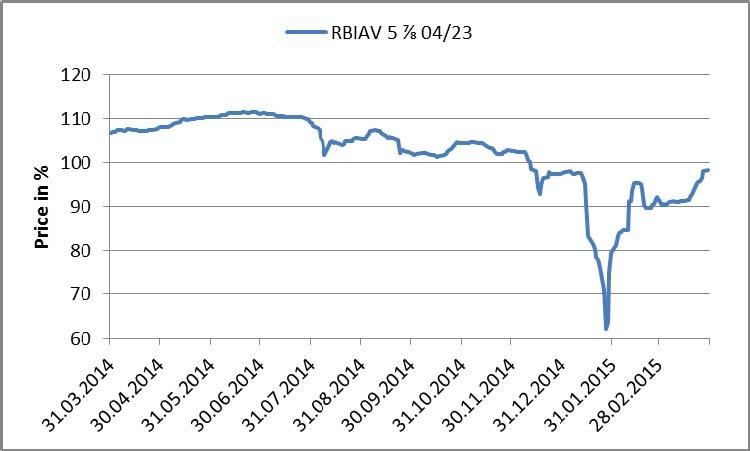

Chart of the Day:

Raiffeisen Rebound: There’s nothing like bad news to boost optimism. CEO, Karl Sevelda, told the press last Wednesday that it may take until 2016 to return to profits as the bank focusses first and foremost on restoring its capital ratios, emphasizing “We’ve said that the overriding goal is to reach the capital ratio of 12% by the end of 2017. All other goals are secondary.” Plans to raise capital ratios fall squarley on a reduction of RWA’s with the sale of Raiffeisen Bank Polska SA a major component of the plan to shrink to health. These statements from the CEO were followed up by comments from Deputy Chief Executive Officer Johann Strobl on Thursday who indicated that RBI will sell additional Tier 1 securities this year. Outstanding sub debt continued its recovery from the January 6th lows on the back of this commitment to scale back business and avoid issuing new equity.

Analysts’ View:

CEE Looking Ahead This Week: The new month is starting this week, which means that PMI indices will be released on Wednesday. For CEE, the question is if we are going to see further positive figures (which would underpin positive risks for the growth outlook), while for Turkey, the question is whether we are going to see further disappointing figures, which could additionally contribute to downside risks there. Before this data, however, on the last day of March, the Romanian central bank is expected to cut the policy rate 25 bps to 2.0%, which should end the easing cycle. Otherwise, as far as data releases are concerned, the week will be mostly packed with data of secondary importance to markets. Maybe the only exceptions from this are the Czech and Turkish 4Q14 GDP releases on Tuesday, and the Slovenian inflation data also on Tuesday. Still on Tuesday, we will see industrial output, retail sales and current account data releases from lots of countries in the region. These data releases should not be extremely important for market movements, but could help analysts ascertain if the currently observable improvement in growth prospects is supported by stable external balance developments in CEE.

Traders’ Comments:

CEE Fixed income: CEE government bond markets remain lackluster as central banks continue to fret over the risk that FX appreciation will derail their efforts to expand monetary policy. Sentiment will be highly dependent on Greece and Fridays US Non-Farm Payrolls this week.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.