Headlines

Propelled by domestic demand, Czech economy booms

Polish consumer prices stayed likely flat in September

Yesterday, only 25.25 billion HUF’s offer arrived for the 20 billion HUF’s 3 month Treasury bill on bond auction of the Hungarian Government debt Management Agency. According to our assumption it is driven by to the fact that banks are required to get rid-off riskier assets at the end of the year and since Hungary’s rating is still not offered for investments therefore banks try to moderate purchase of securities which expire at the beginning of next year. On the other hand, yields hit such low level that it is uncertain if these were attractive for foreign investors.

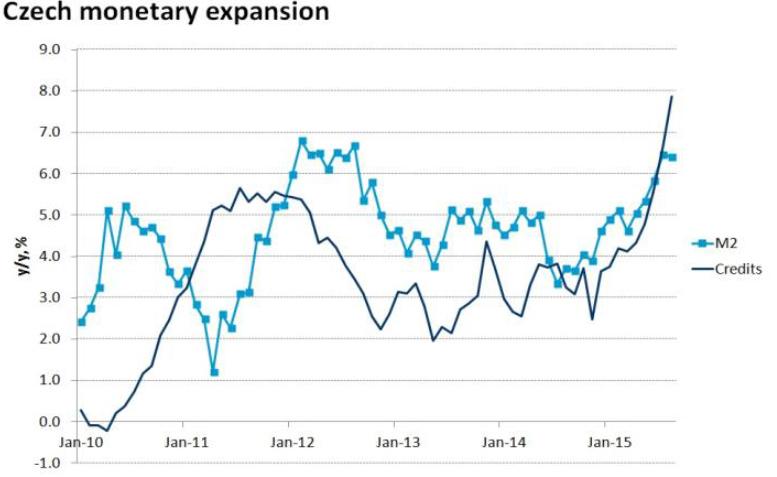

The Czech economy was growing faster in the second quarter this year than preliminary data indicated. According to a revision published today by the Czech Statistical Office, GDP jumped up 1.1% quarter-on-quarter and 4.6% year-on-year. The accelerating growth was driven by domestic demand as households’ consumption rose by 3.1% y/y and fixed investments increased by 7.3% y/y. We believe that the Czech economic growth has maintained momentum also in the third quarter; hence our GDP growth projection stands at 4.3% y/y. Obviously, the Czech domestic demand has been supported by strong monetary expansion as the Czech National Bank accommodates ECB’s relaxed policy through quasi-fixed exchange rate regime. In this respect, today’s release of M2 growth in August it is worth noting, showing robust credit growth of 7.9% y/y (see the chart below).

Later today, the Polish Statistical Office will release the first (ever) flash estimate of headline inflation. We expect the aggregate CPI index to be flat in September, while dropping 0.6% year-on-year. Since the market thinks that the CPI declined 0.7% y/y in September, we believe that a notch higher actual inflation could calm down rate cut bets, which have been partly priced in the front end of the yield curve.

| Currencies | % chng | |

| EUR/CZK | 27.19 | -0.2 |

| EUR/HUF | 313.4 | -0.5 |

| EUR/PLN | 4.24 | -0.1 |

| EUR/USD | 1.12 | 0.0 |

| EUR/CHF | 1.09 | -0.2 |

| FRA 3x6 | % | bps chng |

| CZK | 0.26 | 0 |

| HUF | 1.33 | 0 |

| PLN | 1.69 | -1 |

| EUR | -0.05 | -2 |

| GB | % | bps chng |

| Czech Rep. 10Y | 0.69 | -5 |

| Hungary 10Y | 3.33 | -6 |

| Poland 10Y | 2.84 | 2 |

| Slovakia 10Y | 0.88 | -1 |

| CDS 5Y | % | bps chng |

| Czech Rep. | 51 | 2 |

| Hungary | 168 | 6 |

| Poland | 76 | 0 |

| Slovakia | 52 | 2 |

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.