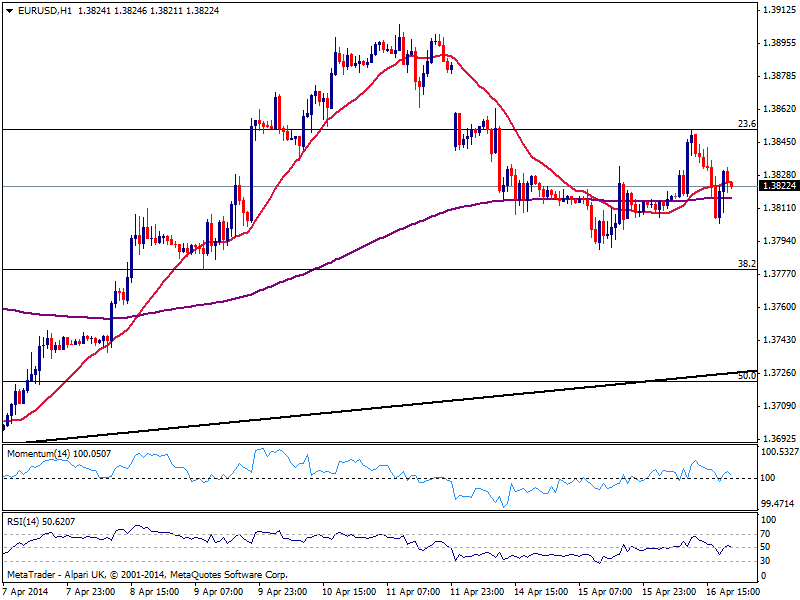

EUR/USD Current price: 1.3818

View Live Chart for the EUR/USD

Moving back and forth, the EUR edged higher against the greenback this Wednesday, having recovered some ground after 2 days of steady losses. The pair rose up to 1.3850 with the European opening in a stocks driven movement and despite the ECB latest threats of taking action against low inflation and a high currency. The US session saw indexes extending their recovery, albeit forex market has shown little reaction in the past few hours.

As for the technical picture, the EUR/USD presents a mild bearish tone ahead of Asian opening, with the pair barely above past Asian session opening and the hourly chart showing price below its 20 SMA and indicators heading lower around their midlines. In the 4 hours chart the pair also present a slightly bearish tone, with price contained below a bearish 20 SMA, currently around 1.3830. Risk to the downside however, remains limited by the strong static support around 1.3780 and only below this level the pair will likely resume early week bearish momentum.

Support levels: 1.3780 1.3750 1.3725

Resistance levels: 1.3850 1.3890 1.3925

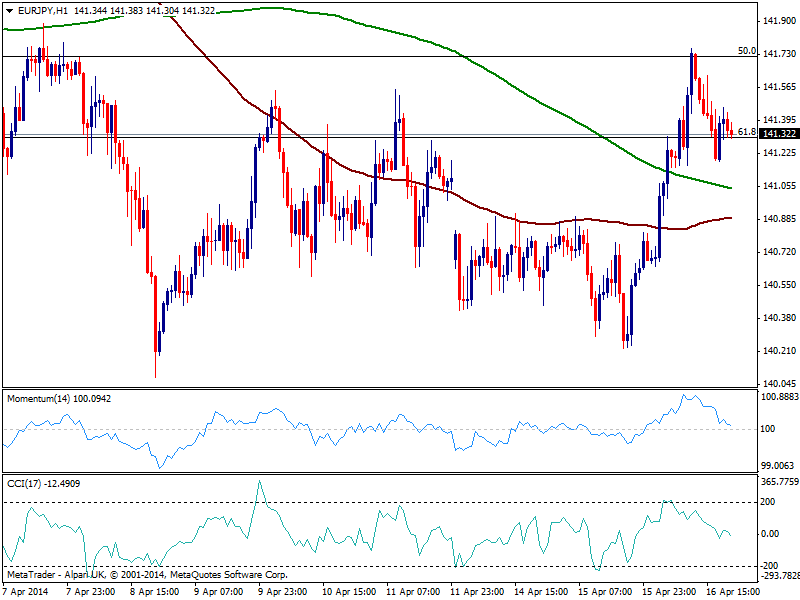

EUR/JPY Current price: 141.32

View Live Chart for the EUR/JPY

Yen capitulated to Nikkei’s gains ever since the day started, easing against most of its rivals to fresh weekly highs. The EUR/JPY not only filled the weekly opening gap, yet extended up to 141.76 halting around a strong Fibonacci resistance. The hourly chart presents a short term bearish bias, with indicators heading lower and approaching their midlines, albeit price holds for now above moving averages. In the 4 hours chart technical readings hold in positive territory, but latest retracement takes out the strength of previous recovery: either a break above mentioned high of below 141.00, will probably set a clearer intraday picture for the pair.

Support levels: 140.90 140.40 139.90

Resistance levels: 141.70 142.20 142.60

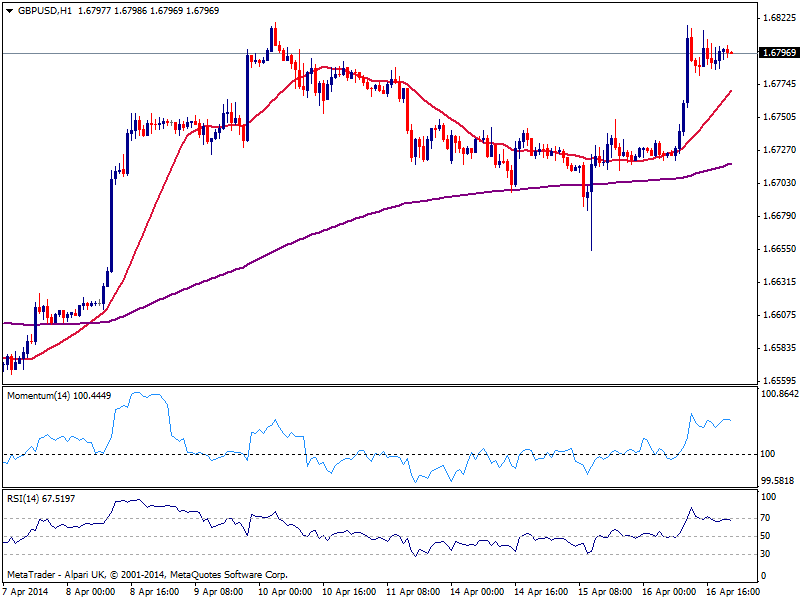

GBP/USD Current price: 1.6792

View Live Chart for the GBP/USD

Quite disappointing, the GBP/USD was unable to extend its run during US hours, spending most of the session consolidating around the 1.6800 figure. The hourly chart shows price consolidating inside a tiny triangle, usually a continuation figure so as long as above 1.6780 risk to the downside remains limited, moreover as technical indicators maintain the positive tone. In the 4 hours chart technical readings present also a positive tone, with a break above 1.6820 year high favoring a quick advance up to 1.6870 next static resistance area, in route to 1.7000.

Support levels: 1.6780 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

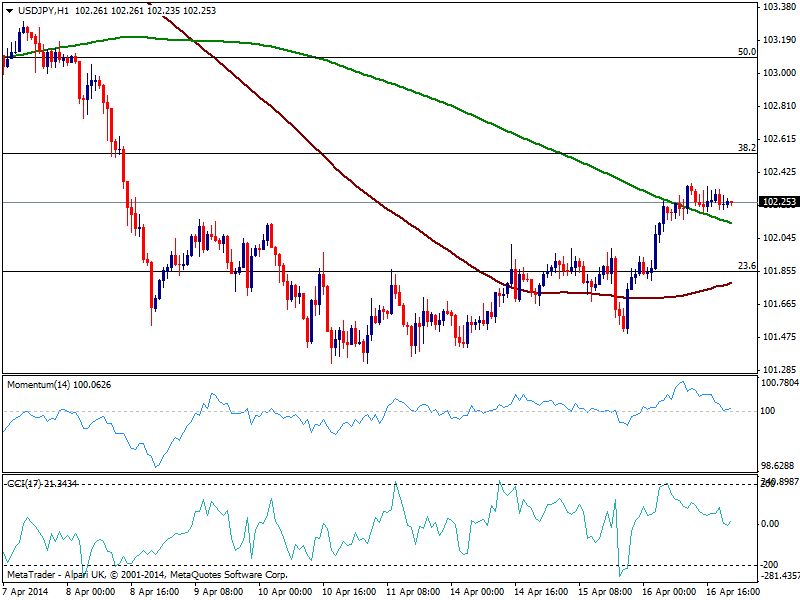

USD/JPY Current price: 102.25

View Live Chart for the USD/JPY

The USD/JPY maintains its gains, trading near its daily high of 102.36 and with the hourly chart showing indicators turning slightly higher around their midlines, suggesting limited bearish interest in the short term. An educated guess would say that traders await Nikkei opening, as another day of gains in the index would be a good reason to keep on buying the pair. A key resistance stands around 102.50/60 strong Fibonacci level, and only above it the upward potential will be clearer, eyeing then the 103.00 area.

Support levels: 102.00 101.55 101.20

Resistance levels: 102.35 102.60 102.95

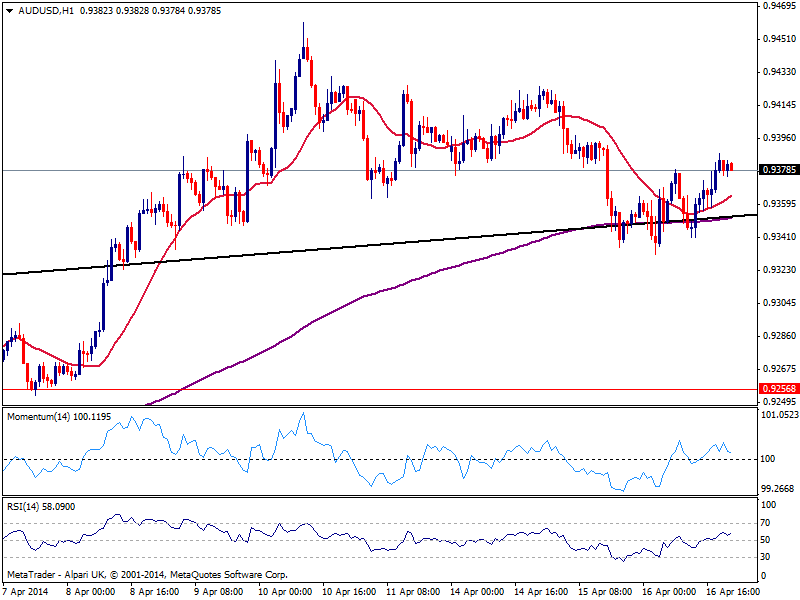

AUD/USD Current price: 0.9378

View Live Chart for the AUD/USD

Aussie extended its recovery albeit was unable to advance beyond 0.9400 against the greenback. The hourly chart shows price above a bullish 20 SMA while indicators hold in positive territory, although lacking upward strength. In the 4 hours chart however, the picture is still bearish as price is being capped by a flat 20 SMA and indicators hold below their midlines.

Support levels: 0.9330 0.9290 0.9260

Resistance levels: 0.9390 0.9445 0.9485

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.