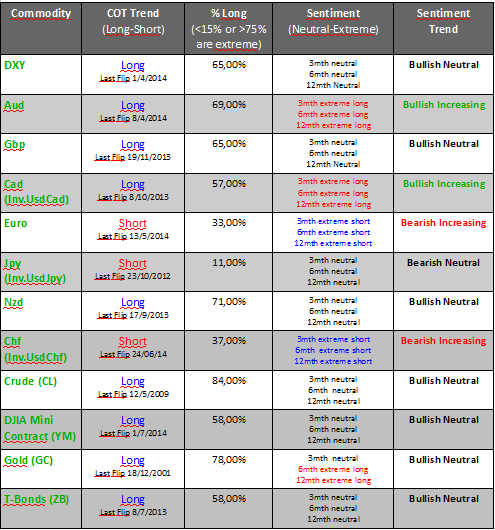

The COT report is a very useful but overlooked sentiment indicator. The way we use it at OrderFlowTrading helps us attain a longer term perspective on major capital flows, as well as a read on how overextended certain markets may be. It is part of a larger arsenal of sentiment indicators that we use.

Recent developments:

- DXY: Specs still long, printing a strong week for the USD.

- Amongs the comm-dolls, last week we saw inflows into both Aud and Cad.

- Amongst European FX, we saw an increase in short interest in both Euro and Gbp.

- Amongst Safe-Haven FX, we saw a loss if interst in both Chf and Jpy.

- Speculative interest is highest in Gbp overall and lowest in Eur overall.

- Most crowded trades: Nzd(FX), Crude (Commodities).

Comments & most intersting charts:

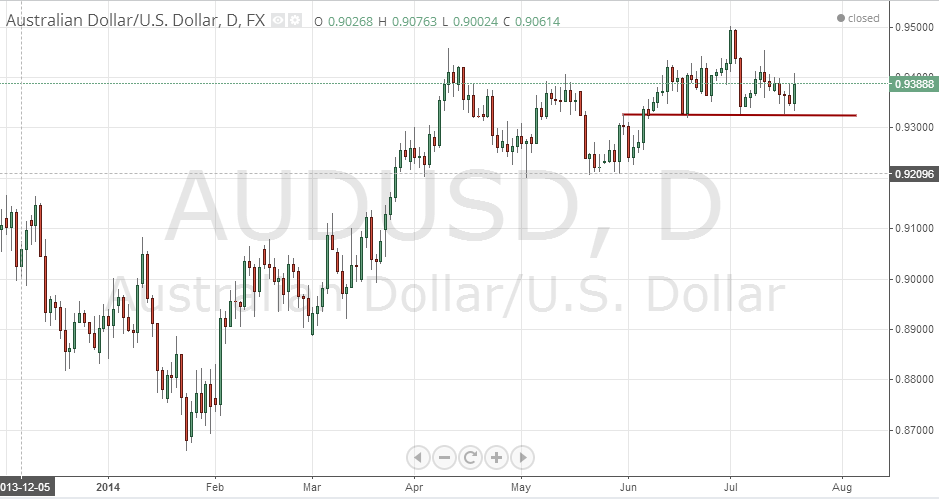

The AUD is still registering an extreme long sentiment situation and the %Long is still relatively high, hence supporting the case for some profit taking. Whilst we are still in a range, we need some confirmation like a break of the recent support ledge.

Source: Tradingview.com

AudUsd Daily chart

NzdUsd has finally decided to give us some sign of profit-taking and downwards momentum. We were expecting it sooner or later, and even if there was no extreme sentiment to be registered last week, the %Long went above 70% and we also have price action to help.

Source: Tradingview.com

NzdUsd Weekly chart

Cad continues to gain interest amongst the spec community and last week we printed a dragonfly doji that would indicate some more Cad strength, in the face of the already extreme long situation. Given the contrasting evidence, this is the least convincing situation and we would not be surprized to see further Cad losses.

Source: tradingview.com

UsdCad Weekly chart

In other news:

- ZB has flipped back to positive, as we expected.

- Euro is still extremely short into this support ledge at the 1.3500s. There may be some evidence for tactical bullish momentum on the back of this extreme sentiment and a daily bullish dragonfly doji from friday, but the opportunity may be better observed on EurNzd – benefitting from “the bird's” fresh downwards momentum.

To sum up: watch AudUsd, NzdUsd, UsdCad and EurNzd this week.

Catch you next week!

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0650 after PMI-inspired rebound

EUR/USD loses traction and retreats to the 1.0650 area after rising toward 1.0700 with the immediate reaction to the upbeat PMI reports from the Eurozone and Germany. The cautious market stance helps the USD hold its ground ahead of US PMI data.

GBP/USD fluctuates near 1.2350 after UK PMIs

GBP/USD clings to small daily gains near 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling stay resilient against its rivals.

Gold flirts with $2,300 amid receding safe-haven demand

Gold (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark in the European session. Eyes on US PMI data.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.