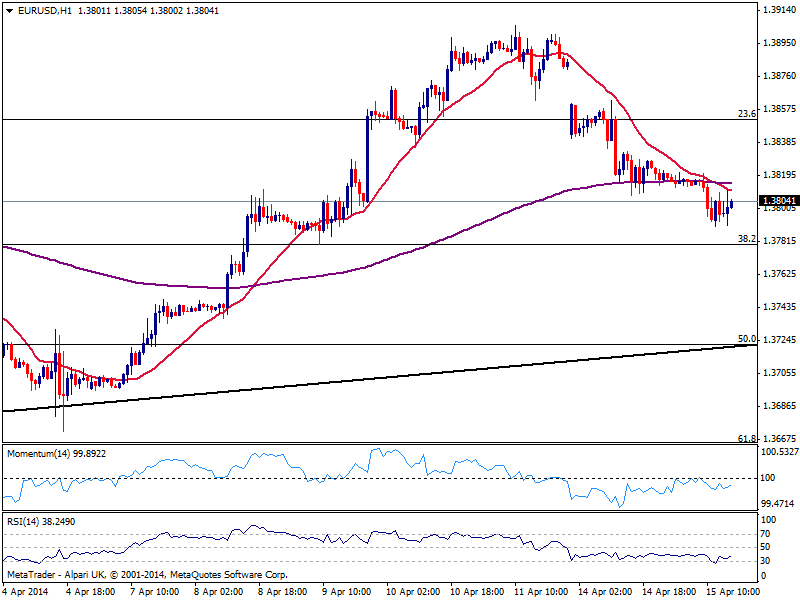

EUR/USD Current price: 1.3804

View Live Chart for the EUR/USD

More entertained day this Tuesday, with data releases from all major economies sees EUR/USD holding around the 1.3800 figure ahead of US opening. In Europe, German ZEW survey came out mixed, with sentiment decreasing in the country, but positive for the region. In the US, inflation readings surprised to the upside with a shy spike up to 0.2% monthly basis, albeit the Empire State manufacturing index presented a huge miss, decreasing to 1.3 from 5.6 previous month. Finally TIC long term purchases for the US beat expectations, while Janet Yellen added nothing new to the economic policy picture. Stocks in Europe present a slightly bearish tone, while gold nosedived, dragging AUD lower against its rivals.

Technically the EUR/USD hourly chart shows price limited below a strongly bearish 20 SMA, while indicators stand neutral in negative territory; in the 4 hours chart indicators maintain a bearish tone, with price coming back some from its 200 EMA, currently around 1.3790. Either a break below 1.3780 or above 1.3820 will set a more clear directional move for the day, with the downside favored towards 1.3720 on a break of the strong Fibonacci support.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3820 1.3850 1.3890

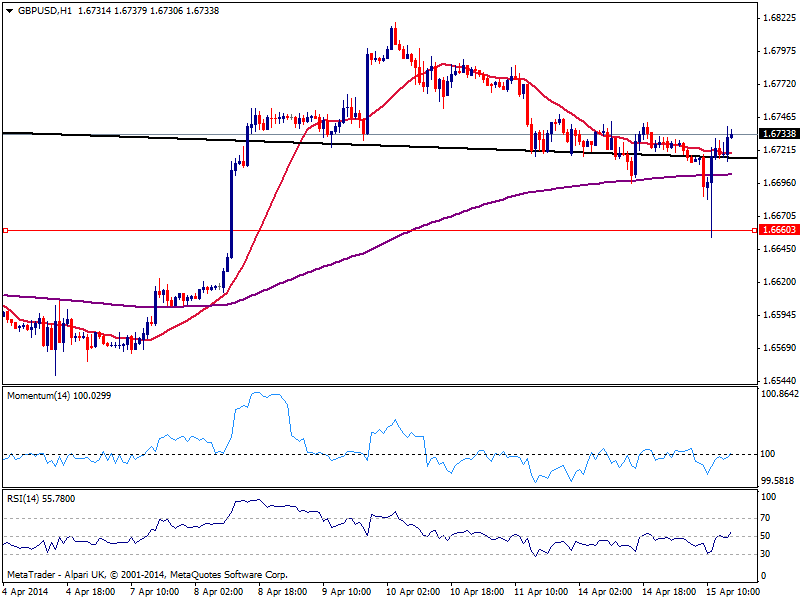

GBP/USD Current price: 1.6733

View Live Chart for the GBP/USD

Pound holds around its daily high against the greenback, reached after the shocking improvement in housing data, which gathered far more attention than inflation readings in line with expectations. As commented on previous updates, buyers around 1.6660 strong static support level were strong enough to halt any attempt to break lower, and when the level was tested triggered an impressive recovery. Technically, the hourly chart shows price above its 20 SMA while indicators grind higher around their midlines, lacking strength at the time being. In the 4 hours chart 20 SMA caps the upside around 1.6745 while indicators lost the downward potential, but hold right below their midlines. Further gains above 1.6750 are now required to confirm a full recovery, eyeing then 1.6820 price zone.

Support levels: 1.6710 1.6695 1.6660

Resistance levels: 1.6750 1.6785 1.6820

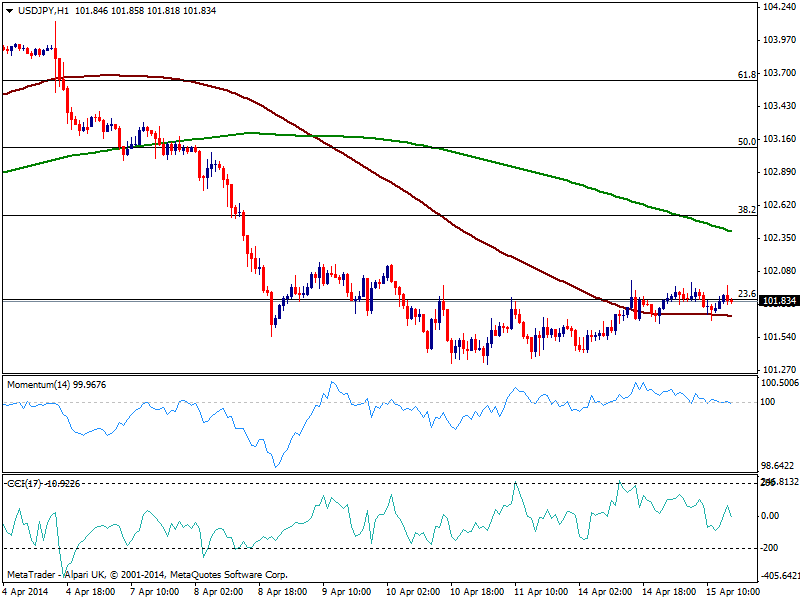

USD/JPY Current price: 101.83

View Live Chart for the USD/JPY

The USD/JPY struggles around the Fibonacci resistance of 101.85, maintaining a pretty right range right below key 102.00 figure. The hourly chart shows price holding also above a flat 100 SMA, while indicators present a slightly bearish tone. In the 4 hours chart technical readings are mostly neutral due to the lack of action surrounding the pair. Nevertheless, the downside remains favored towards 101.20 as long as sellers continue to defend mentioned 102.00 price zone.

Support levels: 101.55 101.20 100.70

Resistance levels: 102.00 102.35 102.60

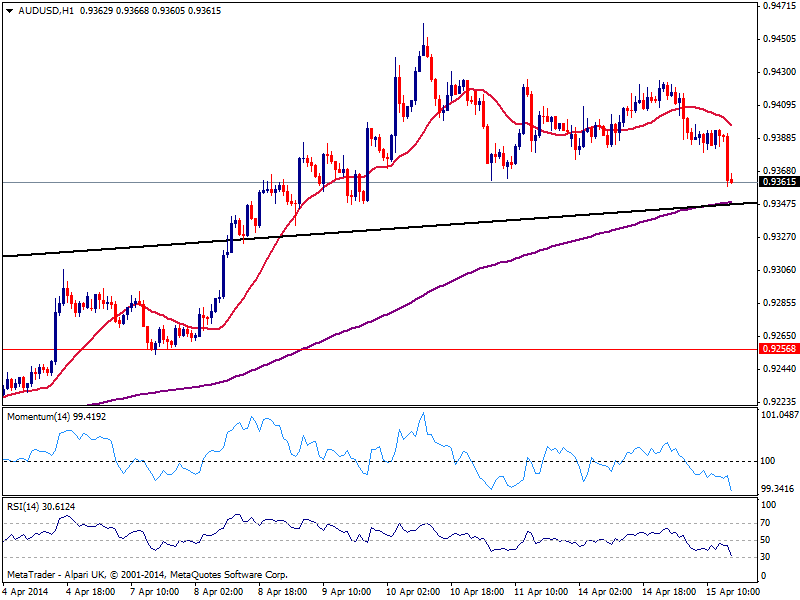

AUD/USD Current price: 0.9361

View Live Chart for the AUD/USD

Not a good day for Aussie today, with the currency weighted by gold drop as commented above: the AUD/USD trades right above 0.9360 static support, presenting a strong bearish short term tone according to the hourly chart, as indicators head lower deep into negative territory while 20 SMA gains bearish slope above current price. In the 4 hours chart technical readings present a slightly bearish tone, with a break below mentioned support favoring a downward extension for today.

Support levels: 0.9360 0.9320 0.9290

Resistance levels: 0.9445 0.9485 0.9530

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.