The technical situation for USDJPY has looked indecisive for the better part of a month and we’re getting to the point where the pair needs to commit one way or another. Next week offers key even risks for the two in the form of a Shinzo Abe speech on October 1 that will see the prime minister announcing plans for: (1) a possible corporate tax break (interesting, rumours of this tax cut this week saw a sharp weakening of the JPY that was quickly erased), (2) whether there will be a stimulus (and whether that stimulus will be financed with debt issuance – probably too early for overt money printing), and (3) whether the sales tax increase will go forward on schedule. Also next week we have the major US economic activity surveys and the US employment report on Friday as well as a Bank of Japan meeting that same day.

In the options market, one-week options are extremely bid in recognition of the near-term risk for volatility while one-month option implied volatility remains low relative to recent history, probably due to the indecisiveness of the chart.

Factors working on the JPY next week

Reasons for pressure on USDJPY to the downside lately include the recent decision by the Fed not to taper asset purchases, even if we’ve had lots of Fed jawboning on the decision being a close one. As well, it appears we have emerging market worries cropping up again, as the JPY is the favourite carry trade funding currency out there at the moment and this serves as a headwind.From here, the most JPY positive factors would be: modest or no corporate sales tax break and a modest stimulus while US data is weak and bonds look strong and risk weak. A sales tax delay would also be seen as JPY positive because the Bank of Japan has targeted this tax as a risk to the recovery and as a policy trigger.

The most JPY negative factors would be a sales tax increase, a corporate tax cut and any stimulus announcement, especially if it is large and not debt financed (the latter would be a real shocker at this point). Meanwhile, if the US data all comes in unequivocally strong (both ISMs and the Friday employment report), this could set up fear of an October taper.

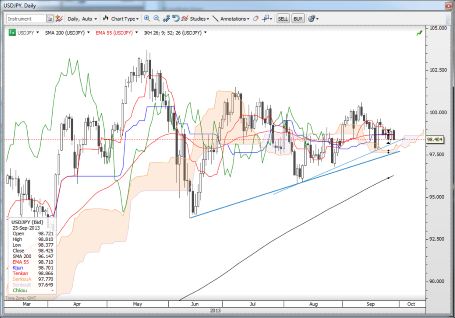

Chart: USDJPY

The trend lines are fairly obvious to the downside, as is the Ichimoku cloud area. The pair really needs to take out 98.00/97.50 to open up a downside break scenario, possibly toward the 200-day moving average or the previous lows from the summer. To the upside, 100.00 is the first milestone, followed by the 100.60+ high. Stay tuned, next week won’t be as quiet for USDJPY as this week

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.