EUR/USD Current price: 1.3457

View Live Chart for the EUR/USD

The EUR/USD trades lower in range, having extended its decline down to 1.3454 fresh year low, and unable to recover above 1.3475 former one broken last Tuesday. In the fundamental front, EU consumer confidence dropped down to -8.4 in July, while there was no major US data to affect currencies. European stocks edged higher, but US indexes stand near breakeven by the end of the American session, not before the S&P reached a fresh all time high.

With little to drive the pair, the EUR/USD remained contained in a tight 20 pips range, maintaining anyway the bearish bias intact. In the short term, the hourly chart shows price right below its 20 SMA and indicators gaining bearish tone below their midlines, while in the 4 hours one indicators continue heading lower despite in oversold territory, leaving little room for recoveries. European PMI readings early Thursday can be the trigger the market needs, with upward corrections up to 1.3570 seen as selling opportunities rather than probable signs of a reversal.

Support levels: 1.3445 1.3410 1.3380

Resistance levels: 1.3500 1.3535 1.3570

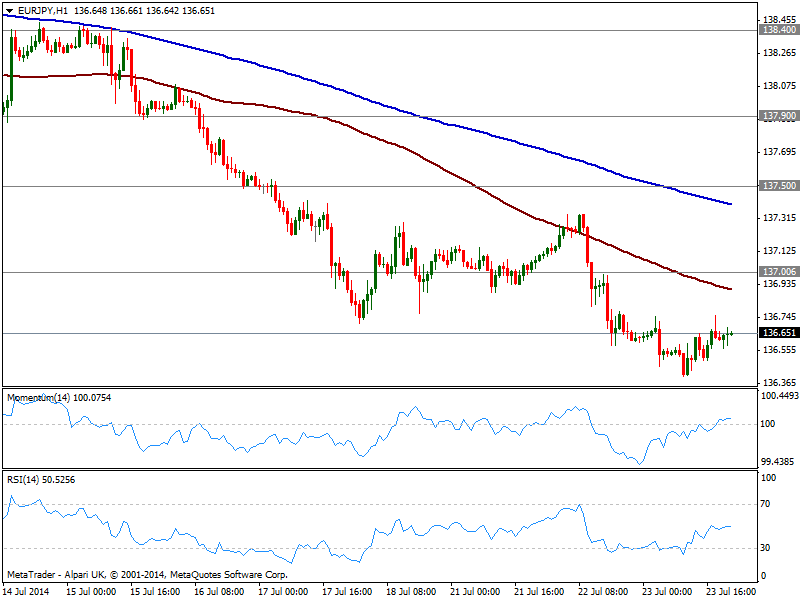

EUR/JPY Current price: 136.65

View Live Chart for the EUR/JPY

The EUR/JPY was again weighted by EUR weakness, albeit the slide remained limited by stocks positive tone along the day. Barely unchanged on the day, the hourly chart shows moving averages maintain a strong bearish bias above current price, while indicators lay flat above their midlines, indicating little buying interest around. In the 4 hours chart however, indicators aim higher still in negative territory, with RSI bouncing from oversold levels, pointing for some advance ahead: in that case 137.00 price zone stands as immediate resistance and only above it the pair may extend it advance, eyeing 137.50 in the short term.

Support levels: 136.60 136.20 135.75

Resistance levels: 137.00 137.50 137.90

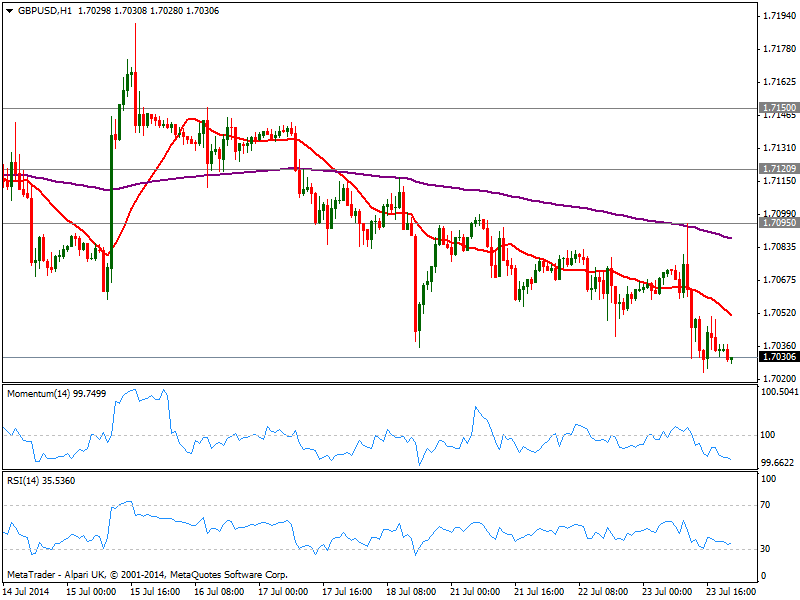

GBP/USD Current price: 1.7030

View Live Chart for the GBP/USD

The GBP/USD eased from a daily high of 1.7095 on the back of a dovish BOE, as the Central Bank not only kept the usual vote unchanged, but governor Carney asseverated there’s no actual date for a rate hike. Nevertheless, the pair was unable to break below 1.7030 static support where it stands, maintaining an overall short term tone: the hourly chart shows 20 SMA gaining bearish momentum above current price while indicators support a break lower. In the 4 hours chart, price stands a few pips below its 200 EMA, unable to extend its decline. Having posted a daily low of 1.7020, a price acceleration below the level should support a downward extension towards 1.6950, with only a recovery above mentioned 1.7095 reversing the negative tone.

Support levels: 1.7020 1.6985 1.6950

Resistance levels: 1.7050 1.7095 1.7120

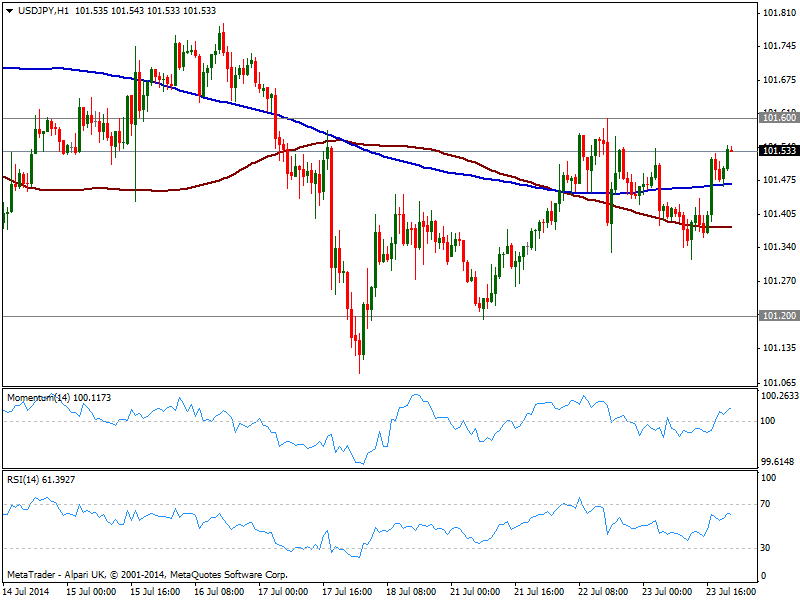

USD/JPY Current price: 101.53

View Live Chart for the USD/JPY

The USD/JPY traded within range, up on the day but still shy of 101.60 immediate resistance. The hourly chart shows indicators heading higher above their midlines, and price finding short term support at its 200 SMA, albeit moving averages are horizontal, and with price moving back and forth around them, have become less reliable. In the 4 hours chart indicators head higher in positive territory, yet chances of an advance are subdue to a break above mentioned resistance.

Support levels: 101.20 101.05 100.70

Resistance levels: 101.60 101.95 102.35

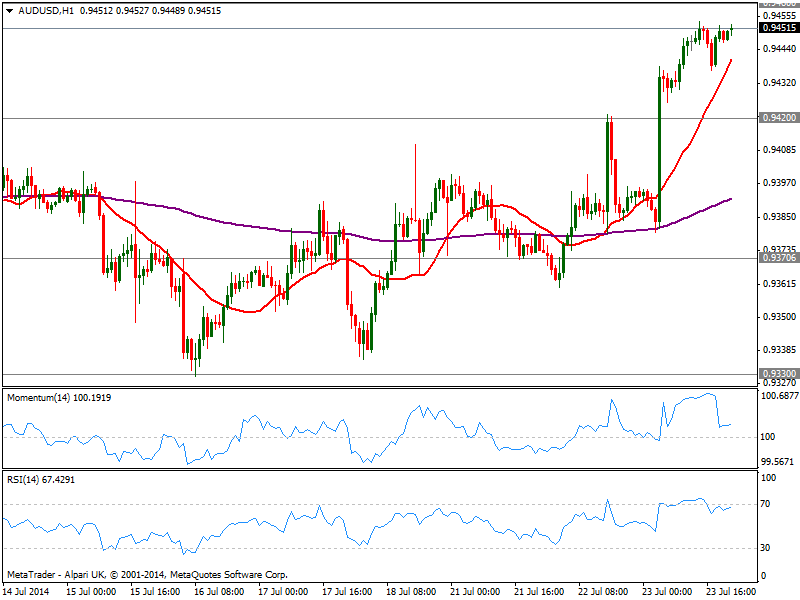

AUD/USD Current price: 0.9452

View Live Chart for the AUD/USD

Aussie was the star of the day, soaring on local rising inflation and extending its advance all through the day. The AUD/USD approaches 0.9460 early Asian session, strong static resistance level, while the hourly chart shows indicators already corrected overbought readings and regain the upside, while 20 SMA heads strongly up below current price. In the 4 hours chart indicators start looking exhausted to the upside, losing their upward potential and turning flat near overbought levels. Nevertheless, further advances beyond 0.9460 should signal an upward continuation, and a quick test of 0.9500 figure. Bulls will maintain the lead as long as price holds above 0.9420 support.

Support levels: 0.9420 0.9370 0.9330

Resistance levels: 0.9460 0.9500 0.9540

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.