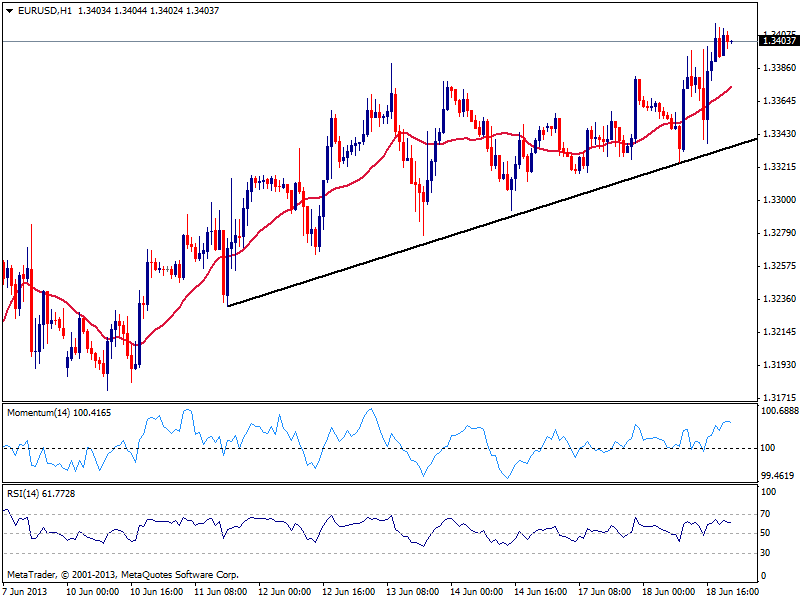

EUR/USD Current price: 1.3403

View Live Chart for the EUR/USD

The EUR/USD managed to advance some this Tuesday, breaking and standing a few pips above the 1.3400 level. Market players had been pretty cautious ahead of tomorrow’s FED economic policy announcement, with the possibility of some tapering already priced in. Still, the announcement and more over, the extension of such tapering, if done, could rock the markets. Anyway, the EUR/USD maintains a bullish tone according to the hourly chart, as price recovered from a short term ascendant trend line to quickly overcome its 20 SMA, while indicators hold in positive territory. The lack of volume at the time being helps indicators turn flat and lack momentum, but there are no signs the upside is not still favored. In the 4 hours chart technical readings present a strong upward momentum, favoring a continuation towards 1.3520, next strong midterm resistance level.

Support levels: 1.3360 1.3330 1.3290

Resistance levels: 1.3410 1.3440 1.3480

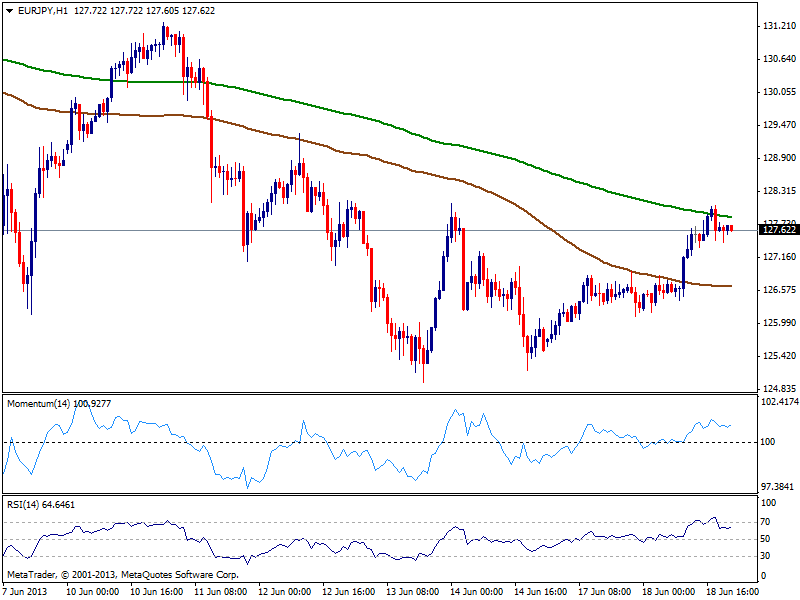

EUR/JPY Current price: 127.61

View Live Chart for the EUR/JPY

The EUR/JPY found support in surging stocks, rising up towards 128.06 before finding sellers. The hourly chart shows price well above a still bearish 100 SMA and limited by the 200 one, while indicators stand in positive territory. In the 4 hours chart, indicators stand above their midlines but quite close to them, giving a neutral technical stance. Overall, steady gains above 128.10 may favor an advance towards 128.80 area, that probe strong in the past. Only steady gains above it will put the pair closer to the bullish path.

Support levels: 127.40 126.90 126.30

Resistance levels: 128.10 128.40 128.80

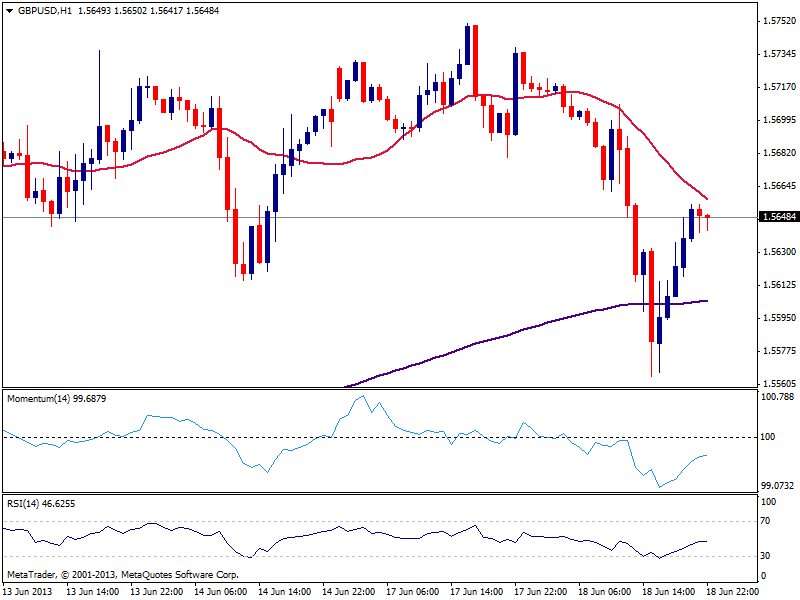

GBP/USD Current price: 1.5648

View Live Chart for the GBP/USD

The GBP/USD recovered from a strong kneejerk triggered with UK higher than expected inflation, still intraday negative but above the 1.5600 mark. Having been as low as 1.5564, the pair recovered slowly but steadily in the US session, with the hourly chart now showing price capped below 20 SMA and indicators losing upward potential below their midlines, which suggest the upside is still limited. In the 4 hours chart technical readings stand around their midlines, while 20 SMA offers dynamic resistance around 1.5700: price needs to recover above this last to be able to run higher again, while lost of the 1.5610 support will expose the downside to fresh weekly lows.

Support levels: 1.5610 1.5560 1.5520

Resistance levels: 1.5660 1.5700 1.5750

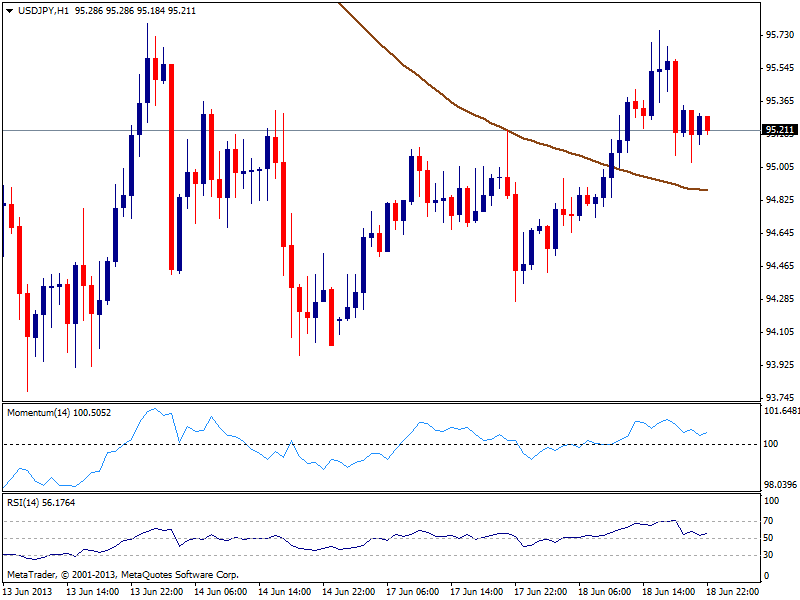

USD/JPY Current price: 95.22

View Live Chart for the USD/JPY

The USD/JPY also managed to advance some, although found selling interest around 95.80. Technical readings show a slightly short term bullish tone, as price stands above 100 SMA and indicators above their midlines, but buying interest remains quite limited. In the 4 hours chart technical readings remain neutral, which suggests market will remain ranging around 95.00 until FOMC announcement.

Support levels: 94.90 94.50 94.10

Resistance levels: 95.30 95.75 96.05

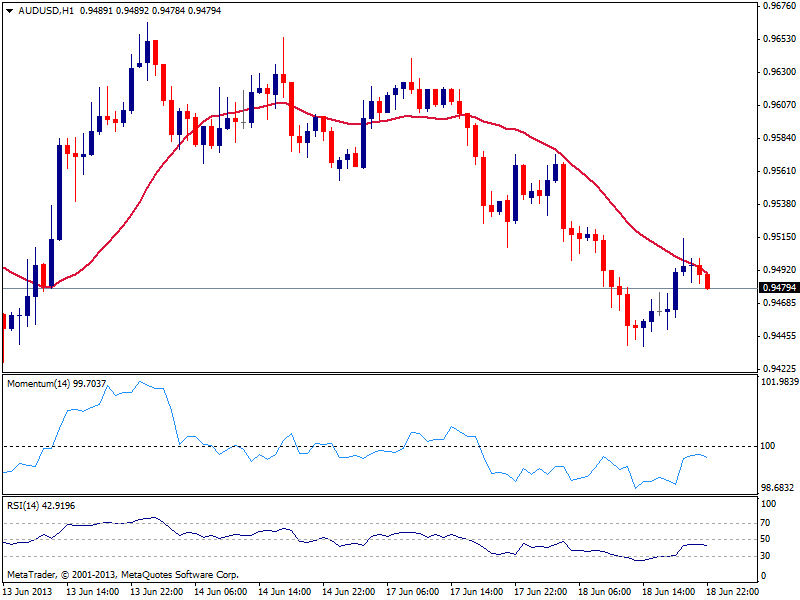

AUD/USD: Current price: 0.9478

View Live Chart for the AUD/USD

AUD/USD remains under pressure, resuming the bearish trend seen starting early May after some limited relief past week. Back below the 95.00 level, the hourly chart shows 20 SMA limiting the upside and acting as dynamic resistance around 0.9500 while indicators turn south below their midlines, reflecting the lack of buying interest. In the 4 hours chart price stands well below 20 SMA as indicators turn flat in negative territory, supporting the shorter term view.

Support levels: 0.9420 0.9380 0.9345

Resistance levels: 0.9510 0.9560 0.9600

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.