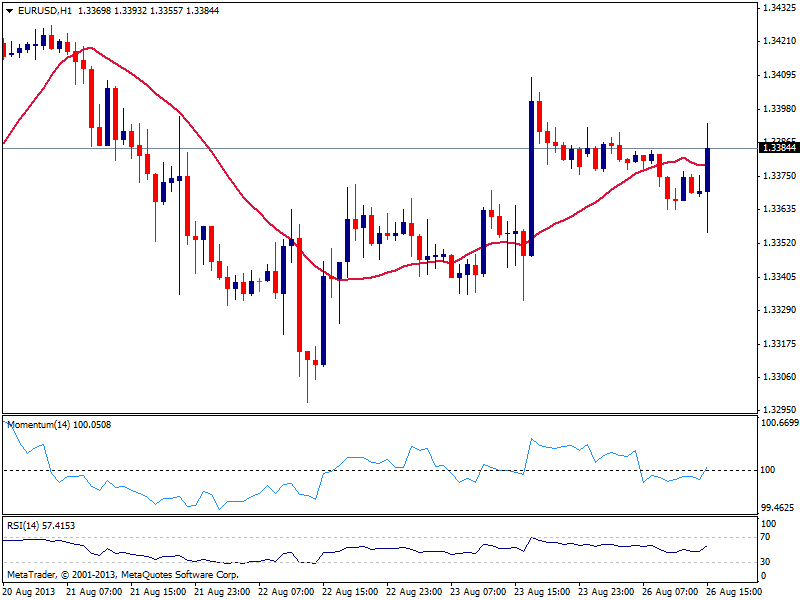

EUR/USD Current price: 1.3384

View Live Chart for the EUR/USD

The EUR/USD surged up to 1.3393 after worse than expected US Durable goods orders that fell strongly, indicating a slowdown in manufacturing and less chances of a September’s QE tapering. As for the hourly chart, technical readings stand in neutral territory, with price aiming to advance above a flat 20 SMA and indicators hovering around their midlines. In the 4 hours chart however, a slightly bullish tone persists, although steady gains above 1.3420 are required to confirm a new leg up.

Support levels: 1.3370 1.3330 1.3290

Resistance levels: 1.3420 1.3450 1.3485

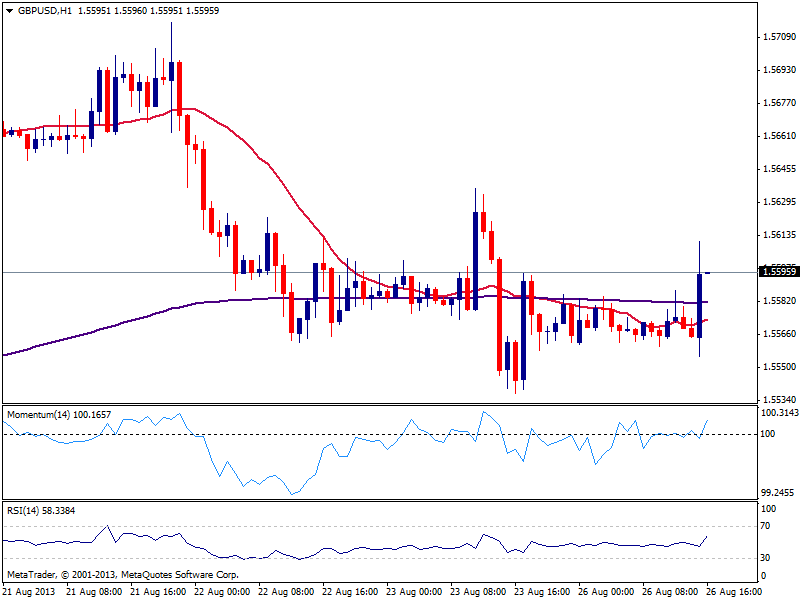

GBP/USD Current price: 1.5595

View Live Chart for the GBP/USD

The GBP/USD surged to test the 1.5600 area on the back of US news, turning intraday bullish and with the hourly chart showing price advancing above a flat 20 SMA and indicators heading north in positive territory. Nevertheless, the pair is far from bullish, as the 4 hours chart shows price retracing from a bearish 20 SMA while indicators barely approach their midlines, still in negative territory. Steady gains above 1.5610 may see the pair advancing further if current levels hold, yet a break below 1.5550 should lead to a new bearish leg towards fresh monthly lows.

Support levels: 1.5550 1.5520 1.5480

Resistance levels: 1.5610 1.5640 1.5690

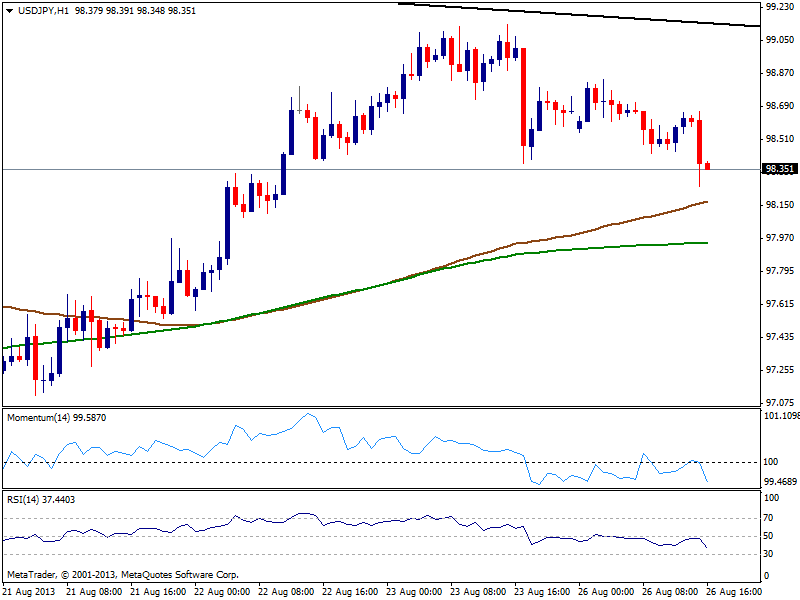

USD/JPY Current price: 98.35

View Live Chart for the USD/JPY

The USD/JPY resumed the downside after the news, continuing its retracement from the daily descendant trend line tested past week. The hourly chart shows indicators gaining a strong bearish momentum and 100 SMA offering dynamic support around 98.20: a break below this last should anticipate a continued slide over the upcoming sessions, eyeing 97.50 support.

Support levels: 98.20 97.80 97.50

Resistance levels: 98.80 99.20 99.60

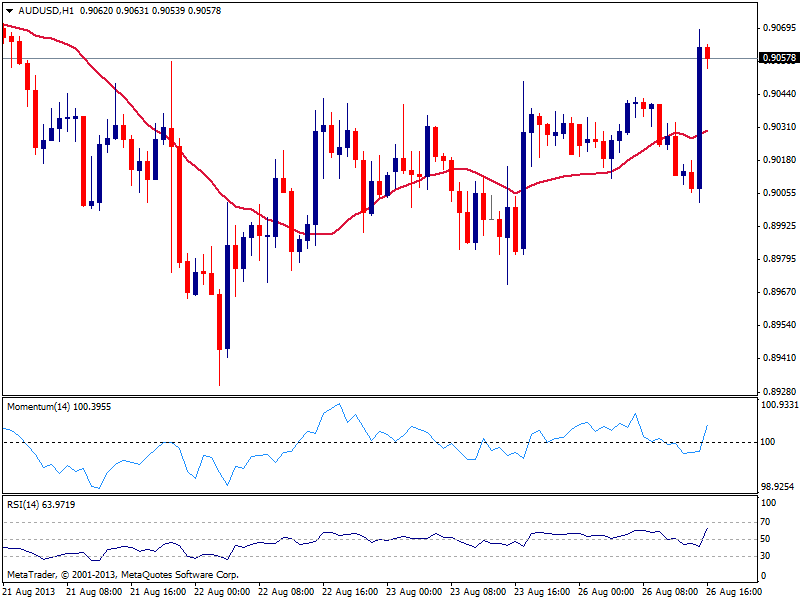

AUD/USD Current price: 0.9057

View Live Chart for the AUD/USD

Australian dollar surged above 0.9050, entering US session with a positive tone according to the hourly chart, as indicators head strongly north above their midlines, while current candle opened above 20 SMA. In the 4 hours chart technical readings are also positive although showing not much strength at the time being. Another round of buying that pushes price above 0.9080 should lead to a continued advance over current session, although expected to remain short term.

Support levels: 0.8990 0.8955 0.8920

Resistance levels: 0.9050 0.9080 0.9120

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.