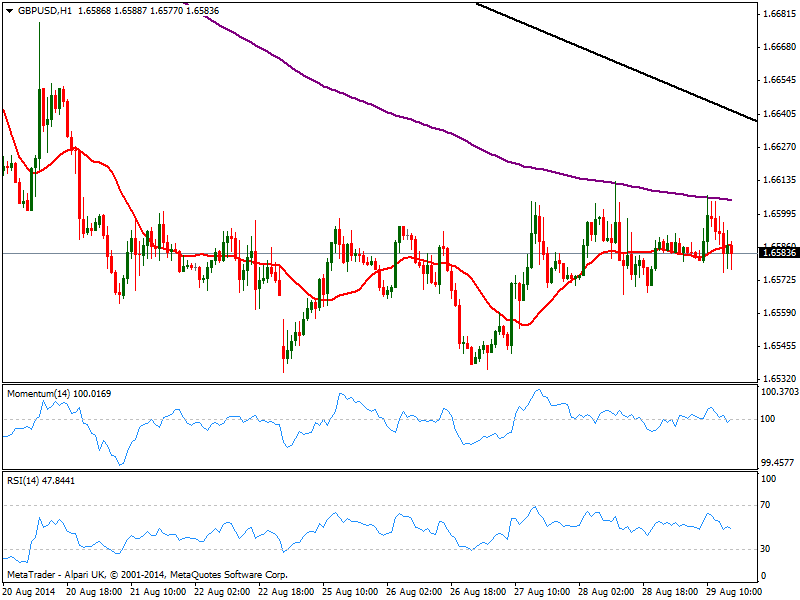

GBP/USD Current price: 1.6583

View Live Chart for the GBP/USD

The GBP/USD pressured the 1.6600 level early Europe, but failed once again to move beyond it, trading in a 30 pips range since early Asian opening right below the level. The technical picture in the short term remains neutral, with price hovering around a flat 20 SMA and indicators steady around their midlines, while the 4 hours chart presents the same technical stance. A daily descendant trend line coming from this year high offers resistance around 1.6650 today in case of a shocking advance, while a break below 1.6540 is required to confirm a new leg down.

Support levels: 1.6540 1.6490 1.6465

Resistance levels: 1.6600 1.6630 1.6650

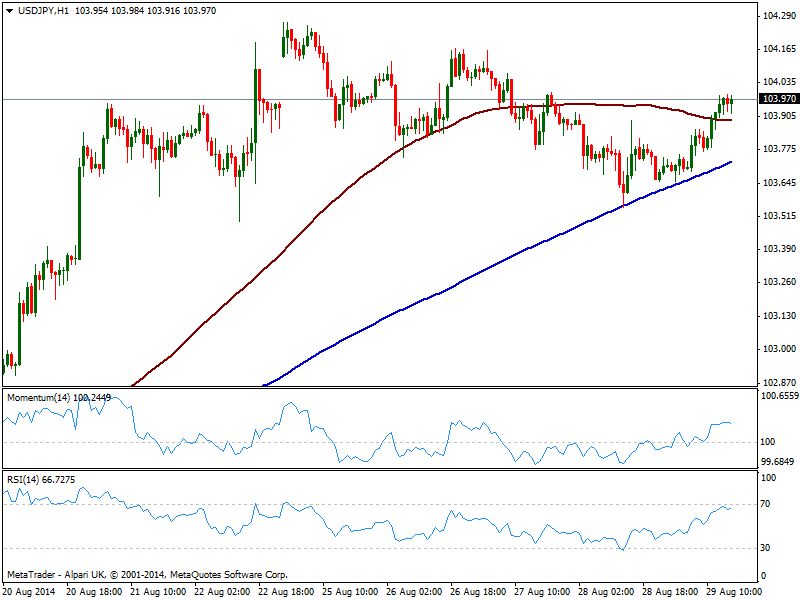

USD/JPY Current price: 103.97

View Live Chart for the USD/JPY

Flirting with the 104.00 figure, the USD/JPY got a boost from negative Japanese data coming from employment and industrial sectors. The pair has managed to add some, but remains capped below its weekly high posted on Monday, with the hourly chart showing price above its 100 SMA and indicators in positive territory, albeit losing early upward strength. In the 4 hours chart indicators head higher around their midlines, not yet suggesting a stronger rise but at least limiting the possibility of a short term decline.

Support levels: 103.55 103.20 102.85

Resistance levels: 104.20 104.50 104.80

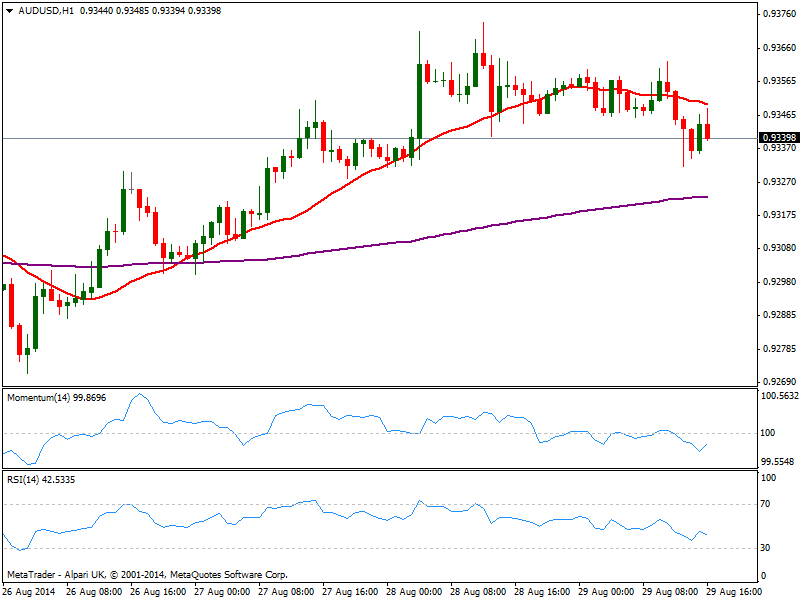

AUD/USD Current price: 0.9340

View Live Chart of the AUD/USD

The AUD/USD eased some further from its recent highs near 0.9370, yet holds so far above 0.9330 with the hourly chart showing price extending below its 20 SMA and indicators in negative territory but diverging between each other. In the 4 hours chart current candle extends below its 20 SMA while indicators turned south but remain above their midlines, pointing at least for a bearish correction towards 0.9300. A weekly close below this last however, will increase the downward potential, exposing 0.9260 price zone.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9410 0.9450

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.