Quotable

“The U.S. sanctions strategy is therefore not designed to change Russian policies; it is designed to make it look like the United States is trying to change Russian policy. And it is aimed at those in Congress who have made this a major issue and at those parts of the State Department that want to orient U.S. national security policy around the issue of human rights. Both can be told that something is being done -- and both can pretend that something is being done -- when in fact nothing can be done. In a world clamoring for action, prudent leaders sometimes prefer the appearance of doing something to actually doing something.”

George Friedman, Stratfor.com

Commentary & Analysis

Mario Draghi: Right or Wrong You Must Marvel at the Results

In my infinite critical wisdom I was early among those who predicted the euro currency wouldn’t survive. I was confident Greece would default and be pushed out of the single currency regime. I believed the ECB was feckless in the face of crisis. I of course was dead wrong on all accounts.

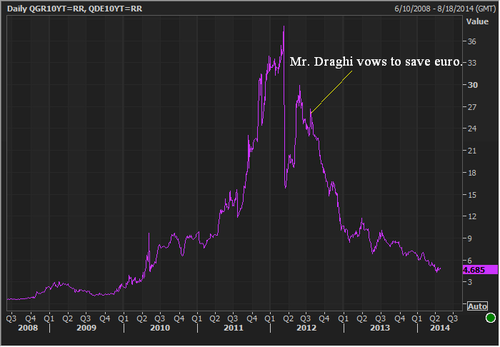

I could say “my call for euro demise was early” and suggest I may still be correct. But when you look at the charts below of the 10-year benchmark bond spreads between those periphery countries teetering on sovereign bankruptcy expectations in the midst of the crisis (and Germany), you have to marvel at the success of the ECB under President Mario Draghi’s stewardship—regardless of how he did it or lucky he may have been:

Greece versus Germany 10-year benchmark spread:

Portugal versus Germany 10-year benchmark spread:

Ireland versus Germany 10-year benchmark spread:

One has to also marvel at how much money was made for those who were brave enough to take Mr. Draghi at his word [I realize local central banks did much heavy lifting here, but there were some brave souls on this trade early who were well rewarded]. This is the bet Jon Corzine was making with customer money that ended up bankrupting MF Global. He was right, just early.

Now the seers and thinkers and forecasters of various stripes are criticizing ECB President Mario Draghi’s monetary policy and see danger from rising deflation—are they wrong again?

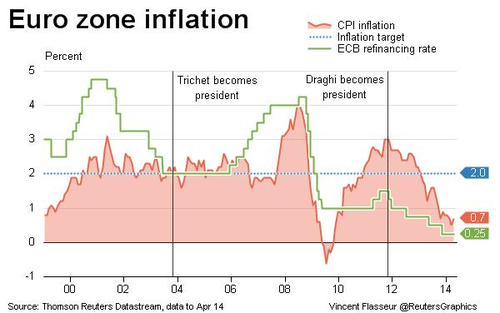

Because of the original sin of forming a currency zone whereby the business cycles were never synchronized, deflationary pressures vary depending on where you are in the Eurozone. The northern-tier countries (Germany, Finland, Netherlands, etc.) inflation rate is close to the ECB target, while the southern tier is running well below the target and a couple a bordering on outright deflation (Greece, Ireland, Portugal, and Spain).

Of course, the ECB can only have one interest rate policy. So does it punish Northern-tier savers by pushing rates lower in order to subsidize the needs of southern-tier debtors?

Why is deflation seen as such a concern for the Eurozone? It is because of the high relative debt levels among the various countries in the region; some are worse-off than others. The real cost of debt effectively rises in a deflationary environment (thus why most governments as debtors love inflation and pay those debts back in devalued fiat currency). But deflation isn’t necessarily bad for Germany—they are a major creditor of the Eurozone; creditors benefit during deflation.

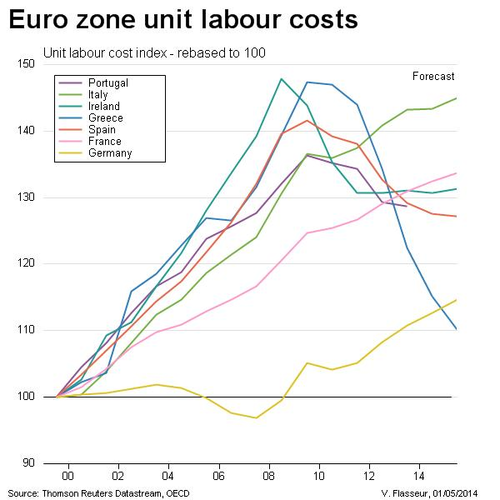

And why should it be any surprise the southern tier is deflating? Deflation was the strategy of austerity; it is required because of a single currency. Countries inside the currency regime are forced to take the adjustment locally—lower wages and higher unemployment—in order to reduce relative production costs; they are unable to devalue (as the UK was) in an effort to improve relative competitiveness.

So labor rates are now starting to converge; though Italy and France unit labor rates are the exception and something to note:

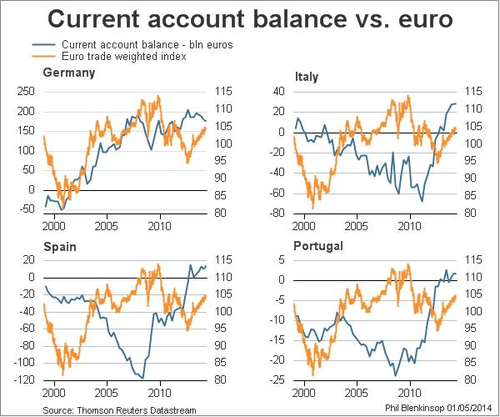

And despite the criticism of Germany from the US Treasury to “consume more” [that worked so well for the US], even the current accounts deficits are improving among the periphery countries.

Mr. Draghi is being criticized by the monetarist for not doing enough with either conventional or non-conventional tools to keep the deflation dragon at bay. The concern is the Eurozone will be caught in the same deflationary spiral which engulfed Japan for decades if the ECB falls too far behind the curve.

Some arguments against Mr. Draghi:

1, Monetary policy works with a lag; he must act now or risk getting behind the curve.

2. He doesn’t acknowledge the large labor and capital output gaps across the Eurozone

3. He doesn’t seem to recognize the high costs of deflation to both personal and high debtor nations

To believe Mr. Draghi doesn’t recognize every one of those criticisms above is non-sense. He knows all of that. But he also knows he has to balance the needs of the dominant engine of Europe—Germany—against those of weaker countries. It is not an enviable position when Bundesbank members are breathing down your neck and the German press labels you the “Italian central bank” president.

Though time will tell, I think Mr. Draghi is also correct to point out there are vast differences between the structure of the Japanese economy and the Eurozone. This doesn’t mean if deflationary pressures grow across the Eurozone, and that is likely if the global economy doesn’t provide some help, Mr. Drahgi won’t cut interest rates and move to negative deposit rates for institutions in an effort to force them to lend more.

But keep in mind he is only the head of a central bank. He admits at every ECB meeting I have watched that monetary policy cannot take the place of proper structural reform. He is right. And those who believe in the magic of monetary policy manipulation as the end all and be all I think are wrong.

Is the euro saved and here to stay? For now, I think you have to say yes. Or maybe it’s too early to tell. :) Either way, trading the euro as if another crisis is just around the corner is likely a big mistake—it has been for me.

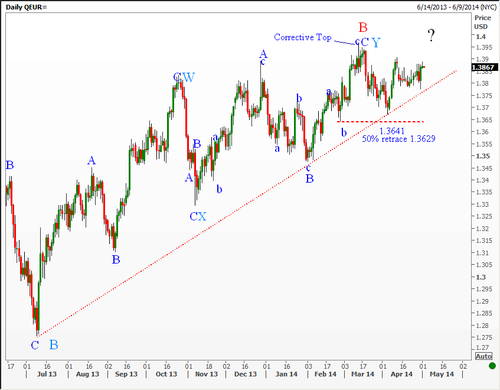

Tomorrow we get a look at US non-farm payroll. I think a good report pushes EUR/USD lower; otherwise that 1.400 barrier looks very tempting:

Currency Currents is strictly an informational publication and does not provide individual, customized investment advice. The money you allocate to options should be strictly the money you can afford to risk. While every effort is made to evaluate the actual experience of subscribers, all performance figures must be considered hypothetical, and past results are no guarantee of future performance. Detailed disclaimer can be found at http://www.blackswantrading.com/disclaimer.html

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.