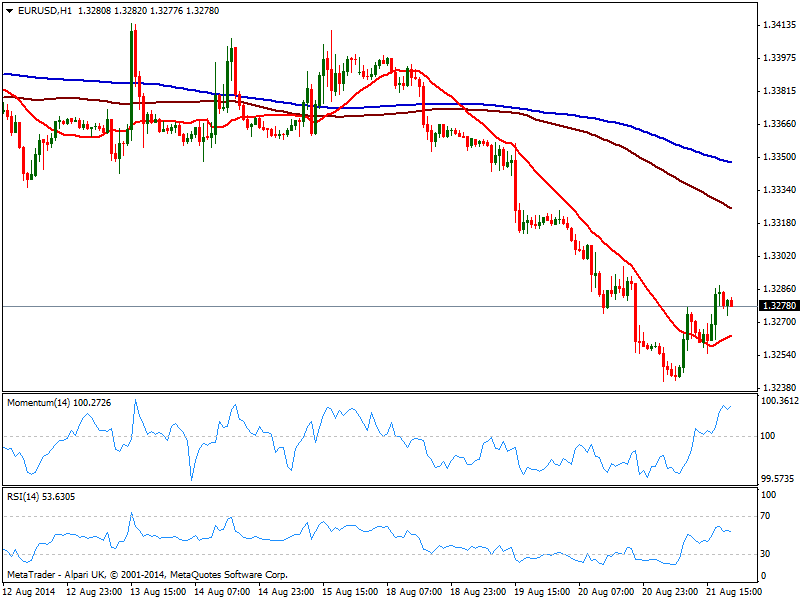

EUR/USD Current price: 1.3283

View Live Chart for the EUR/USD

The US session comes to an end leaving little across the FX board, the most boring market of the day. Stocks and commodities on the other hand, tell another story: US indexes soared with DJIA firm above 17000 and S&P a few points below the 2000 mark and closing at a new all time high. Gold sunk to 1275 as risk appetite was not enough to halt dollar strength, just paused it. Among majors, the greenback edged lower except against the JPY, but the bearish movements have been limited. US Jackson Hole symposium will have both, Draghi and Yellen speaking tomorrow, probably another good reason for traders to stay on hold.

As for the EUR/USD, the pair recovered from yet another year low of 1.3241, having however remained limited below the 1.3300 figure. The hourly chart shows price above a mild bullish 20 SMA, with indicators losing upward strength in positive territory. In the 4 hours chart indicators corrected oversold readings, but remain well into negative territory, while 20 SMA maintains a strong bearish slope around 1.3310, all of which suggest the upside will remain limited, and rather be a selling opportunity than a sign of a bottom.

Support levels: 1.3250 1.3210 1.3170

Resistance levels: 1.3310 1.3340 1.3385

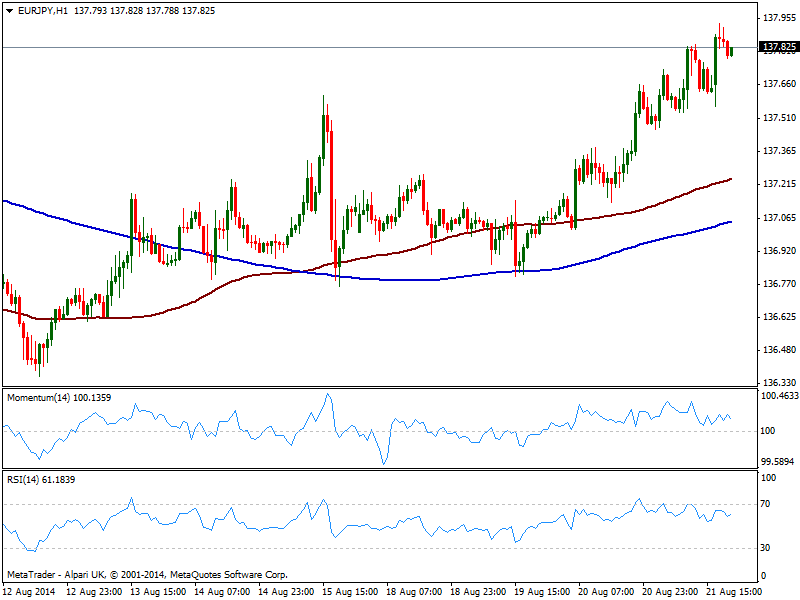

EUR/JPY Current price: 137.83

View Live Chart for the EUR/JPY

Yen was the biggest loser on Thursday, with the EUR/JPY stalling a few pips below the 138.00 mark and holding nearby as a new day starts. The upward movement was slow but steady, leaving the hourly chart with not much upward strength: moving averages remain flat below current price and indicators barely stand above their midlines. In the 4 hours chart however, momentum remains strong as price extends above moving averages, both around 137.10/20 offering now short term support. Steady gains above 138.00 should lead to a quick advance up to 138.40 while above this last the upward acceleration will likely accelerate towards 138.90 price zone.

Support levels: 137.20 136.80 136.40

Resistance levels: 138.00 138.40 138.90

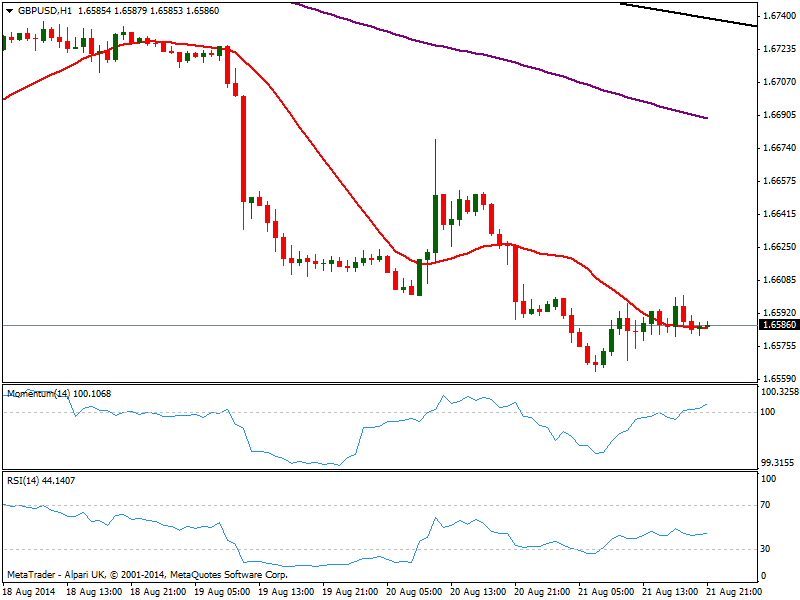

GBP/USD Current price: 1.6586

View Live Chart for the GBP/USD

Pound stands steady near its daily low against the greenback, of 1.6563, having been unable to recover after another round of negative data in the UK: both Retail Sales and Public Finances readings missed expectations. The short term technical picture is quite neutral, with the hourly chart showing price barely moving around a flat 20 SMA and indicators horizontal en neutral territory. In the 4 hours chart RSI stands steady at 33 while momentum aims higher still below its midline, and 20 SMA heads south above current price, offering dynamic resistance around 1.6630 now. For the most the downside is favored, with key support now at 1.6545, April this year monthly low.

Support levels: 1.6545 1.6510 1.6470

Resistance levels: 1.6630 16680 1.6710

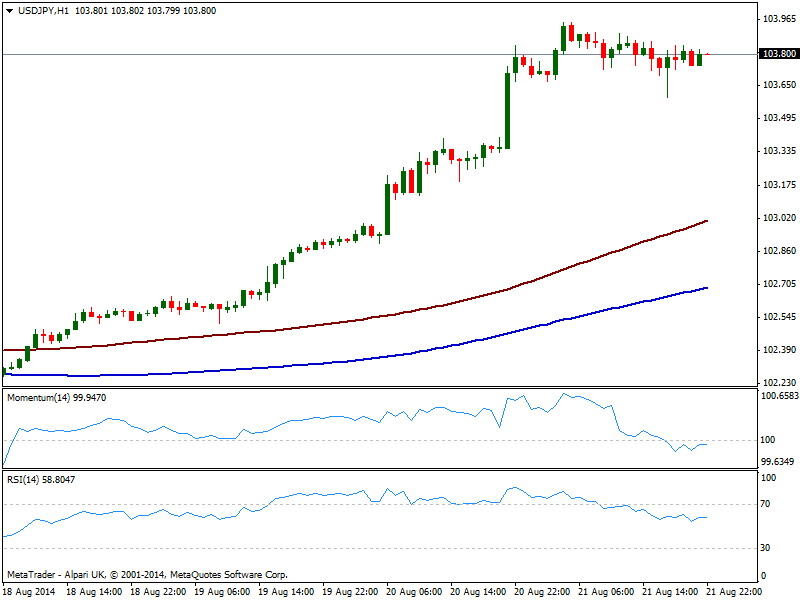

USD/JPY Current price: 103.80

View Live Chart for the USD/JPY

The USD/JPY reached a fresh high of 103.95 early Thursday, consolidating nearby for the rest of the day. The general outlook is still bullish, considering the hourly chart shows moving averages finally moving higher below current price, while indicators erased all of their overbought conditions. In the 4 hours chart indicators stand in extreme overbought levels, losing their upward strength but not yet signaling a downward correction, all of which suggest the upside is still favored.

Support levels: 103.40 103.20 102.80

Resistance levels: 103.95 104.20 104.45

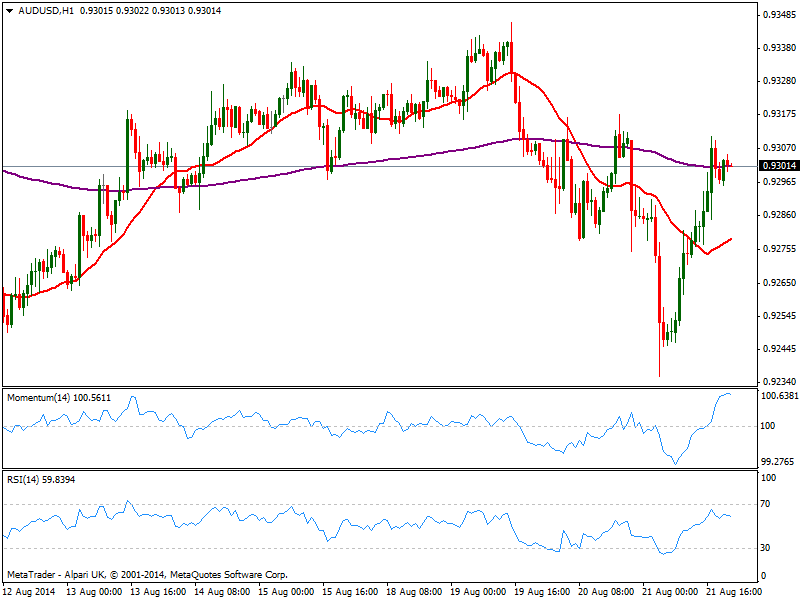

AUD/USD Current price: 0.9301

View Live Chart for the AUD/USD

The AUD/USD surged from a low of 0.9236 posted after weak Chinese data past Asian session, boosted by risk appetite and back around the 0.9300 price zone. Ahead of Asian opening, the hourly chart shows indicators losing upward strength near overbought territory, while 20 SMA presents a bullish slope below current price. In the 4 hours chart price stands right below its 20 SMA while indicators aim higher in negative territory, suggesting the rally is losing steam. Renewed selling pressure below 0.9260 should lead to a downward continuation while the critical resistance stands at 0.9330 and if above, chances are of another leg higher.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.