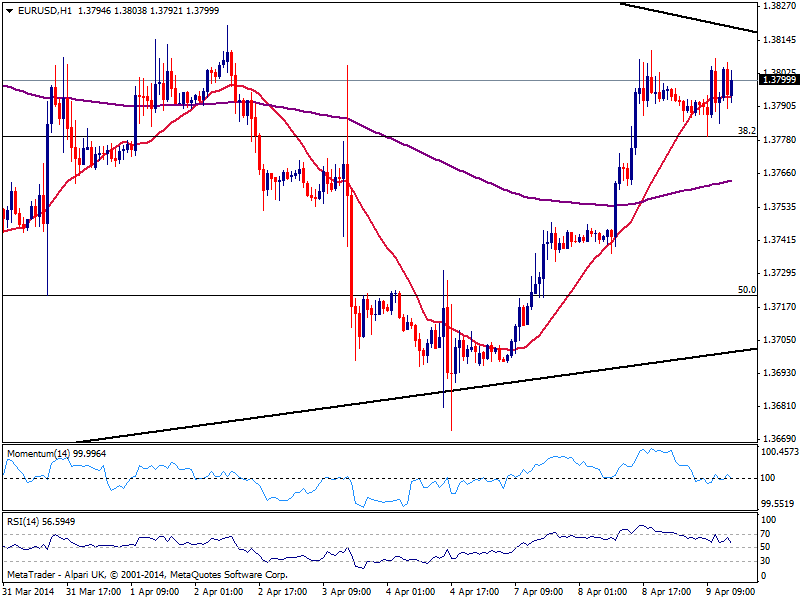

EUR/USD Current price: 1.3799

View Live Chart for the EUR/USD

The EUR/USD stands around the 1.3800 level since early Asian session opening, confined to a 30 pips range ahead of FOMC Minutes in the US afternoon. With little indications on upcoming movements coming from technical readings, the hourly chart shows at least the pair found buyers around the 1.3780 static Fibonacci support, yet remains below the descendant trend line coming from 1.3966, today around 1.3825. In the meantime, stocks halted last days’ bleeding and post some shy intraday gains ahead of US opening. Nevertheless, the market will likely wait for the Federal Reserve, expected to maintain the tone of previous meetings. If that’s the case and we continue to lack a certain date for rate hikes, the pair may finally break higher and extend towards the 1.3880 price zone.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3875 1.3910

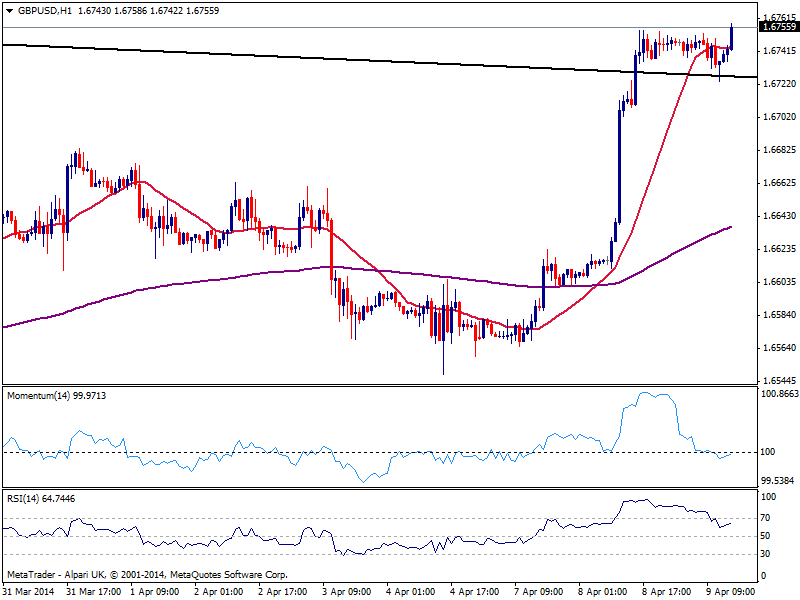

GBP/USD Current price: 1.6755

View Live Chart for the GBP/USD

The GBP/USD stands a few pips above yesterday’s high, having held above the descendant trend line broke yesterday, offering now support around 1.6720. The hourly chart shows indicators corrected extreme overbought readings and head slightly higher, while price stands above a flat 20 SMA. In the 4 hours chart indicators remain in overbought territory, looking a bit exhausted as 20 SMA maintains a strong bullish slope below current price. As per price behavior, current levels suggest there’s still room to the upside towards 1.6821 this year high.

Support levels: 1.6720 1.6660 1.6620

Resistance levels: 1.6760 1.6820 1.6860

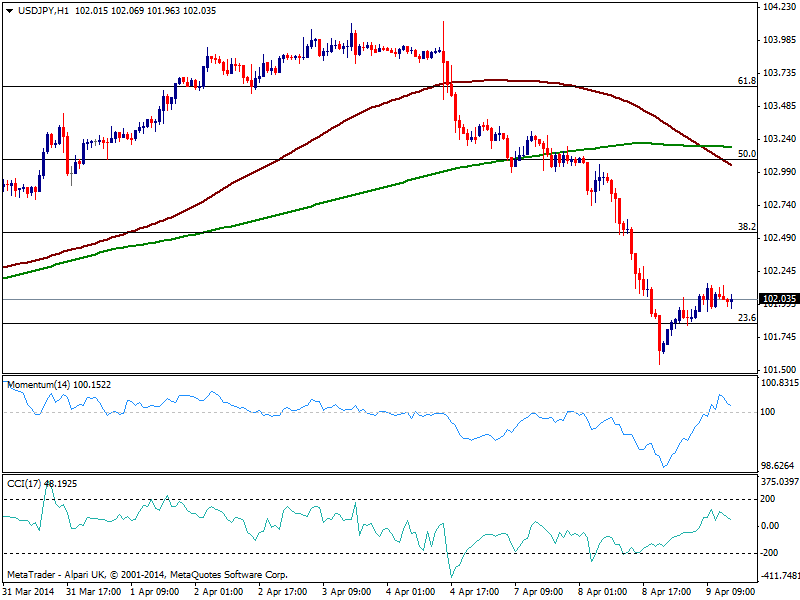

USD/JPY Current price: 102.03

View Live Chart for the USD/JPY

The USD/JPY corrected higher again trading along with Nikkei, albeit the recovery so far has been pretty shallow, with the pair struggling to maintain the 102.00 figure. The hourly chart shows indicators turning south in positive territory, while 100 SMA crosses 200 one to the downside well above current price, suggesting bears maintain the lead. In the 4 hours chart indicators corrected oversold readings, but hold well below their midlines and losing upward potential, which will likely help keep the upside contained.

Support levels: 101.25 100.80 100.35

Resistance levels: 102.20 102.60 103.00

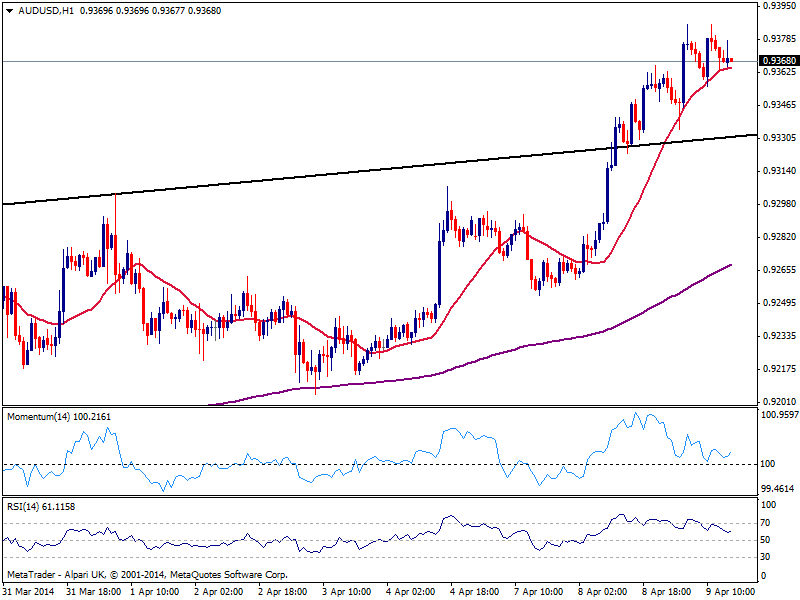

AUD/USD Current price: 0.9367

View Live Chart for the AUD/USD

Aussie took one more step against the greenback over Asian hours, extending up to 0.9386 on improved consumer sentiment and housing data. The AUD/USD hourly chart shows price consolidating above its 20 SMA that turns flat and losses upward potential, while indicators aim slightly higher after correcting overbought readings. In the 4 hours chart the overall bullish trend prevails albeit some downward corrective movement towards 0.9330 support can’t be ruled out.

Support levels: 0.9330 0.9370 0.9240

Resistance levels: 0.9390 0.9445 0.9485

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.