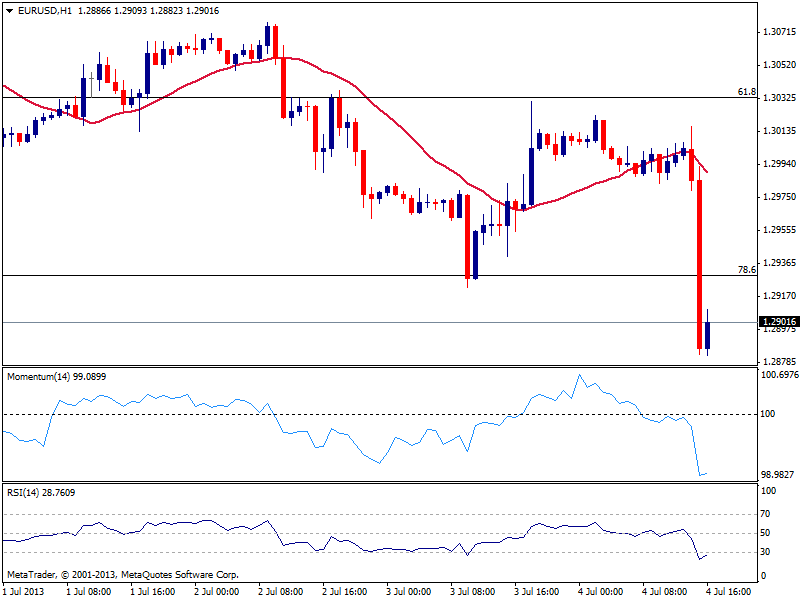

EUR/USD Current price: 1.2904

View Live Chart for the EUR/USD

Not a good day in Europe, as both Central Banks, the BOE and the ECB, came with a dovish stance that sent local currencies strongly down against their American rival. The EUR/USD fell down to 1.2883 so far, finding as expected some buying interest around the strong static support level, yet unable so far to regain ground beyond 1.2920, former low and immediate resistance. With the US market closed on holiday, there’s a chance we lack volume enough to trigger another strong rally, but the downside remains favored with a break to fresh lows opening doors for attest of the 1.2800 area.

Support levels: 1.2880 1.2840 1.2800

Resistance levels: 1.2920 1.2950 1.2985

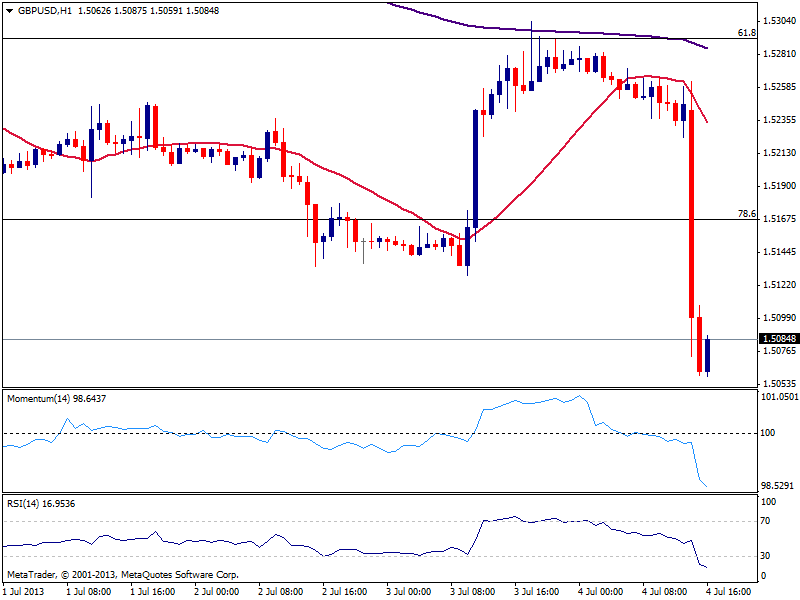

GBP/USD Current price: 1.5085

View Live Chart for the GBP/USD

Extremely oversold in the hourly chart, the GBP/USD was hit hard for an unexpected, also dovish statement from the BOE. The pair reached a daily low of 1.5059 before managing to bounce some, still unable to recover the 1.5100 mark. The 4 hours chart shows a strong bearish momentum that supports further slides once buying interest around 1.5050 gets overcome. The key 1.50 figure should contain the downside, at least today ahead of US employment figures tomorrow.

Support levels: 1.5050 1.5010 1.4970

Resistance levels: 1.5130 1.5160 1.5200

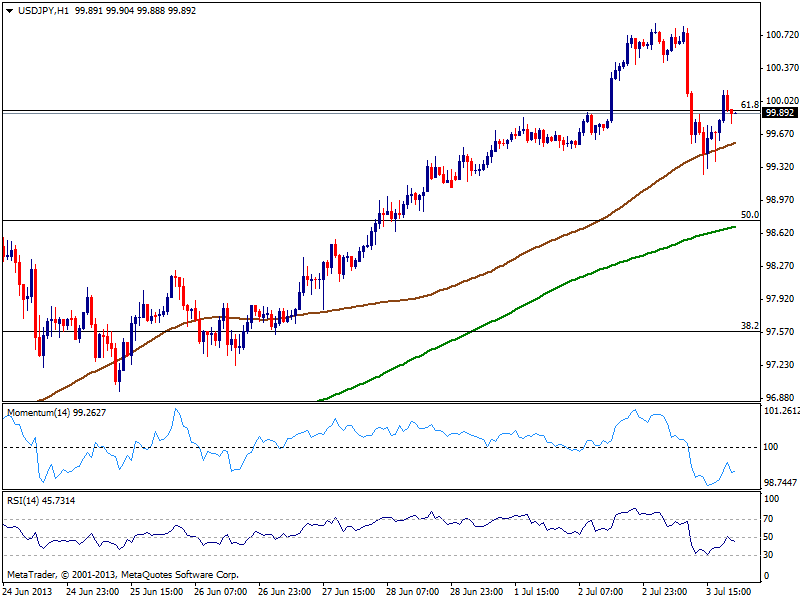

USD/JPY Current price: 100.06

View Live Chart for the USD/JPY

Dollar momentum is helping USD/JPY recover the 100.00 mark, although there has been little reaction in the pair that remains range bound. The hourly chart shows price barely above its 100 SMA currently around 99.80, while indicators stand in neutral territory. In bigger time frames, the pair presents a slightly bullish tone, but limited as long as price stands below 100.30.

Support levels: 99.80 99.50 99.25

Resistance levels: 100.30 100.70 101.10

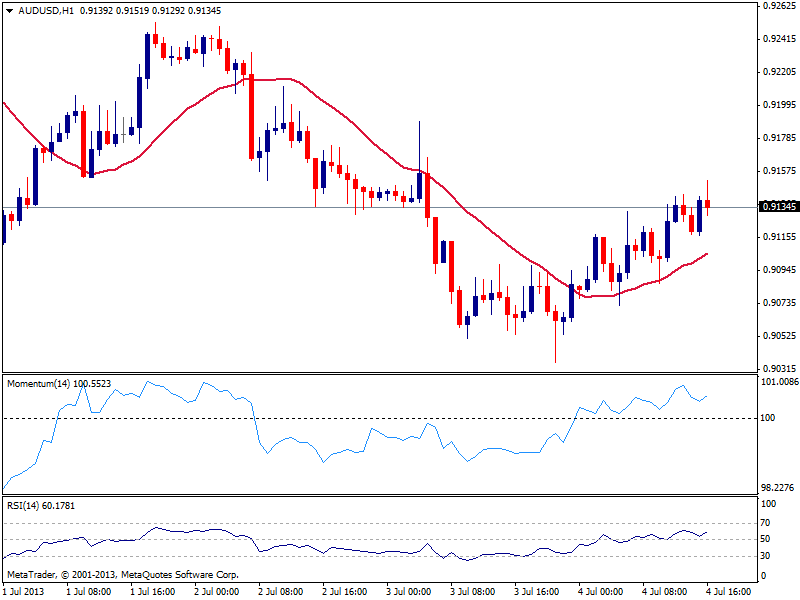

AUD/USD: Current price: 0.9134

View Live Chart for the AUD/USD

The AUD/USD is barely changed after the news, holding near 0.9150 resistance after recovering some ground during past Asian session. The hourly chart shows price heading higher above a bullish 20 SMA that offers dynamic support currently around 0.9105, while indicators head north above their midlines, which supports some gains in the pair. In the 4 hours chart price struggles right below 20 SMA, while indicators head higher still below their midlines: a price acceleration above 0.9150 is now required to confirm an advance up to 0.9200/20 area.

Support levels: 0.9195 0.9060 0.9020

Resistance levels: 0.9150 0.9190 0.9220

Recommended Content

Editors’ Picks

EUR/USD clings to modest gains above 1.0650 ahead of US data

EUR/USD trades modestly higher on the day above 1.0650 in the early American session on Tuesday. The upbeat PMI reports from the Eurozone and Germany support the Euro as market focus shift to US PMI data.

GBP/USD extends rebound, tests 1.2400

GBP/USD preserves its recovery momentum and trades near 1.2400 in the second half of the day on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.