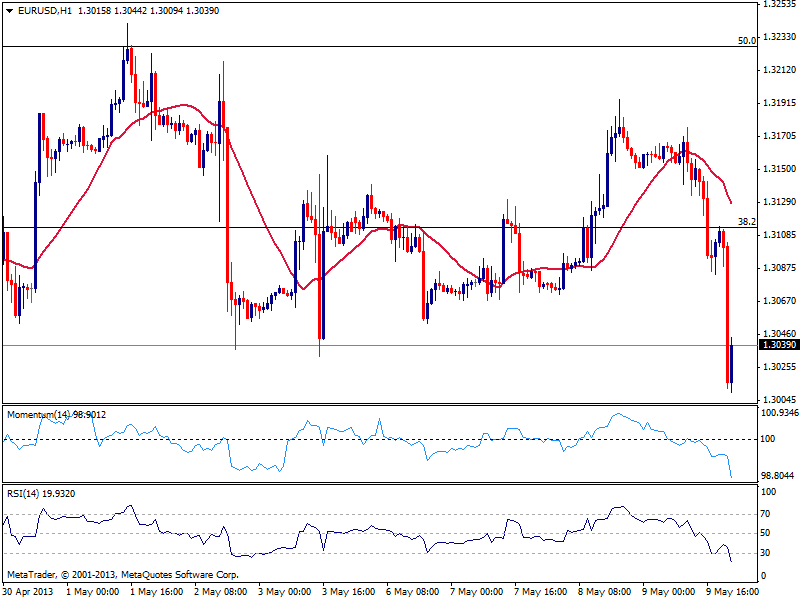

EUR/USD Current price: 1.3037

View Live Chart for the EUR/USD

The EUR/USD saw a 100 pips quick slide in this American afternoon, triggered by a strong upward momentum in greenback, as USD/JPY broke above 100.00. Regardless the wild moves across the board, the EUR/USD manages to hold above the base of this past months range, respecting the 1.30/1.32 levels. However, this move has definitely put bears back on alert mode, and further slides may come along the way, with a break below 1.2970, 38.2% retracement of the latest daily fall signaling a stronger midterm fall, eyeing first 1.2880 static support zone.

As for the short term, the hourly chart shows a strong bearish momentum with indicators heading south into oversold territory, while the 4 hours chart shows still plenty of room to go, as indicators head lower around their midlines. Short term sellers will try to catch the rally on pullbacks towards the 1.3050/80 price zone, yet as long as below this last, downside remains exposed.

Support levels: 1.3010 1.2970 1.2925

Resistance levels: 1.3050 1.3080 1.3115

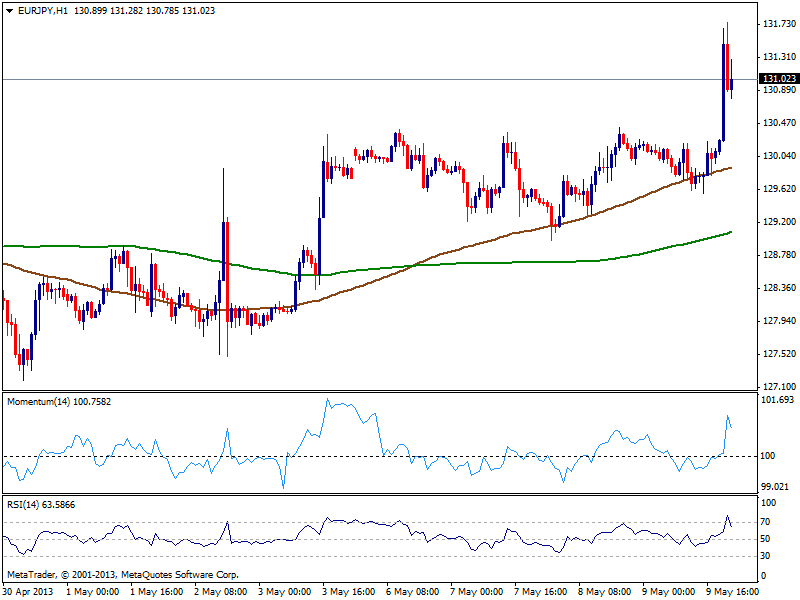

EUR/JPY Current price: 131.02

View Live Chart for the EUR/JPY (select the currency)

EUR/JPY reached 131.75 in the heat of yen selloff, levels not seen since January 2010, although EUR weak nature put the pair back down towards current 131.00 area. The hourly chart shows price found support in its 100 SMA earlier today, well below current price now, around 129.60, while indicators retrace from extreme overbought territory aiming for a correction. Still former high around 130.40 is the level to watch as dips towards that area should see late buyers jumping into the bullish party. In bigger time frames, the upside is still favorer with 133.60 now at sight.

Support levels: 131.00 130.40 129.80

Resistance levels: 131.70 132.25 133.00

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold stays in consolidation above $2,300

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.