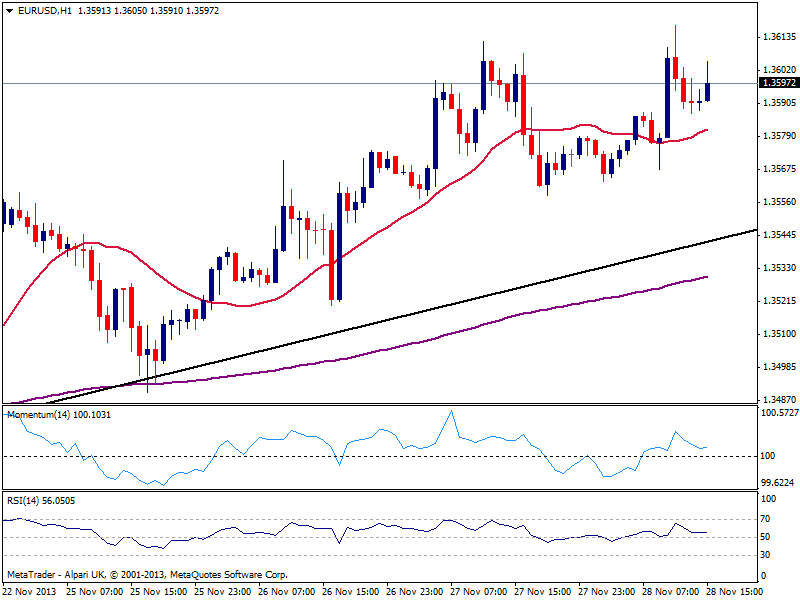

EUR/USD Current price: 1.3600

View Live Chart for the EUR/USD

The EUR/USD hovers around the 1.3600 area, in a quite thin trading session as per US markets closed on Thanksgiving. The dollar however, maintains a quite negative tone particularly against its European rivals, with the EUR/USD having reached a higher high of 1.3617 so far today. Technically, the hourly chart shows a quite neutral stance albeit positive, with indicators flat above their midlines and 20 SMA flat below current price. In the 4 hours chart a slightly positive tone prevails, yet 1.3660 will likely keep the upside limited today.

Support levels: 1.3530 1.3490 1.3440

Resistance levels: 1.3620 1.3660 1.3710

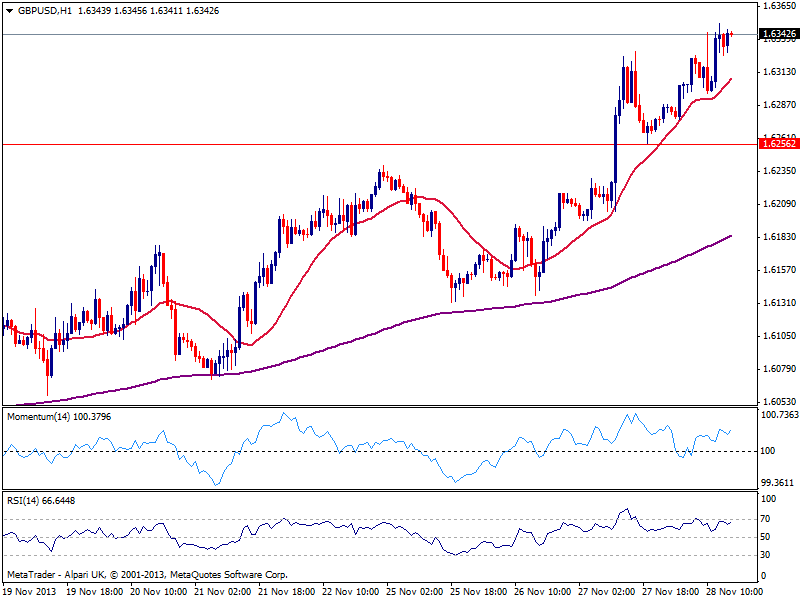

GBP/USD Current price: 1.6342

View Live Chart for the GBP/USD

The GBP/USD holds near fresh highs of 1.6345 having found buyers late Wednesday around key midterm support of 1.6250. The hourly chart shows 20 SMA maintaining a strong upward slope, offering dynamic support now around 1.6300 as indicators head higher in positive territory. In the 4 hours chart technical readings present a strong upward momentum despite overbought conditions, still supporting a test of the year high of 1.3680 posted early January.

Support levels: 1.6300 1.6250 1.6215

Resistance levels: 1.6380 1.6420 1.6450

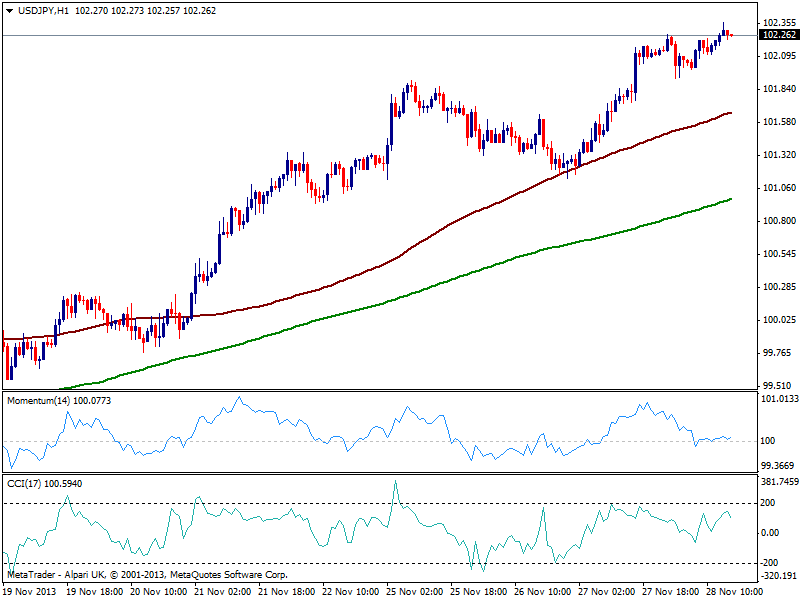

USD/JPY Current price: 102.26

View Live Chart for the USD/JPY

The USD/JPY advanced some this Thursday, although trades in a tight quiet range. Holding above 102.00, the hourly chart shows momentum horizontal above its 100 level, while moving averages continue advancing below current price, and supporting the bullish tone of the pair. In the 4 hours chart momentum also heads north in positive territory, supporting further gains in the short term.

Support levels: 101.90 101.60 101.15

Resistance levels: 102.50 102.90 103.30

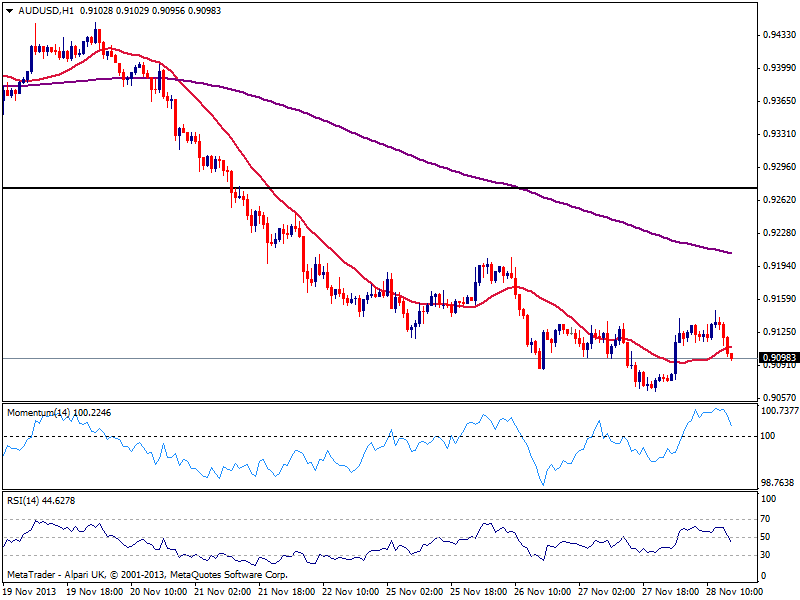

AUD/USD Current price: 0.9098

View Live Chart for the AUD/USD

Aussie found some buyers due positive local data during Asian hours, yet sellers surged again around 0.9160 still strong resistance level. The dominant bearish trend remains pretty much intact with the hourly chart showing indicators turning south and current candle opening below 20 SMA. In the 4 hours chart technical indicators also head south in negative territory, supporting a break below 0.9060 immediate support.

Support levels: 0.9060 0.9020 0.8980

Resistance levels: 0.9120 0.9160 0.9210

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.