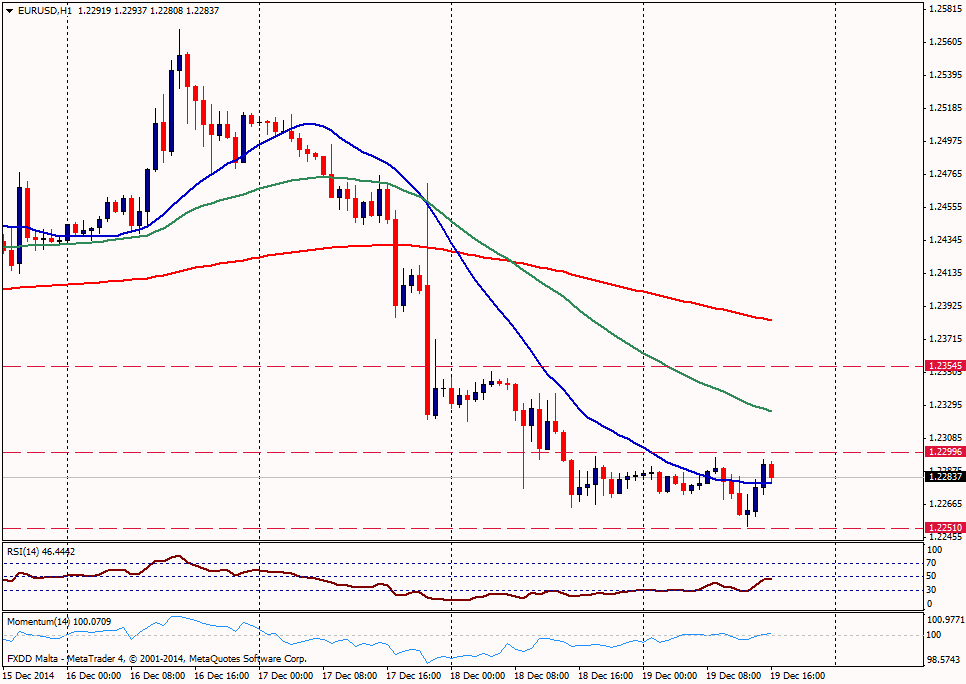

EUR/USD Current price: 1.2293

View Live Chart for the EUR/USD

The EUR/USD is trading flat on Friday, consolidating barely above 1.2250 on a quiet day in the forex market. Price action is likely to remain limited on Friday, ahead of holidays and with no economic data from the US.

Technical indicators are also flat showing no clear signals for the coming hours. The upside remain capped by 1.2300; a consolidation on top could give momentum to the euro, but as it approached 1.2330 - 1.2350 expect some sellers to show up. If it consolidates above 1.2350 it would have surpassed an important short term resistance. The long term trend points to the downside and the pair continues to test 2014 lows. A break below 1.2240, could create some volatility and pushed the EUR/USD toward 1.2200.

Support levels: 1.2240 1.2200 1.2150

Resistance levels: 1.2300 1.2330 1.2350

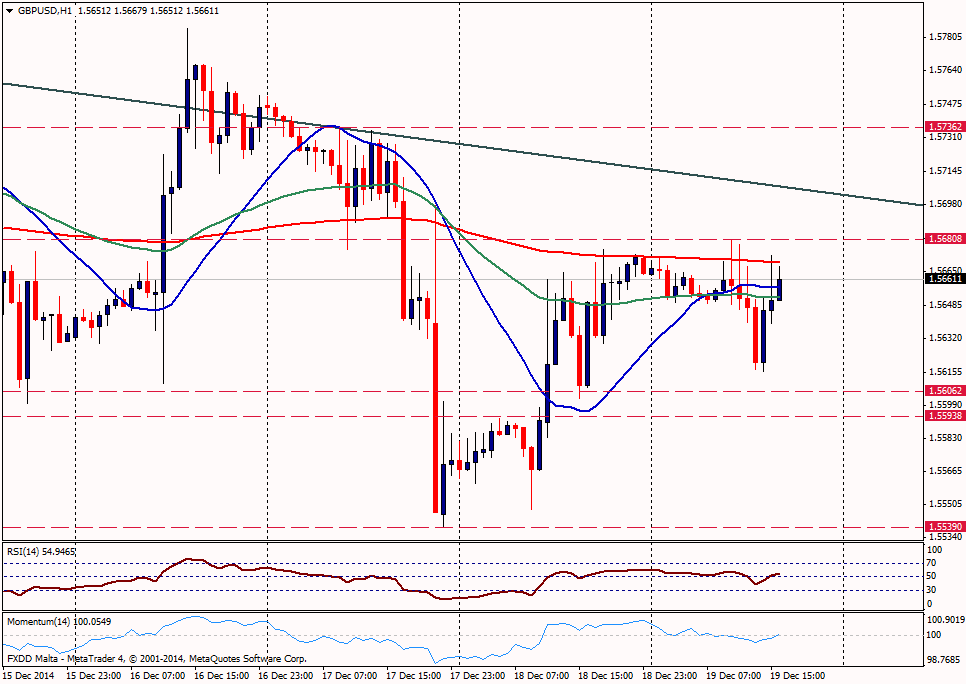

GBP/USD Current price: 1.5650

View Live Chart for the GBP/USD

As the EUR/USD, the GBP/USD also remains quiet, currently trading at the same level it close yesterday. The pair dropped during the European session but managed to erase losses and holds a bullish tone ahead of Wall Street opening bell, but the upside remains capped by 1.5680. A break higher is likely to pushed the pair further to the upside, but no majors movements are expected, unless something rocks financial markets. Above 1.5680, the pair is likely to climb on top of 1.5700, but above here the rally might become unstable and could lose momentum around 1.5735/40.

If the pound fails to rise above 1.5680 it could made another attempt to the downside, but there is a strong support at 1.5600 - 1.5590; that would need a strong US dollar to break it. A rebound around 1.5590 is likely to occur; if the pair consolidates below 1.5585, 2014 lows would be exposed.

Support levels: 1.5615 1.5590 1.5540

Resistance levels: 1.5680 1.5735 1.5770

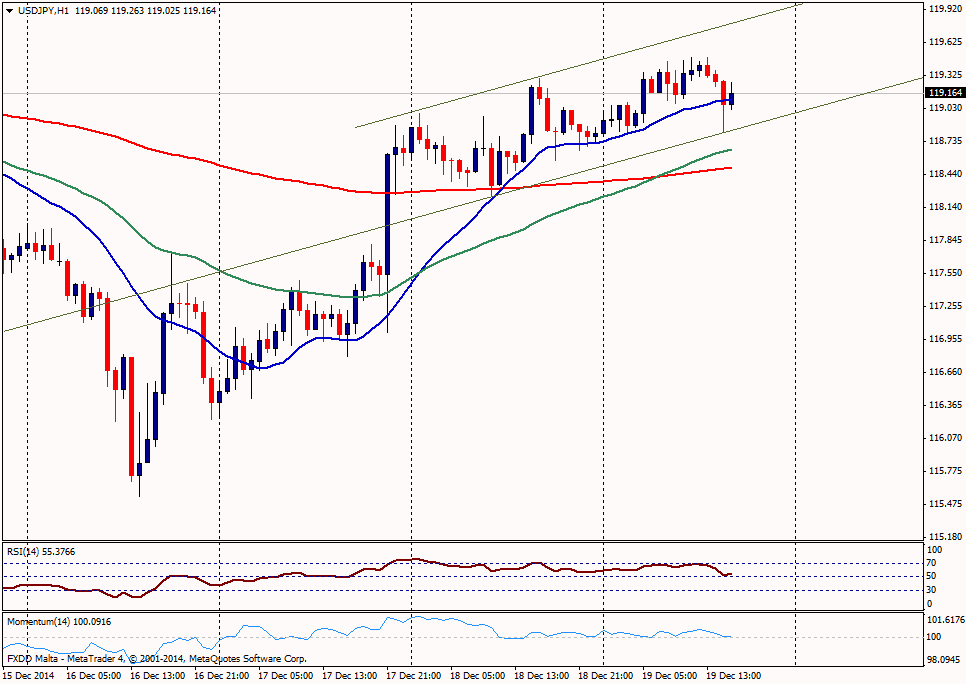

USD/JPY Current price: 119.20

View Live Chart for the USD/JPY

The pair is moving inside an ascendant channel in the hourly chart and the bottomed was recently tested. Greenback was holding a bullish tone but after finding resistance at 119.50 and pulled back. Currently price is moving around the hourly 20-SMA, a consolidation below would weakened the USD/JPY for some hours and it could decline to test the lower limit of the channel. A break below would signal an extension of the downside move to 118.50 and below here to 118.30.

On the upside, above 119.50 the rally could extend to 119.80/60 where the upper limit of the hourly channel is located; above, 120.00 is likely to cap the rally.

Support levels: 118.80 118.50 118.25

Resistance levels: 119.50 120.00 120.25

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.