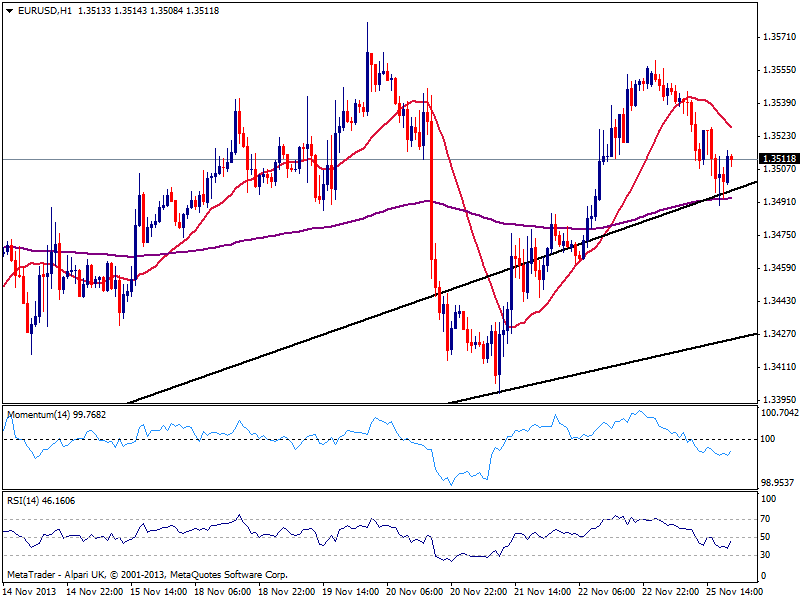

EUR/USD Current price: 1.3511

View Live Chart for the EUR/USD

The EUR/USD spent most of the past two sessions fading its early gains up to 1.3559 got in Asia. With little data around, the usual lack of volatility of Mondays was felt even more. Nevertheless the pair managed to hold above the 1.3500 level and attempts to recover some ground in this US afternoon. The hourly chart shows price steady below a bearish 20 SMA and indicators heading higher still below their midlines. In the 4 hours chart price stands right below a flat 200 EMA while indicators are flat above their midlines giving not much clues on direction. Despite the dominant bullish trend the pair stands in the middle of nowhere, needing some further technical clarity to start offering trading opportunities.

Support levels: 1.3470 1.3430 1.3390

Resistance levels: 1.3520 1.3550 1.3580

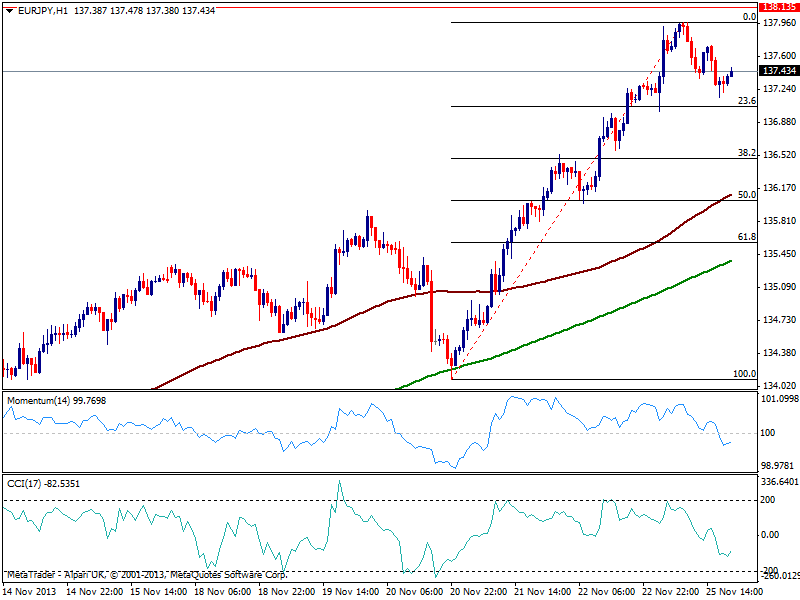

EUR/JPY Current price: 137.43

View Live Chart for the EUR/JPY

Yen weakness continues to dominate the pair, as the EUR/JPY soared to 137.96 fresh 4 years high. The hourly chart shows indicators reached overbought levels once and corrected lower along with price. Still price held above the 23.6% retracement of its latest bullish leg, which left little room for more slides despite indicators stand below their midlines. In the 4 hours chart indicators also look exhausted to the upside and correct lower, yet the upside continues to be favored, with a break above 138.10 area pointing for a slow but steady advance up to 140.00.

Support levels: 137.10 136.60 136.10

Resistance levels: 138.10 138.50 139.00

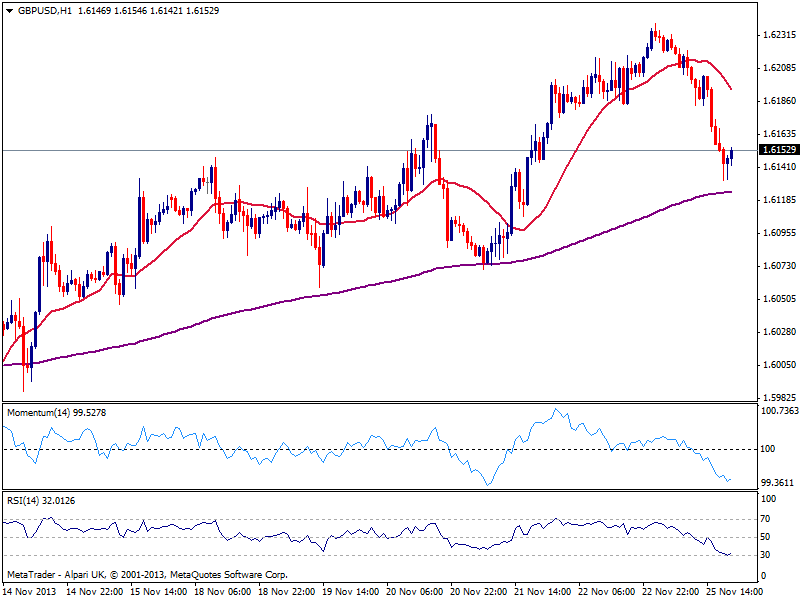

GBP/USD Current price: 1.6153

View Live Chart for the GBP/USD

Little changed since US opening, the GBP/USD retraced after approaching key 1.6250 area. The hourly chart shows indicators losing bearish slope near oversold levels, while 20 SMA turns south above current price, offering dynamic resistance now around 1.6190. In the 4 hours chart current candle opened below 20 SMA and indicators head lower still above their midlines, suggesting the current corrective movement may extend lower if price holds below 1.6160 area immediate resistance. A recovery above this last however, may see price advancing back towards mentioned key area around 1.6250.

Support levels: 1.6120 1.6085 1.6040

Resistance levels: 1.6160 1.6190 1.6225

USD/JPY Current price: 101.69

View Live Chart for the USD/JPY

The USD/JPY continues consolidating around its daily high of 101.90, establishing above the 101.50 mark, immediate short term support. In the hourly chart, moving averages maintain a positive tone below their midlines, yet indicators enter negative territory, presenting some short term divergences: a break below mentioned support may trigger a deeper downward correction, yet as long as above 101.00 the upside continues to be favored. In the 4 hours chart indicators also grind lower from extreme overbought level, but with price near the highs, there’s not much room for slides right now.

Support levels: 101.80 101.35 101.05

Resistance levels: 102.00 102.30 102.65

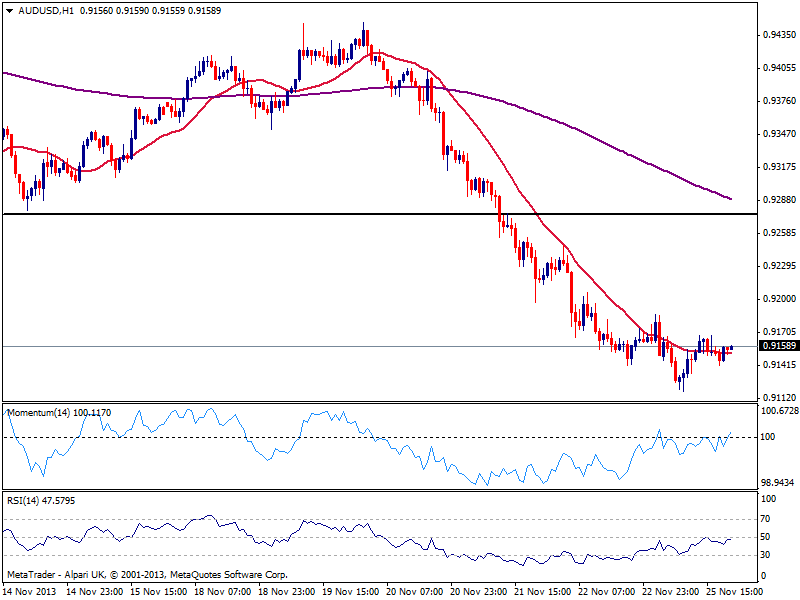

AUD/USD Current price: 0.9158

View Live Chart for the AUD/USD

The AUD/USD also had a pretty dull trading day, although extended its slide to a lower low of 0.9118. Despite the exhaustion of technical indicators in the short term, the pair was unable to correct much higher, about to close the day pretty much unchanged. The hourly chart shows price in a tight range around a flat 20 SMA as indicators turn flat in neutral territory. In the 4 hours chart indicators corrected partially the extreme oversold readings, yet with price unable to recover higher, chances remain of further falls. In this last time frame, 20 SMA offers intraday resistance around 0.9220 and approaches to that level will likely be seen as selling opportunities.

Support levels: 0.9140 0.9110 0.9060

Resistance levels: 0.9190 0.9220 0.9260

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.