Summary

Latest CFTC positions data, published on Friday, reveals that the market has turned more risk-positive, with safe haven positions turning less bullish. JPY, Gold and US 2-year Treasury note were the biggest losers last week in positioning term, with the leveraged community reducing defensive positions, as the market turned more pro-risk.

FX

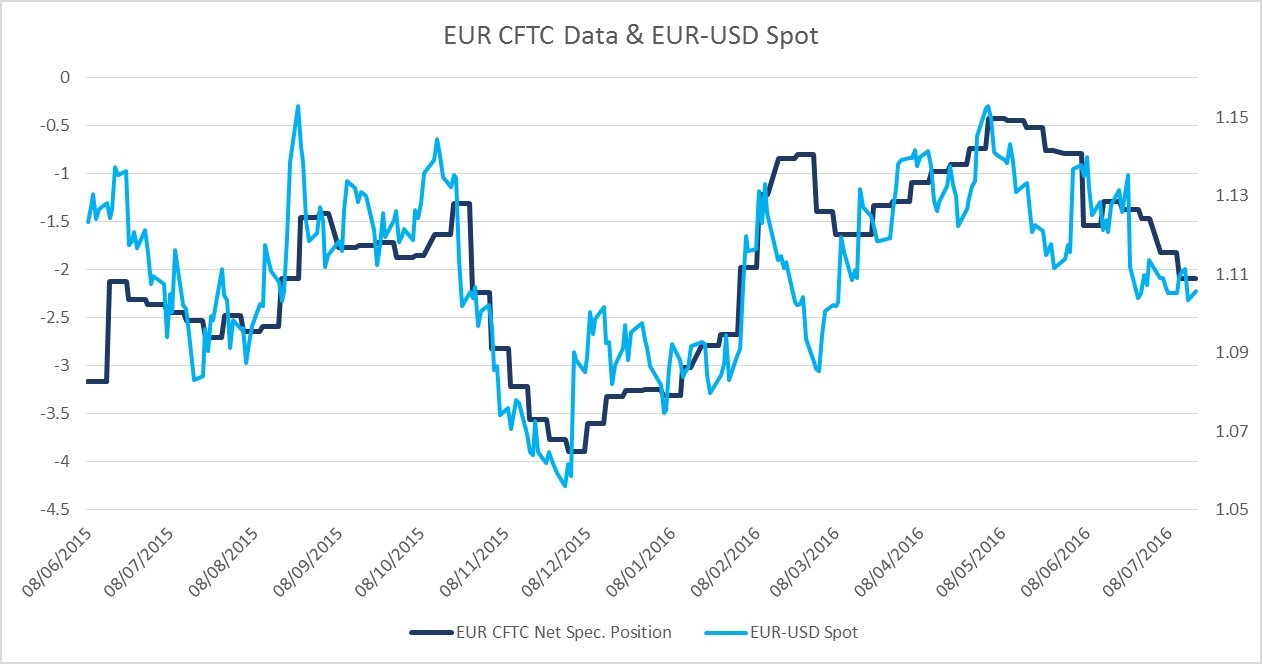

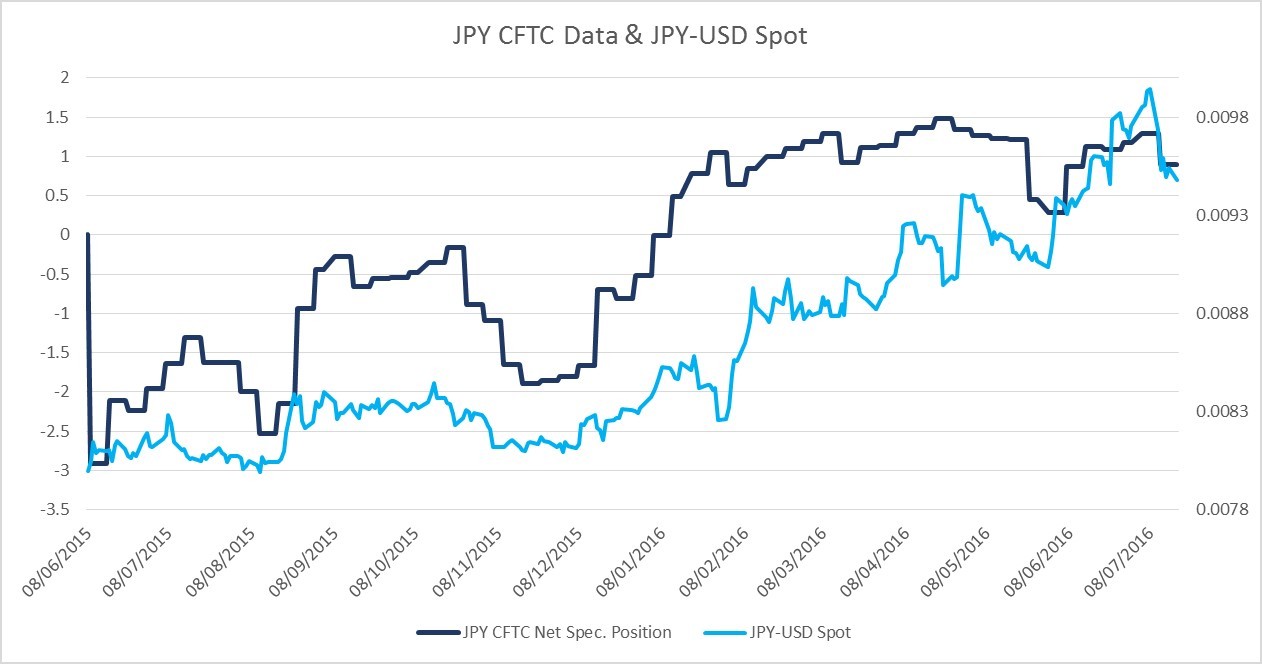

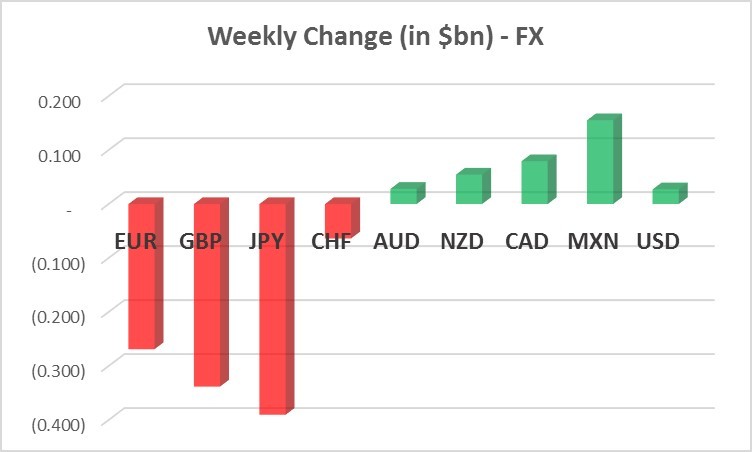

Last week change in positioning saw mixed Dollar positioning, with EUR,GBP and JPY losing ground against the Dollar, while high-yielding currencies (MXN, CAD, NZD and AUD) gaining ground.

GBP net short position moved further, and now the lowest it has been since 2013.

JPY long speculative positions were slightly reduced, and they are now off 8-years high. This moves in tandem with the recent price action in USDJPY.

Commodities Currencies (AUD, NZD, and CAD) continued to move slightly more positive in positioning term.

MXN positioning continues to exhibit a sharp recovery in positioning term. MXN short positions were reduced further (about 1.5$bn USD were sold against the MXN by the leveraged accounts last week).

Commodities

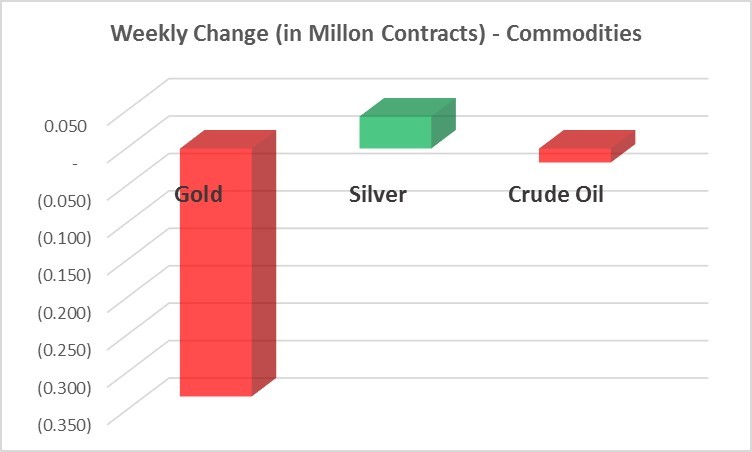

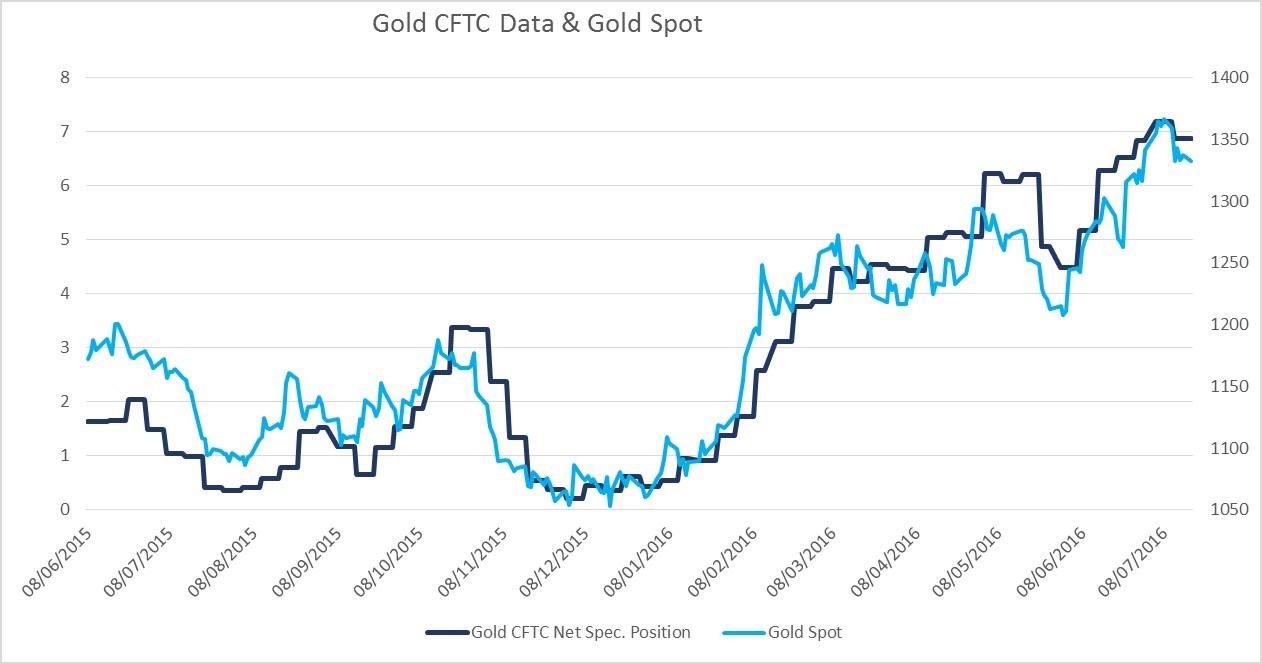

Last week change in positioning saw mixed change in positioning. Gold and Oil long positions were reduced, while Silver positioning turned more positive.

Gold long speculative positions were reduced by about 330,000 contracts, while Silver positions gained about 43,000 contracts. That change is also reflected by the ETF holdings of gold/silver (tracked by Bloomberg, under "ETFGTOTL Index" and "ETSITOTL Index").

Oil positions were reduced by about 19,000 contracts.

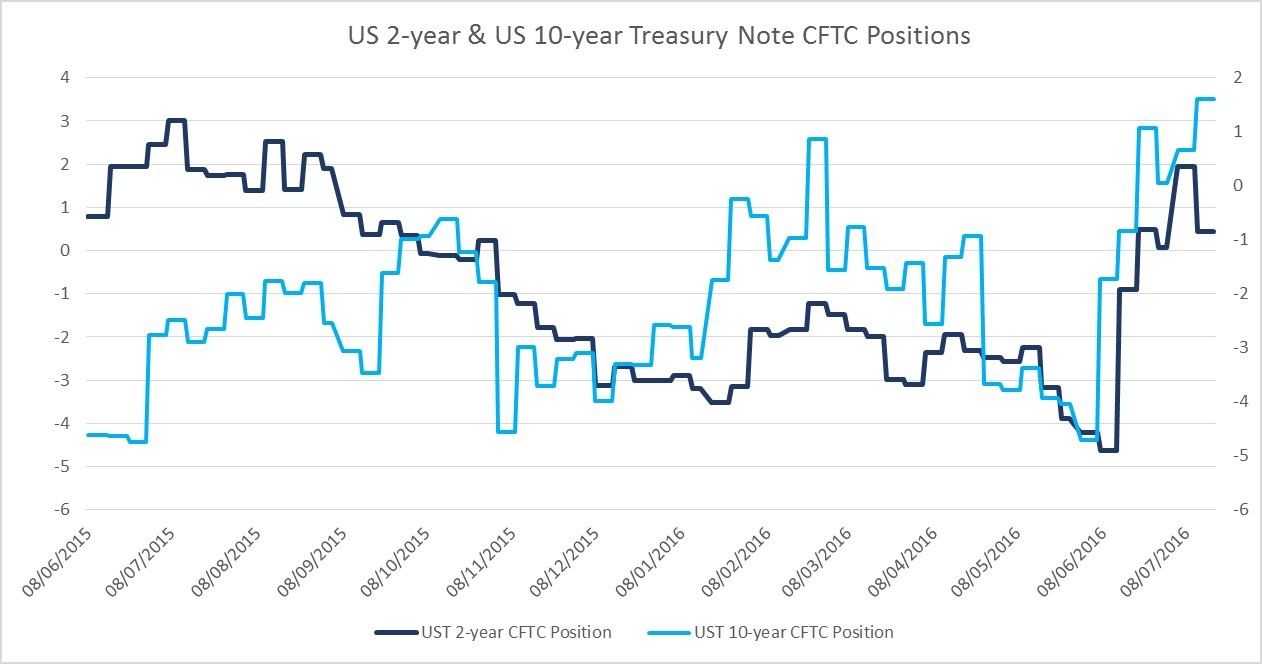

Rates

Last week change in positioning was somewhat mixed, with the 2-year note positioning reduced, while 10-year note positioning gaining ground. This should not come as a surprise, as the rate outlook for the US has changed significantly following the recent Non-Farm Payroll. Two main themes are governing the US rates market:

1. Rate hike probability moved significantly higher last week (from less that 20% to about 40% by year-end)

2. The Yield Curve steepened from extremely flat curve. That should signal a more positive outlook for rates.

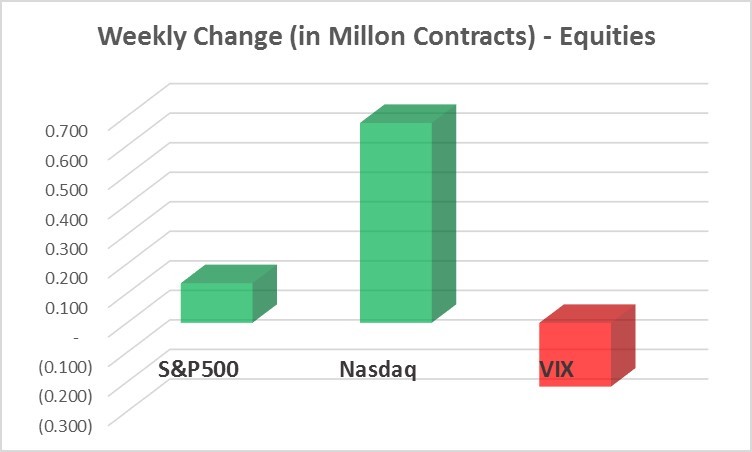

Equities

Leveraged positions in US equity market turned positive last week, with both S&P500 and NASDAQ positions gaining about 41,000 contracts on average. VIX speculative positions were reduced by about 215,000 contracts.

S&P500 positions gained about 22,600 contracts, as S&P500 trading near all-time high.

NASDAQ positions gained about 67,700 contracts

VIX positioning was trimmed down as investors turned less fearful of market's downturn. The weekly decline in VIX leveraged positions stood at 21,600 contracts.

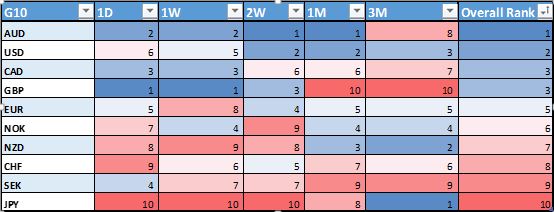

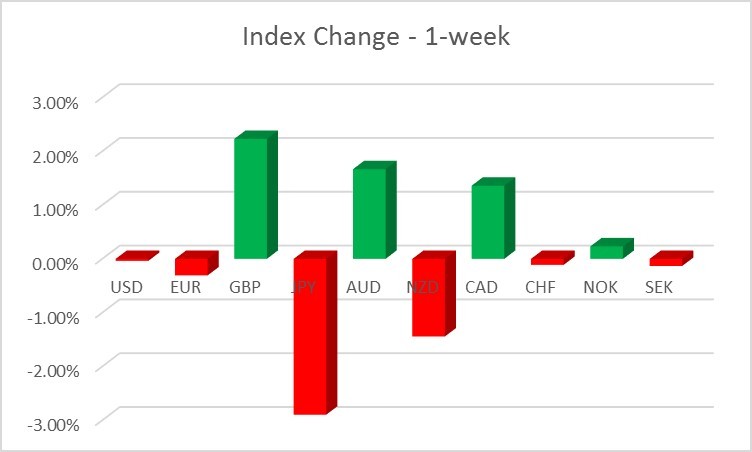

FX Scoreboard

Our G10 Scoreboard shows AUD as the biggest winner overall (trading the strongest against its G10 peers), followed by USD and CAD.

The weakest among G10 currencies are the JPY, SEK and CHF.

NOK and SEK continue to diverge further, as SEK continued to weaken last week. AUD and NZD moved in opposite direction last week, as AUD strengthened while NZD weakened (mostly due to increasing odds of August rate cut by the RBNZ, and confusion regarding Jul 21st unscheduled RBNZ press release).

Lastly, as we noted last week, CAD and NOK appeared on the scoreboard as an interesting pair to look at (due to divergence of oil-correlated currencies). Since last Monday CAD strengthened about 1.5% against the NOK.

Good Luck,

EZTRADER Market Analysis Team

1. Introduction This risk disclosure and warning notice is provided to you (our Client and prospective Client) in compliance to the Provision of Investment Services, the Exercise of Investment Activities, the Operation of Regulated Markets and Other Related Matters Law 144(I)/2007, as subsequently amended from time to time (“the Law”), which is applicable in WGM Services Limited (“the Company”). All Clients and prospective Clients should read carefully the following risk disclosure and warnings contained in this document, before applying to the Company for a trading account and before they begin to trade with the Company. However, it is noted that this document cannot and does not disclose or explain all of the risks and other significant aspects involved in dealing in Binary Options. The notice was designed to explain in general terms the nature of the risks involved when dealing in Binary Options on a fair and non-misleading basis.

2. Risks 2.1. Trading in Binary Options is VERY SPECULATIVE AND HIGHLY RISKY and is not suitable for all members of the general public but only for those investors who: (a) understand and are willing to assume the economic, legal and other risks involved. (b) taking into account their personal financial circumstances, financial resources, life style and obligations are financially able to assume the loss of their entire investment. (c) have the knowledge to understand Binary Options trading and the underlying assets and markets. 2.2. The Company will not provide the Client with any advice relating to Binary Options, the underlying assets and markets or make investment recommendations of any kind. So, if the Client does not understand the risks involved he should seek advice and consultation from an independent financial advisor. If the Client still does not understand the risks involved in trading in Binary Options, he should not trade at all. 2.3. Binary Option are derivative financial instruments deriving their value from the prices of the underlying assets/markets in which they refer to (for example currency, equity indices, stocks, metals, indices futures, forwards etc.). Although the prices at which the Company trades are set by an algorithm developed by the Company, the prices are derived from the underlying assets /market. It is important therefore that the Client understands the risks associated with trading in the relevant underlying asset/ market because fluctuations in the price of the underlying asset/ market will affect the profitability of his trade.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.