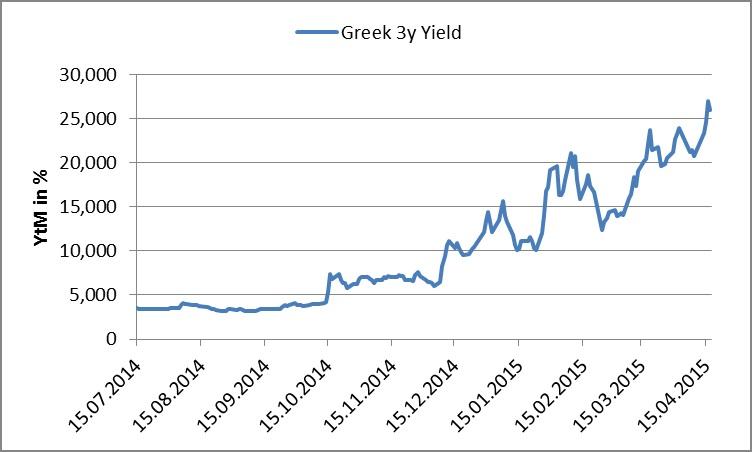

Chart of the Day:

Greek Bond Sell Off: The difference in fortunes couldn’t be more dramatic. While the yield on the Bund fell to a record low below 8 bps, it is bond prices and not yields that are making record lows in Greece.

Analysts’ View:

RO Bonds: The MinFin sold bonds maturing in Feb-25 worth RON 200 mn as planned, at an average yield of 3.20%. Total demand was RON 539.8 mn. The announcement about the cut in the VAT for food to 9% beginning with June (from 24% at present) was received as neutral to slightly positive by investors and last Friday S&P confirmed Romania’s rating at BBB- with a stable outlook. In our view, better revenue collection to the state budget and consolidation of economic growth at higher levels are of key importance for preserving foreign investors’ confidence after the fiscal easing. We maintain our 5-year ROMGB yield forecast at 2.3% for the remainder of this year.

PL Macro: The labour market data should confirm improved conditions, as employment and wages are expected to grow (consensus at 1.2% y/y and 3.4% y/y, respectively). Such a development is supportive of private consumption, which we expect to be a major positive contributor to economic growth in 1Q15. Although the data should confirm the pretty optimistic outlook for the economy, it is going to be mostly neutral for markets. We expect the zloty to remain strong (4.02 vs. the EUR at the end of 1H15) and 10Y yields to move toward 2.1% at the end of the quarter.

Traders’ Comments:

CEE Fixed income: Price action on CEE fixed income was once again very muted as the tug-of-war between QE and a Grexident leaves yields largely unchanged but spreads to Bunds wider. 10y yield spreads are at or close to the widest levels since 3 months in Turkey, Hungary, Romania, Poland, Bulgaria & the Czech Republic. Slovenia and Slovakia which share the Euro with Germany are at or below the average of the last 3 months. Slovenia is also a direct beneficiary from QE as its bonds are eligible for the ECB bond buying programme.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.