Driven by both increased bullishness and short covering after Draghi's speech last week, the euro speculative longs saw almost 6.2k contracts added to the 103.8k contracts from the previous week, while shorts were cut by 6.7k contracts to 73.7k . The 36.3k gross long euro contracts is the highest since last October when they reached about 72.4k contracts.

Selling of yen, on the other hand, resumed and the net short yen positions went from -79k to -99k contracts hitting a seven week high.

The Swiss franc long positions were also extended from 21.8 to 28k with shorts being sharply reduced 19.6k to 14.1k, having an effect on the net positioning towards multi-week highs at 8.9k.

Net long sterling positions, being the highest net long positioning among small speculators, were cut by 7.6k contracts to 22k among the non-commercials where it is the second most bullish position after the euro. Open interest in this contract is at its highs above 240k.

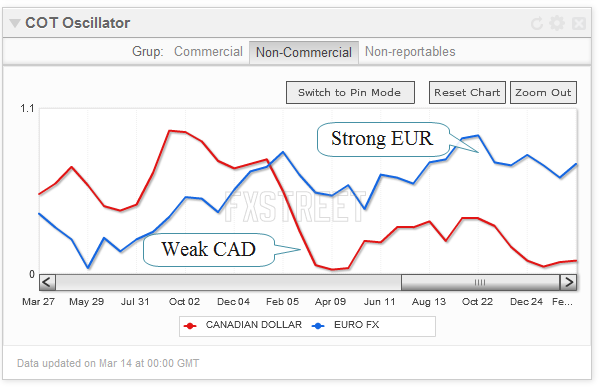

Among the commodity currencies, the Canadian dollar was reduced to the biggest net short since December 2013: -52k (from 61k) likely driven by the Bank of Canada's unchanged tone at its March monetary policy meeting. The 8.9k difference is still noticeable.

In the Australian dollar, the risk was pared back from both the long and short side with almost no change in the gross positioning. The New Zealand dollar kept adding to its net long at a highest value since May last year more long contracts being added.

Speculators kept their exposure to the U.S. dollar during the week of March 11 in the net short territory with no big variance from the previous period. The aggregate long contracts continue to accelerate at the same pace as shorts and open interest almost reaches the 60 mark after bottoming at 40k in December.

Click here to import this COT study to your My Studies.

What does it mean for traders? Last week's message prevails: “Positioning in the euro and Sterling favors an advance in the EUR/GBP cross, and a positive development of the potential double bottom reversal pattern which has been on the built for two months, to be confirmed with a firm break of 0.8350.†The difference being that the pattern is now confirmed with the recent surge above its neckline (0.8350).

When taken the USD out of equation, the EURCAD is one of the pairs with more extreme positioning, a situation reflected in the price charts at multi-year highs. A significant change in one of the two contracts can give trading opportunities other then trend following breakouts.

About Commitments of Traders

The weekly Commitment of Traders report summarizes the total trader positions for open contracts in the futures trading markets. The CFTC categorizes trader positions according to commercial hedgers, non-commercials (also called speculators) and nonreportable traders (usually small traders/speculators). The report is published every Friday and shows futures positions data that was reported as of the previous Tuesday.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.