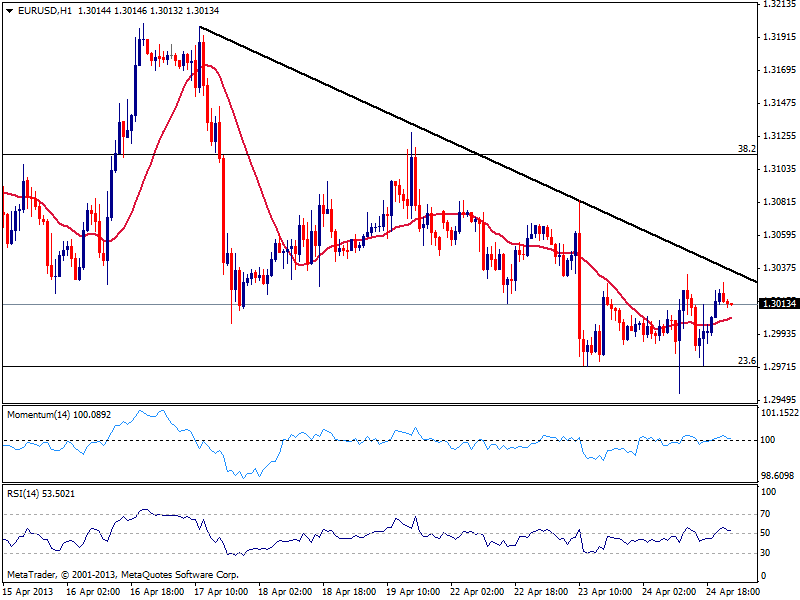

EUR/USD Current price: 1.3013

View Live Chart for the EUR/USD

A fresh weekly low, this time at 1.2954, was not enough to trigger further sells in the EUR/USD, that managed to recover from the level, back to current 1.3000 area where it stands. Back and forth, the pair has spent most of the last sessions struggling around the level, looking heavy as market players had already priced in a probable rate cut next week, regardless will hardly mean anything for anyone. Fundamental data both sides of the shore disappointed this Wednesday, giving no much clues on direction either, while US stocks traded in tight ranges ending up barely below their opening.

As for the EUR/USD, short term bias remains negative, with a descendant trend line now standing around 1.3030/40 area, offering short term resistance. Technical readings are flat in the hourly chart, reinforcing the idea of a stronger break below 1.2970 required to trigger more slides. In the 4 hours chart 20 SMA heads south and capped the upside at least twice over the past 24 hours, offering now dynamic resistance also in the 1.3030/40 area.

Support levels: 1.2970 1.2925 1.2880

Resistance levels: 1.3040 1.3070 1.3115

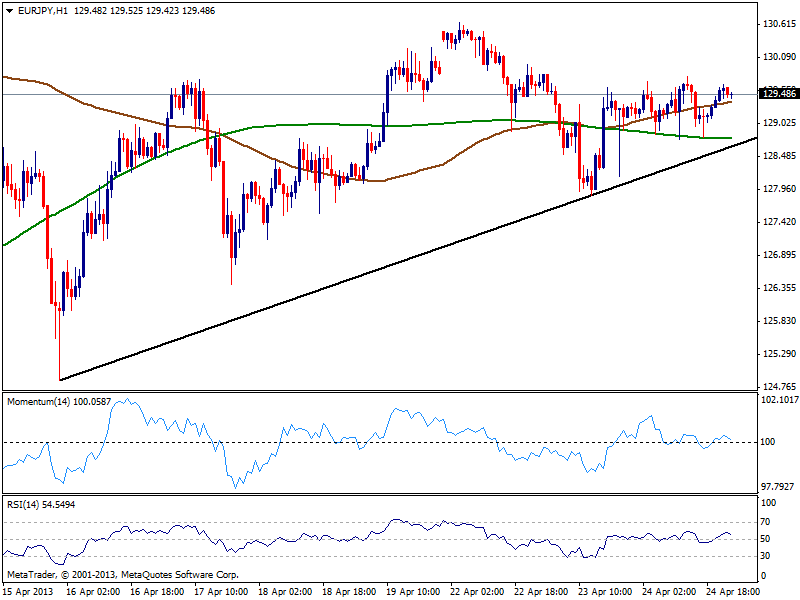

EUR/JPY Current price: 129.49

View Live Chart for the EUR/JPY (select the currency)

Not much to add to previous updates on yen pairs, as sellers prefer to wait for pullbacks or a break of recent highs to continue riding the trend. With no follow trough above 130.00, but with retracements also limited, the EUR/JPY hourly chart sees price holding above 100 SMA, indicators barely above their midlines, and a short term ascendant trend line standing around 128.40 now, all of which supports certain consolidation and limited retracements for current session. In bigger time frames, a slightly bullish tone persists although with not enough momentum at the time being, with a break above 130.60 now required to see the bullish trend resume.

Support levels: 129.10 128.80 128.20

Resistance levels: 130.10 130.60 131.30

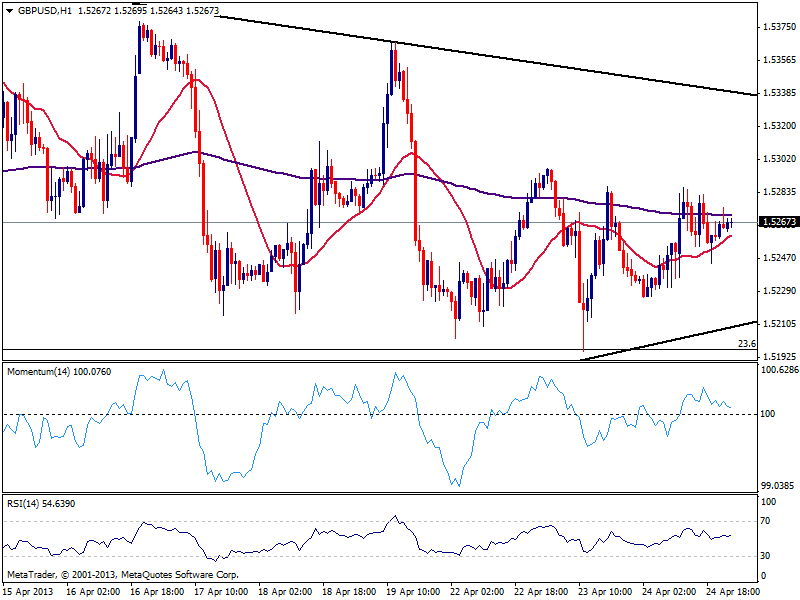

GBP/USD Current price: 1.5267

View Live Chart for the GBP/USD (select the currency)

The GBP/USD remains hovering around 1.5260 area, and an early attempt to extend gains was limited by 1.5290/1.5300 where strong selling interest remains aligned. The hourly chart shows price above a bullish 20 SMA as indicators head lower above their midlines, while in the 4 hours chart technical readings remain flat. 1.5190/1.5300 are the extremes of the range to play, probably until next week.

Support levels: 1.5225 1.5190 1.5150

Resistance levels: 1.5280 1.5300 1.5330

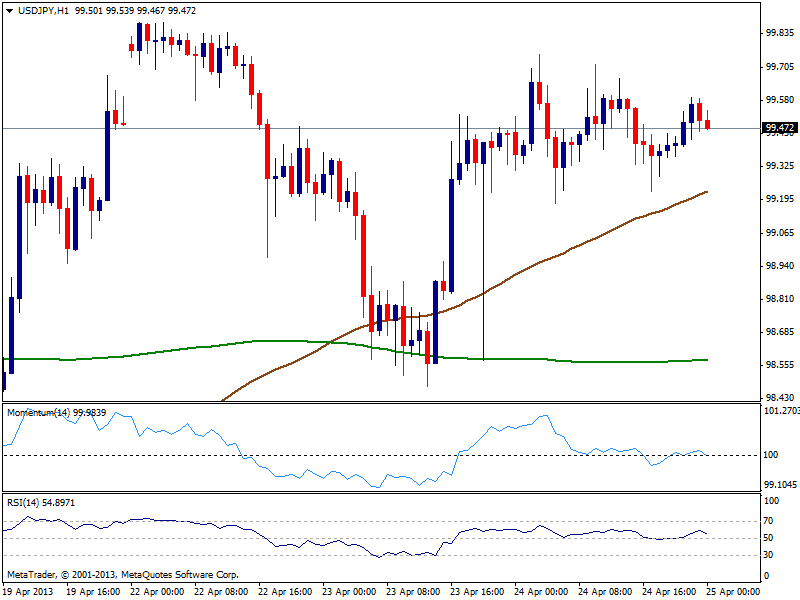

USD/JPY Current price: 99.47

View Live Chart for the USD/JPY (select the currency)

As said for EUR/JPY yen crosses maintain the range, with the pair comfortable in the 99.20/99.70 price zone. Short term technical readings hold a positive tone, as despite indicators hold flat near their midlines, 100 SMA advances higher below current price, widen the distance with 200 one. At this point is a matter of patient, and waiting for the pair to finally take out the 100.00 level.

Support levels: 99.20 99.00 98.60

Resistance levels: 99.70 100.00 100.35

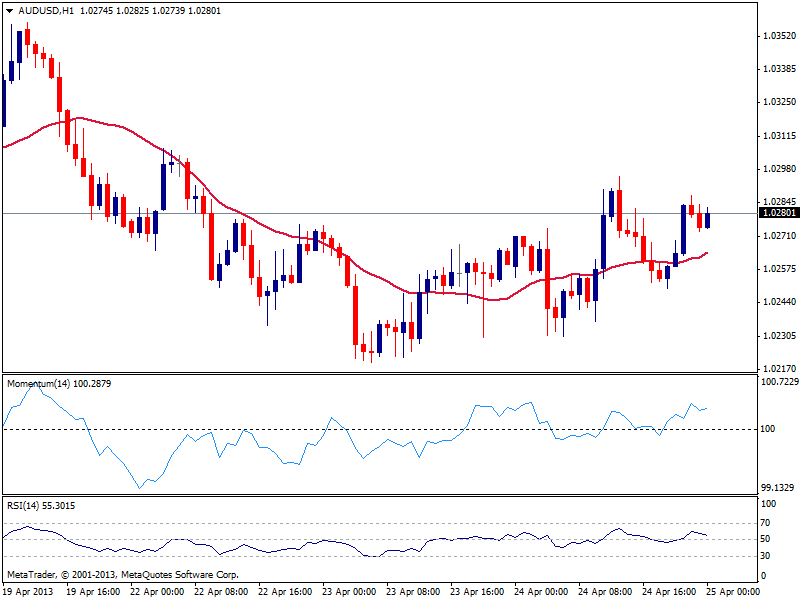

AUD/USD: Current price: 1.0280

View Live Chart for the AUD/USD (select the currency)

The AUD/USD ends the day with a positive tone, although found sellers around 1.0300 and barely added 20 pips on the day. The hourly chart shows an increasing bullish tone, with price above 20 SMA, slowly grinding higher, and momentum above 100 and heading north. In the 4 hours chart technical readings also turned positive, yet 1.0335 static resistance area ahs prove strong in the past: only steady gains above this level will favor further AUD recoveries, while slides below 1.0260 will put the pair back in the bearish track.

Support levels: 1.0260 1.0220 1.0180

Resistance levels: 1.0300 1.0335 1.0370

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.