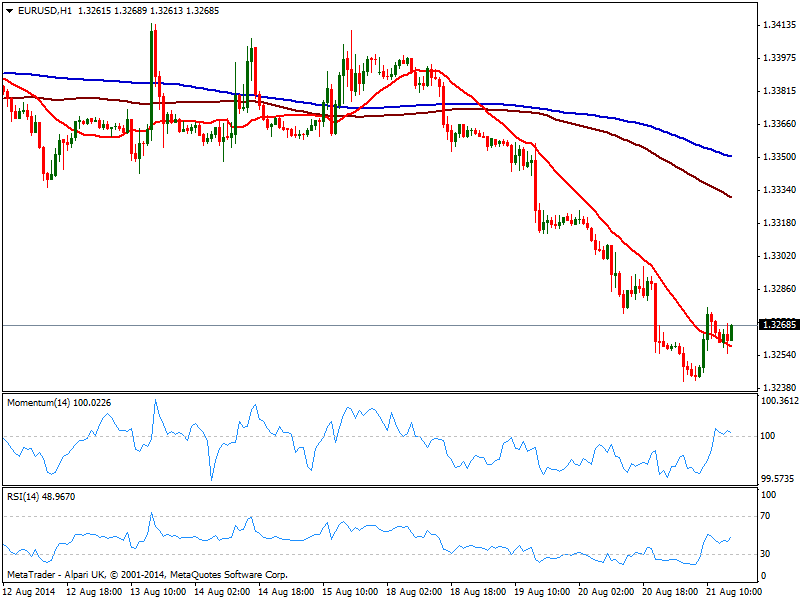

EUR/USD Current price: 1.3271

View Live Chart for the EUR/USD

Having posted a lower low daily basis at 1.3241, the EUR/USD trades pretty much unchanged intraday, hovering around its daily opening. Dollar momentum seems temporarily interrupted, with US indexes at record highs and US 10Y yields above 2.40%, giving high yields a breath. Technically however, the pair is far from suggesting a strong upward potential, with the 1 hour chart showing indicators flat above their midlines and price above a still bearish 20 SMA. In the 4 hours chart indicators maintain their bearish slope despite in oversold levels, supporting the shorter term view.

Support levels: 1.3250 1.3210 1.3170

Resistance levels: 1.3300 1.3330 1.3370

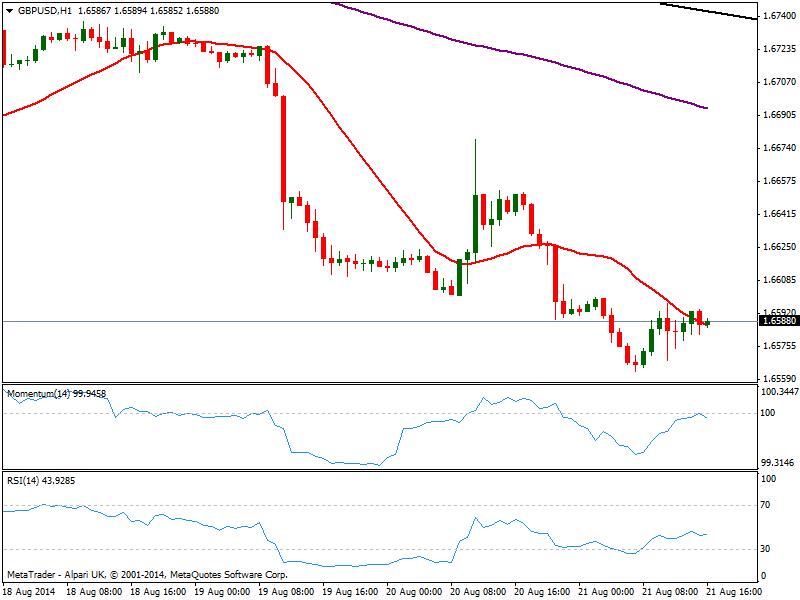

GBP/USD Current price: 1.6587

View Live Chart for the GBP/USD

Worse than expected Retail Sales and Public Finances in the UK keep GBP/USD around a 4 month low, despite the European session has been pretty uneventful when it comes to price action. Nevertheless, the pair maintains a bearish tone, at least in the short term, with the hourly chart showing indicators turning back south in negative territory after testing their midlines, and price stuck around an also bearish 20 SMA. In the 4 hours chart the technical stance is also bearish, with 1.6545, April this year low, as critical support to break to see further downward potential.

Support levels: 1.6545 1.6510 1.6470

Resistance levels: 1.6630 16680 1.6710

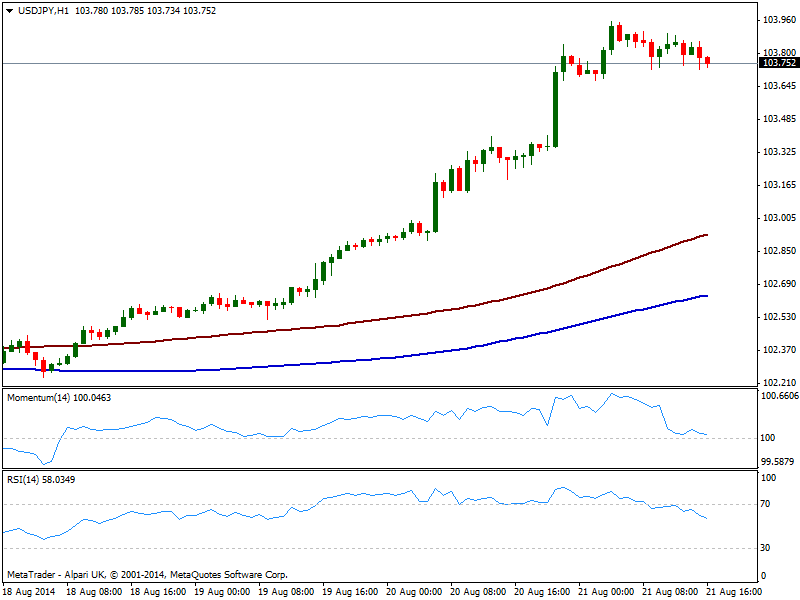

USD/JPY Current price: 103.75

View Live Chart for the USD/JPY

The USD/JPY eases some from a fresh high of 103.95, consolidating however near it early US opening. The hourly chart shows that while price barely shed 20 pips, momentum has corrected all of its overbought condition and losses downward potential around its midline, while RSI heads south supporting some further downward corrective move. In the 4 hours chart indicators turn lower but hold in extreme overbought levels, limiting the downward potential at the time being.

Support levels: 103.40 103.20 102.80

Resistance levels: 103.95 104.20 104.45

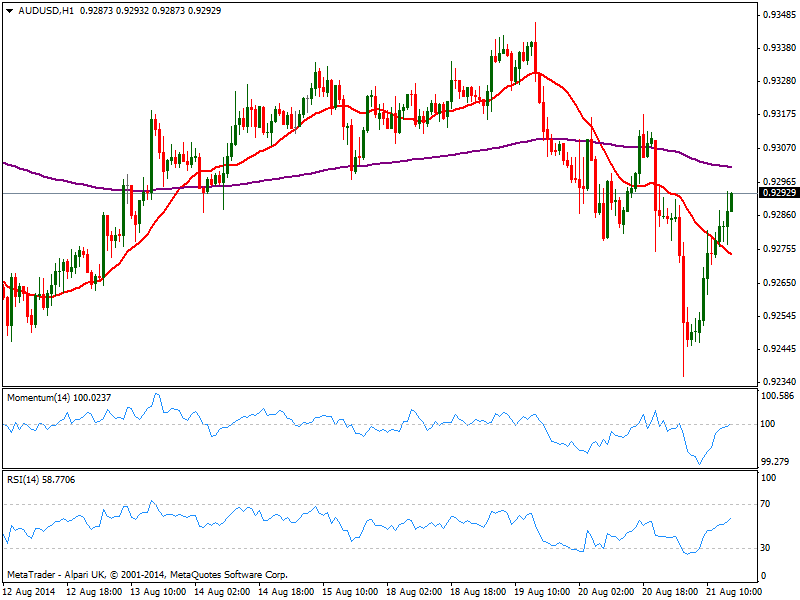

AUD/USD Current price: 0.9292

View Live Chart for the AUD/USD

The AUD/USD suffered a strong slide over Asian hours on the back of weak Chinese data, bouncing however from a low of 0.9236. Quickly approaching 0.9300, the hourly chart shows a clear upward potential that suggest a probable test of the 0.9330 strong static level. In the 4 hours chart however, 20 SMA maintains a bearish slope right above current price, while indicators lose upward strength below their midlines.

Support levels: 0.9260 0.9220 0.9180

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.