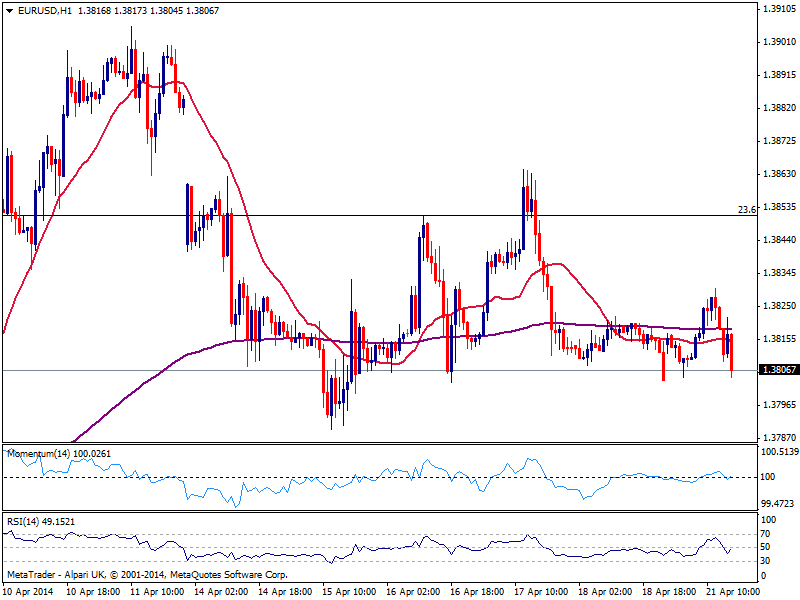

EUR/USD Current price: 1.3806

View Live Chart for the EUR/USD

The pair refuses to leave the 20 pips range where it trades since late Thursday with US opening, the first market to fully operate today. However the calendar will remain pretty much empty and little should be expected from majors, as US futures point for a quiet opening. The EUR/USD maintain a neutral technical bias, holding right above the 1.3800 figure and with a break either below the Fibonacci support of 1.3780 or above the static resistance of 1.3825 to set an intraday trend, albeit chances are of maintaining the mentioned range for today.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3860 1.3890

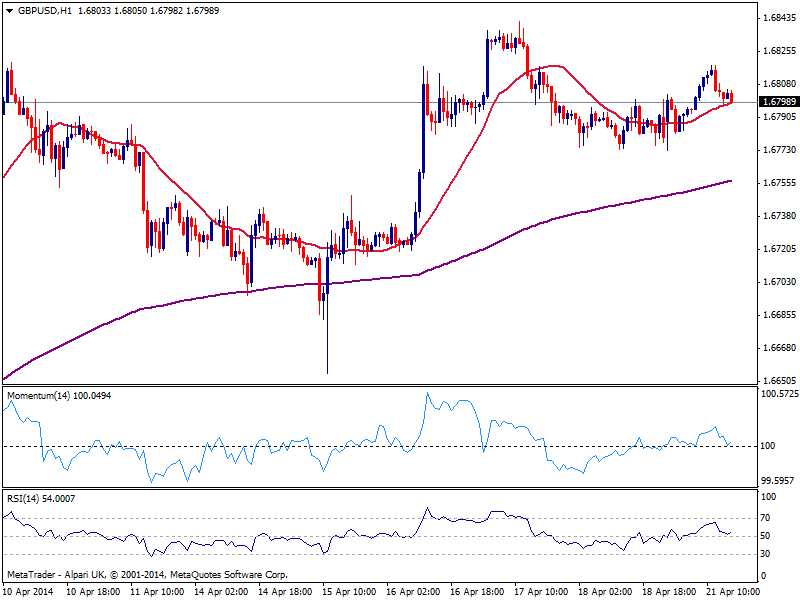

GBP/USD Current price: 1.6798

View Live Chart for the GBP/USD

The GBP/USD stands around 1.6800, having advanced early Europe up to 1.6818, maintaining the overall positive tone despite the lack of action seen across the board. Short term buyers still stand defending the 1.6770 price zone, and more down at 1.6745. A break above 1.6820 on the other hand, should see the pair advancing higher, looking for a test of 1.6870 November 2009 monthly high.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

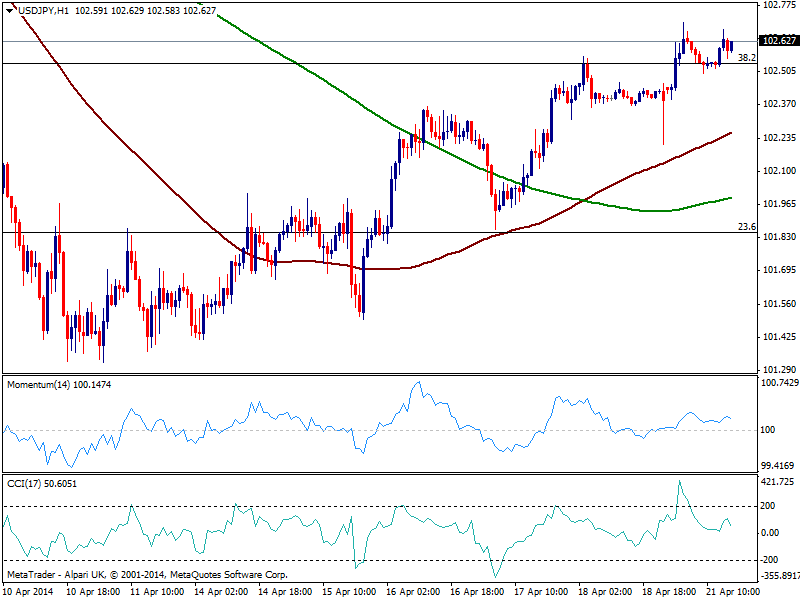

USD/JPY Current price: 102.62

View Live Chart for the USD/JPY

The USD/JPY spiked higher in Asian hours, after Japanese Trade Balance deficit widened further, putting yen in the bearish path against most rivals. The pair stands right at the 102.60 Fibonacci area albeit finding little support to extend gains either from technical readings or stocks. However, the outlook is positive now, with a probable approach to the 103.00 price zone as long as buyers surge on approaches to 102.30/40 price zone.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.95 103.20 103.70

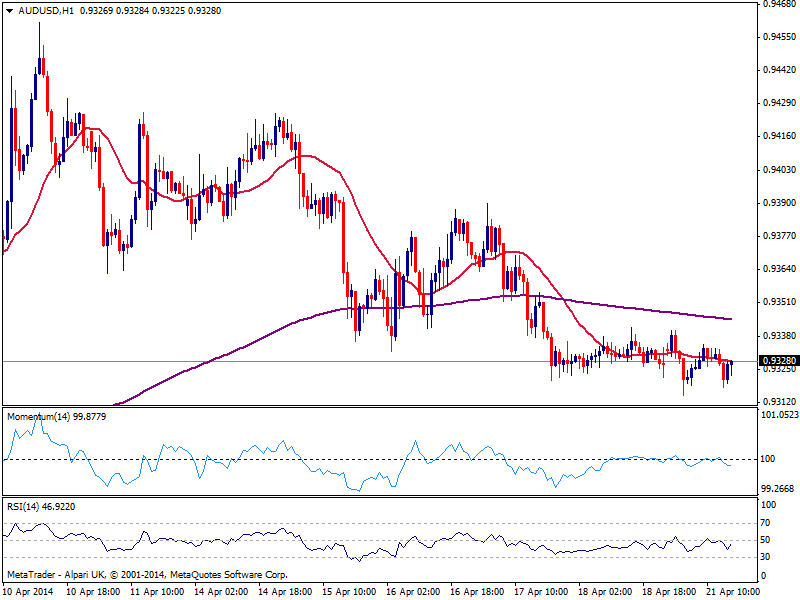

AUD/USD Current price: 0.9328

View Live Chart for the AUD/USD

Australian dollar trades slightly negative yet in range, having posted a lower low daily basis at 0.9315, but showing no directional bias in the hourly chart. Nevertheless as commented on previous updates, the pair remains in control of bears after reaching 0.9460 early April, with scope to extend down to 0.9260 strong midterm support.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9355 0.9390 0.9445

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.