Headlines

Zloty hit a one-month low

Regional PMIs in focus this week

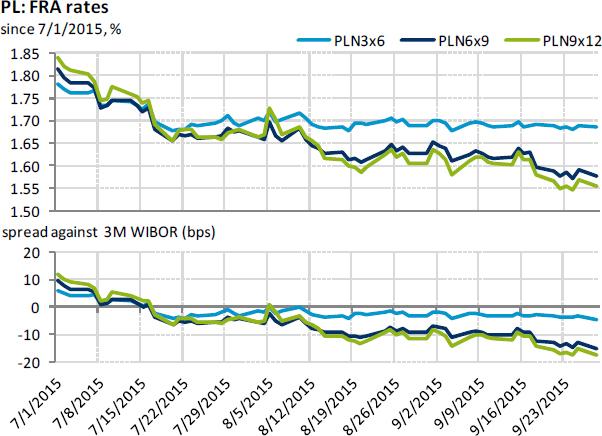

While the Czech koruna was eventually little changed on Monday amid a relatively thin (holiday) trade, the zloty weakened by about 0.3 % and hit a onemonth low against the euro as world stock indices kept sliding and overall global market sentiment remained negative. Moreover, the Polish fixed-income market has begun to bet on a rate cut (see the chart below).

Regarding the rest of this week, regional eye-catcher is a release of manufacturing PMI figures for September. The Polish index is likely to draw the most attention. Let us recall that the index fell sharply in August and hit an eleven-month low. While industrial production itself keeps relatively robust pace of growth of about 5 % year-on-year, market bets on further monetary policy easing could heighten should the index disappoint. Please note that bets on a rate cut increased in the last couple of weeks and markets see solid chance of lowering of official interest rates even in six months horizon. We, however, keep our base case and expect stable rates in the months and quarters to come.

| Currencies | % chng | |

| EUR/CZK | 27.23 | 0.0 |

| EUR/HUF | 314.8 | 0.1 |

| EUR/PLN | 4.24 | 0.5 |

| EUR/USD | 1.12 | 0.4 |

| EUR/CHF | 1.09 | -0.1 |

| FRA 3x6 | % | bps chng |

| CZK | 0.90 | 0 |

| HUF | 1.33 | 0 |

| PLN | 1.70 | 2 |

| EUR | -0.03 | 1 |

| GB | % | bps chng |

| Czech Rep. 10Y | 0.74 | 3 |

| Hungary 10Y | 3.39 | -1 |

| Poland 10Y | 2.83 | -3 |

| Slovakia 10Y | 0.90 | -4 |

| CDS 5Y | % | bps chng |

| Czech Rep. | 49 | 0 |

| Hungary | 162 | 0 |

| Poland | 74 | 0 |

| Slovakia | 50 | 0 |

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.