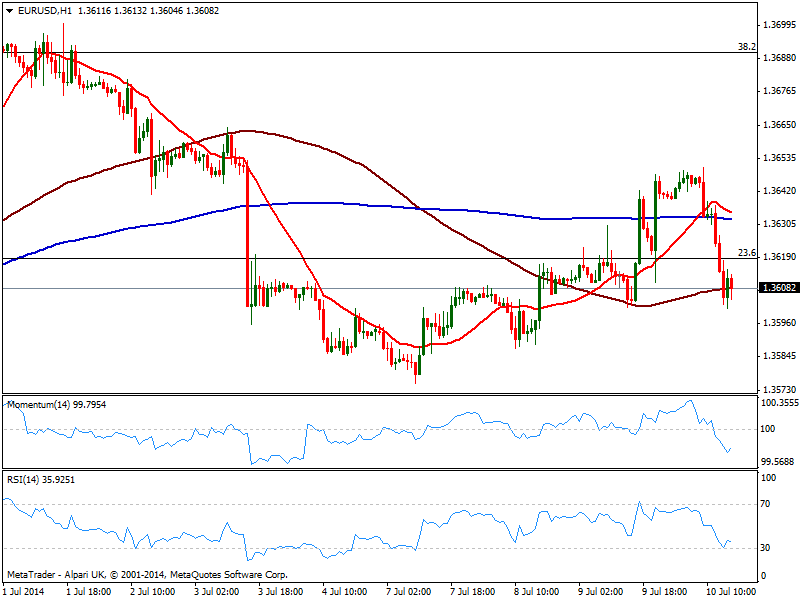

EUR/USD Current price: 1.3608

View Live Chart for the EUR/USD

The EUR/USD gave up all the ground added after FOMC, with dollar and yen strongly up on risk aversion: having warned on market complacency just yesterday, stocks entered a selling spiral that points for a strong and continued slide for today. As for the EUR/USD technical picture, the hourly chart shows price holding right above 1.3600 figure, while indicators lost some of the downward potential but remains well into negative territory. In the 4 hours chart indicators present a strong bearish tone, yet hover above their midlines, not yet signaling a continued slide. The base of the range at 1.3570/80 continues to be the level to break to confirm a continued slide in the pair.

Support levels: 1.3570 1.3530 13500

Resistance levels: 1.3645 1.3675 1.3700

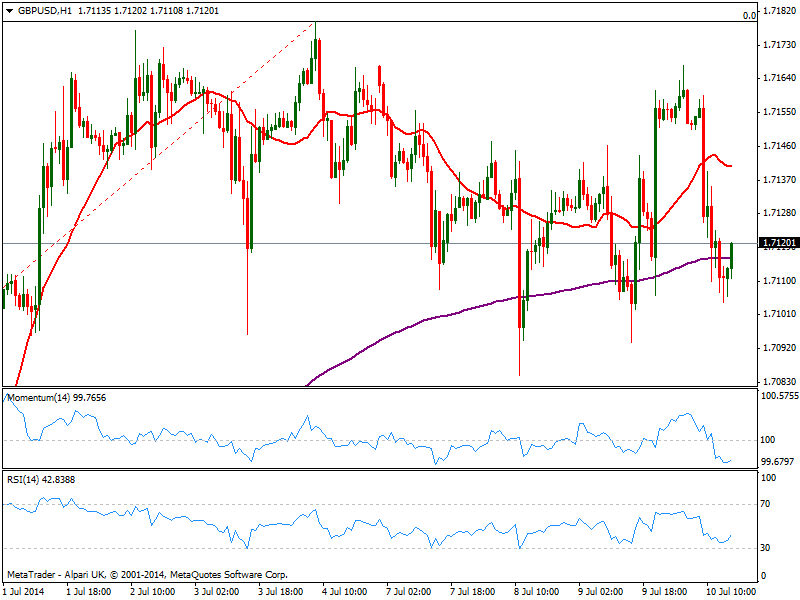

GBP/USD Current price: 1.7119

View Live Chart for the GBP/USD

The GBP/USD eased some on the back of worse than expected UK trade balance readings, but holds pretty well above 1.7100 despite dollar intraday strength. The hourly chart shows indicators exhausted to the downside near oversold levels and turning back north, while 20 SMA stands flat above current price. In the 4 hours chart the technical picture is mild bearish, with risk to the downside limited by 1.7060, 23.6% retracement of the latest bullish run

Support levels: 1.7095 1.7060 1.7020

Resistance levels: 1.7150 1.7180 1.7220

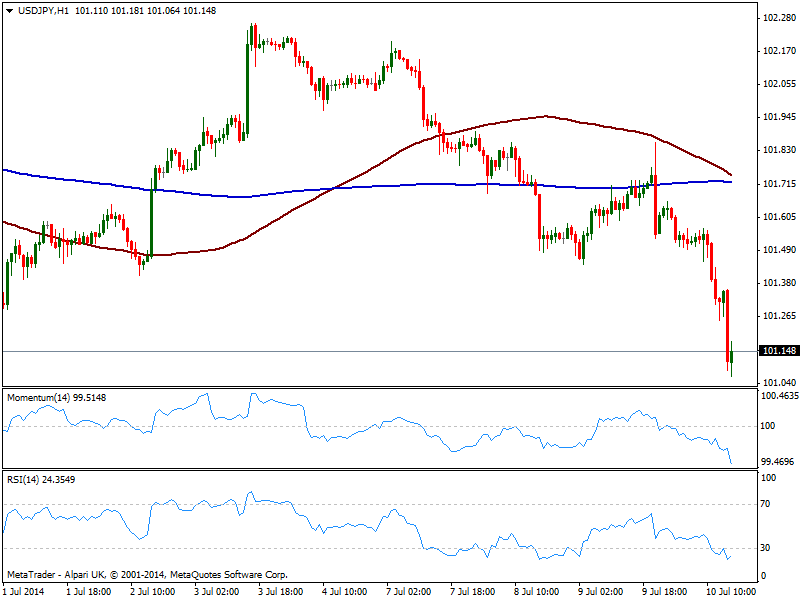

USD/JPY Current price: 101.14

View Live Chart for the USD/JPY

Yen leads the way this Thursday, with the USD/JPY flirting with the 101.00 level and trading at fresh 2-month lows. The hourly chart shows a strong bearish momentum, with 100 and 200 SMAs converging now in the 101.70 price zone. In the 4 hours chart technical readings also maintain a strong bearish tone, supporting a retest of this year low around 100.70. Immediate resistance stands now at 101.20/30 former daily lows.

Support levels: 101.00 100.70 100.25

Resistance levels: 101.30 101.70 101.95

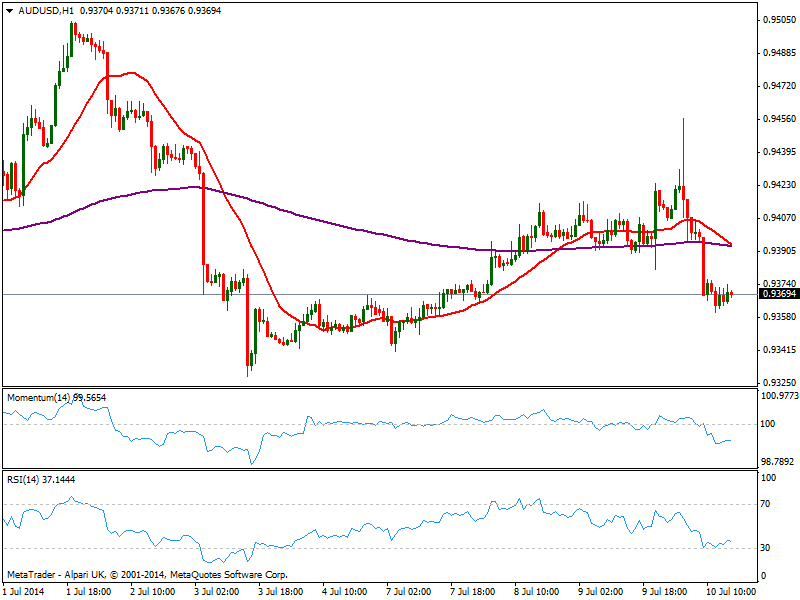

AUD/USD Current price: 0.9369

View Live Chart for the AUD/USD

AUD/USD holds around critical 0.9370, supported by gold momentum, trading at $1342/oz, levels not seen since past March. The AUD/USD surged near 0.9460 but worse than expected local employment readings put the pair under pressure early Asia. Nevertheless, the hourly chart presents a mild bearish tone, with price below moving averages and indicators in negative territory, showing no actual momentum at the time being. In the 4 hours chart technical readings present a strong bearish tone, albeit price struggles to break its 200 EMA around current levels. Critical support stands at 0.9330 as buyers had defended it for these last weeks. A break below it exposes the pair to a slide down to 0.9260 strong static support zone.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.