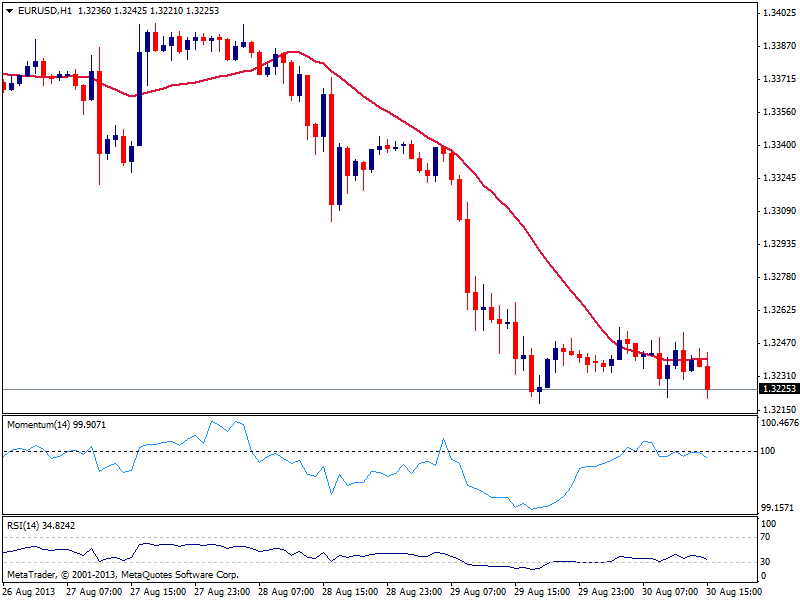

EUR/USD Current price: 1.3217

View Live Chart for the EUR/USD

Despite slightly disappointing US data, the greenback maintains its strength across the board, accelerating against the EUR, with the pair testing recent lows around 1.3220. The pair has been trading in a quite limited range this Friday, capped below 1.3254 daily high. The hourly chart shows price below 20 SMA and indicators heading lower, supporting a soon test of the 1.3180 static support level; 4 hours chart shows indicators still heading south despite in oversold territory, which supports the shorter term view.

Support levels: 1.3180 1.3140 1.3100

Resistance levels: 1.3250 1.3300 1.3345

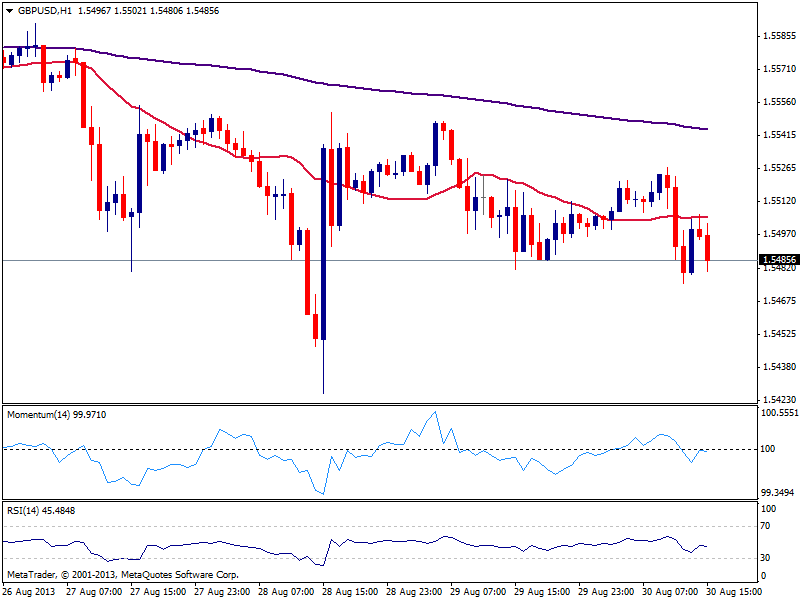

GBP/USD Current price: 1.5485

View Live Chart for the GBP/USD

The GBP/USD trades also lower in range, approaching its daily low ahead of US opening, and with the hourly chart showing a slightly bearish tone, with price finding short term resistance in a flat 20 SMA and indicators heading lower below their midlines. In the 4 hours chart the distance in between 20 SMA and 200 EMA continues to shrink, with both indicators containing price; however, the downside is still favored as per indicators heading lower below their midlines and current dollar strength.

Support levels: 1.5445 1.5400 1.5360

Resistance levels: 1.5520 1.5550 1.5595

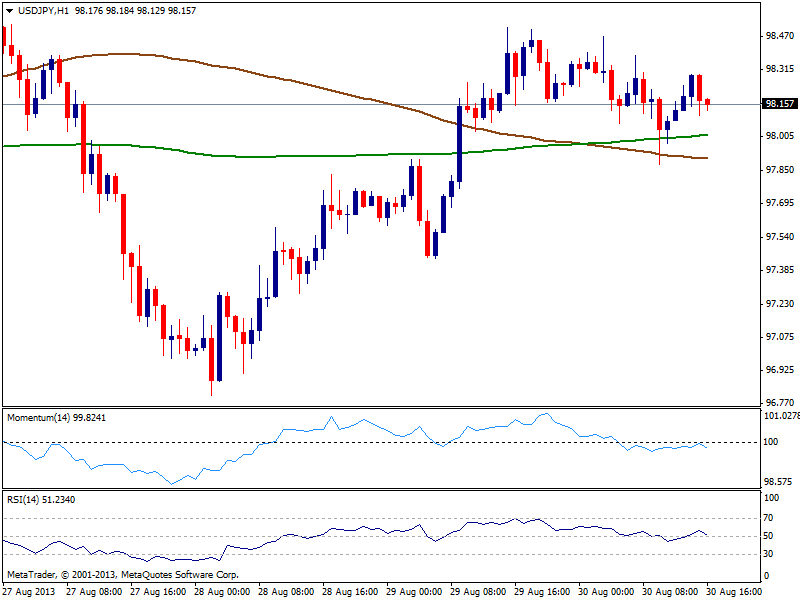

USD/JPY Current price: 98.15

View Live Chart for the USD/JPY

Technical picture in the USD/JPY remains unchanged, with price holding right above its moving averages in the hourly chart and indicators standing around their midlines, lacking clear direction at the time being. Risk to the downside increases with local share markets in red, and US indexes pointing for a negative opening: break of the daily low around 97.90 is required to confirm further slides today, down towards 97.00/20 price zone.

Support levels: 97.90 97.50 97.20

Resistance levels: 98.50 98.85 99.20

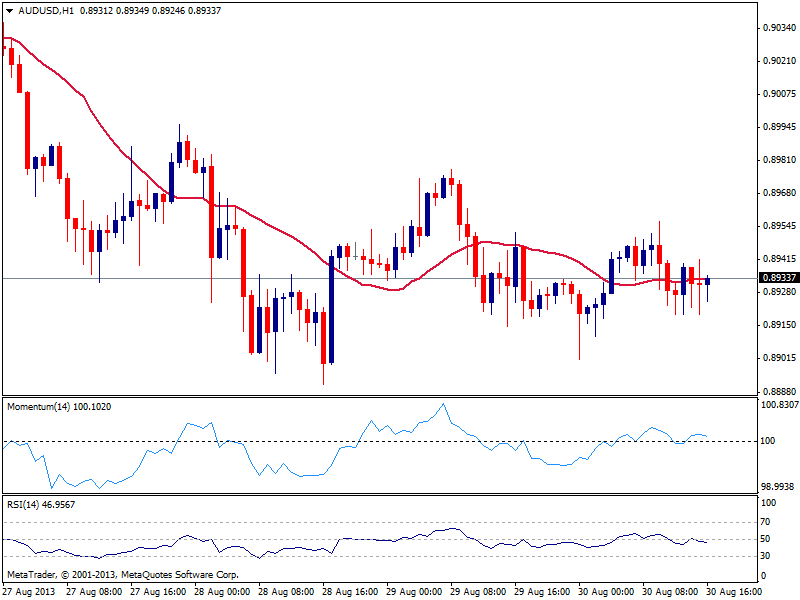

AUD/USD Current price: 0.8933

View Live Chart for the AUD/USD

The AUD/USD also found no reasons to move far away, with technical readings presenting a quite neutral stance in the hourly chart. An attempt of recovery remained limited by 0.8930, but the pair held above the weekly low of 0.8891. 4 hours chart shows price barely below 20 SMA and indicators flat around their midlines, giving no clues on direction either. Being the last trading day of the month, some profit taking may affect the market and reverse latest greenback gains, but if stocks remain under pressure, the movement should be limited.

Support levels: 0.8910 0.8885 0.8840

Resistance levels: 0.8935 0.8980 0.9020

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.