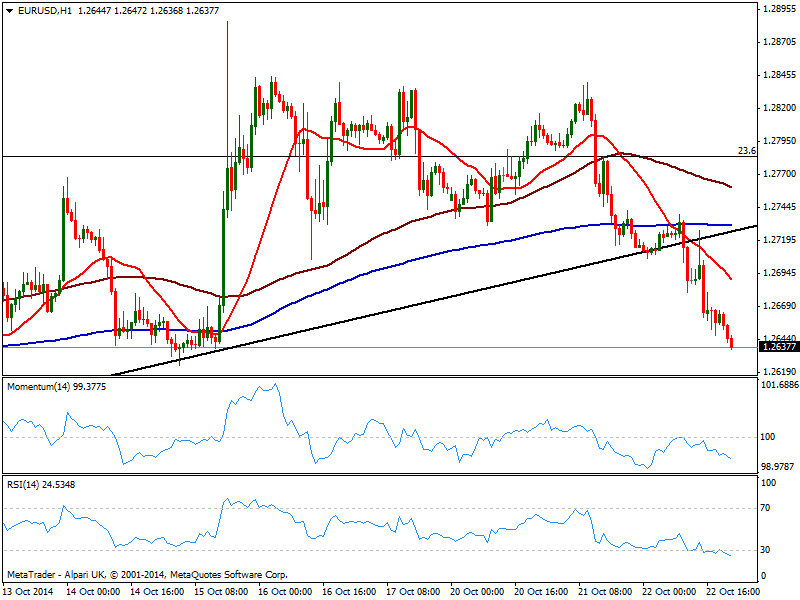

EUR/USD Current price: 1.2637

View Live Chart for the EUR/USD

The EUR/USD broke lower late US afternoon, trading at fresh lows near the 1.2640 level, with the pair having been on the losing side ever since early European opening: first, rumors that several European banks will fail the test the ECB is conducting, push the pair below the critical 1.2700 mark; then better than expected US inflation did the rest, pushing price down to 1.2660. After failing at a critical resistance on Tuesday, in the 1.2845, the pair completed a 200 pips slide, which suggest the bearish trend is ready to resume.

The technical picture shows that, after breaking the daily ascendant trend line the pair even completed a pullback before resuming the downside, with 1.2720 price zone now being a selling level if reached. As for the 1 hour chart, price accelerated below moving averages, with 20 SMA crossing below 100 and 200 ones, reflecting the strength of the bearish move. Indicators, in the same time frame, maintain a strong bearish slope. In the 4 hours chart technical readings also support the downside, with 1.2620 now as next support: a break below it is required to confirm a new leg down, eyeing then 1.2570/80 as immediate bearish target.

Support levels: 1.2620 1.2580 1.2550

Resistance levels: 1.2660 1.2700 1.2740

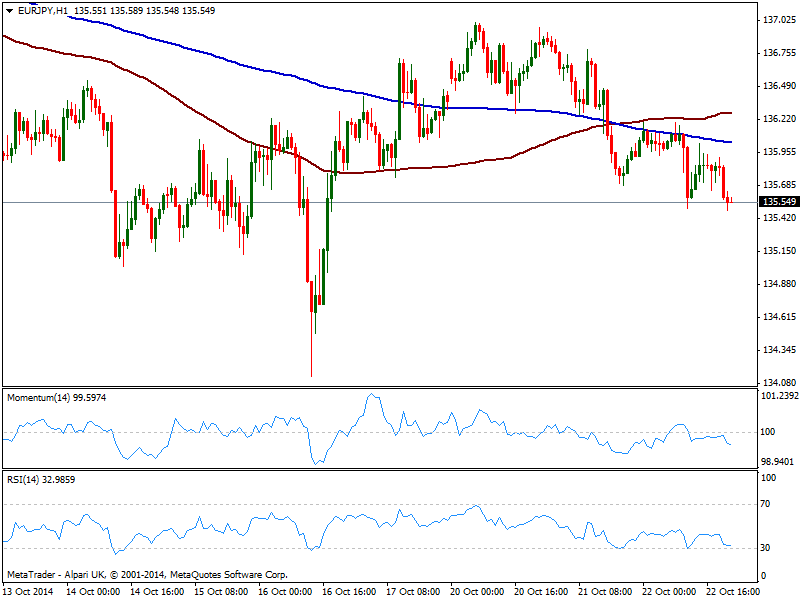

EUR/JPY Current price: 135.55

View Live Chart for the EUR/JPY

The EUR/JPY trades at fresh 4 day lows, with yen still on demand across the board, as the Japanese currency failed to ease, with Tuesday rising stocks. On Wednesday, indexes all over the world opened with a positive tone, but turned south as the day developed, with US indexes closing in the red, adding to yen strength. Technically, the 1 hour chart shows price extending below moving averages with 200 SMA still below 100 one but acting as short term resistance around the 136.00 figure, while indicators maintain the negative tone below their midlines. In the 4 hours chart, technical readings also present a negative tone, with next support now at 135.00 price zone.

Support levels: 135.05 134.70 134.20

Resistance levels: 136.10 136.60 137.05

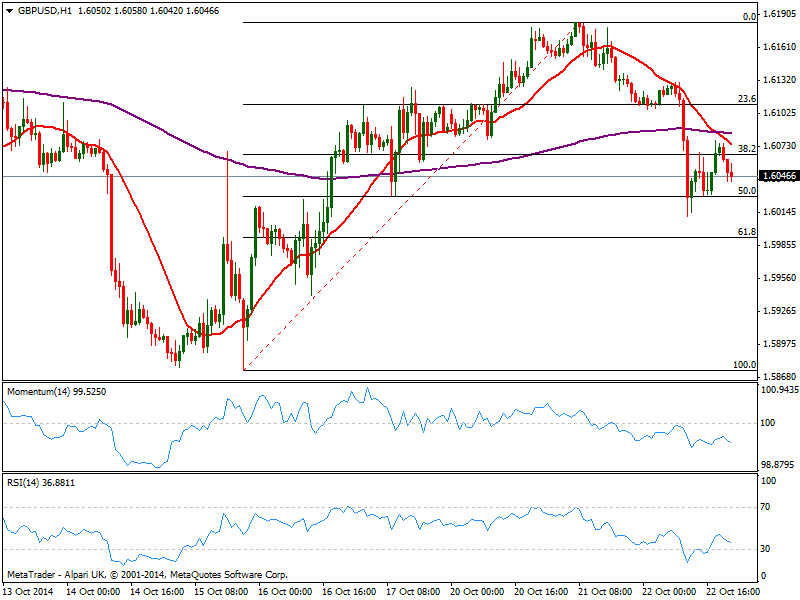

GBP/USD Current price: 1.6046

View Live Chart for the GBP/USD

Pound suffered not only of dollar strength, but also with BOE Minutes: the UK Central Bank left its monetary policy unchanged, but the statement was focused on European slowdown weighting on the economy growth, pushing price down to 1.6011 fresh weekly low. Following bounces ended up shy of the 1.6100 figure, and the pair enters Asia maintaining a bearish tone in the short term, with the 1 hour chart showing indicators heading south below their midlines and price developing below a strongly bearish 20 SMA. In the 4 hours chart the technical picture is also bearish, with a critical support now at 1.5995, 61.8% retracement of the latest bullish run from 1.5874 to 1.6153: break below it should lead to a full 100% retracement over the upcoming sessions.

Support levels: 1.5995 1.5950 1.5910

Resistance levels: 1.6065 1.6090 1.6125

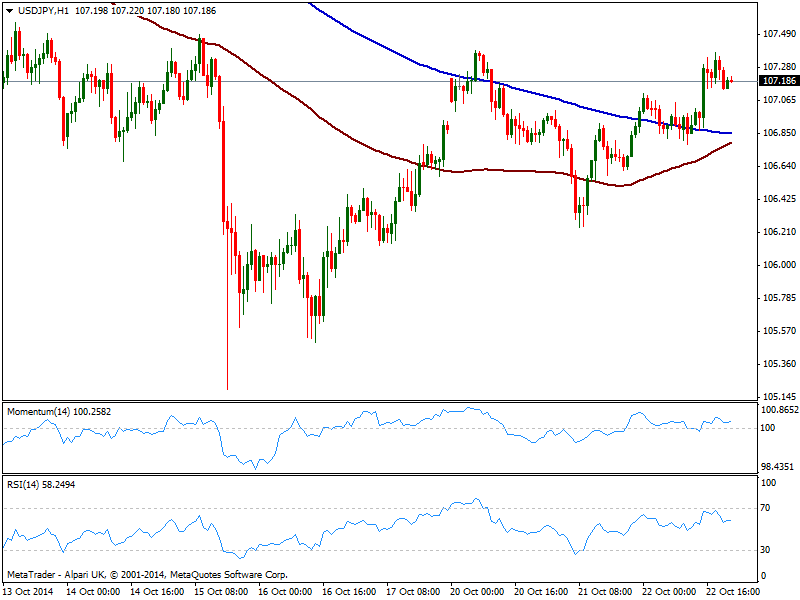

USD/JPY Current price: 107.17

View Live Chart for the USD/JPY

The USD/JPY gained some ground, but insignificant considering the pair’s advance did not overcame 50 pip and stalled below former weekly high of 137.38. The 1 hour chart shows price easing from its high with 100 and 200 SMAs converging in the 106.70 price zone, as indicators turn lower, still above their midlines. In the 4 hours chart the technical stance is neutral despite the recovery above 107.00, with some directional strength required to see the pair setting a clearer trend.

Support levels: 106.95 106.60 106.30

Resistance levels: 107.35 107.60 108.00

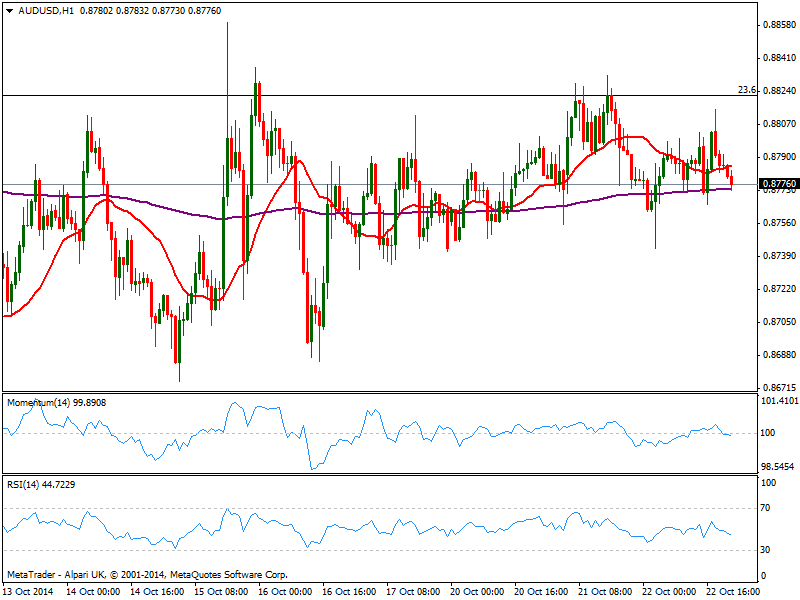

AUD/USD Current price: 0.8776

View Live Chart of the AUD/USD

Dismissing an early kneejerk down to 0.8743 following Australian CPI readings, the AUD/USD held within a tight range, trading between 0.8770 and 0.8820 for most of the day. As commented on previous updates, the pair has been for over a month developing in range, between 0.8640 and mentioned 0.8820, but establishing in the upper side of it, finding now support at 0.8730 since the week started. Whilst is not easy to predict when or to where the range will finally be broken, the fact is as tighter and persistent in time, the more explosive will be the reaction once it eases: is still a matter of patient, as technical readings both in 1 and 4 hours charts continue to present a neutral stance, with price moving back and forth around flat 20 SMAs, and indicators hovering around their midlines.

Support levels: 0.8770 0.8730 0.8690

Resistance levels: 0.8820 0.8860 0.8900

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.