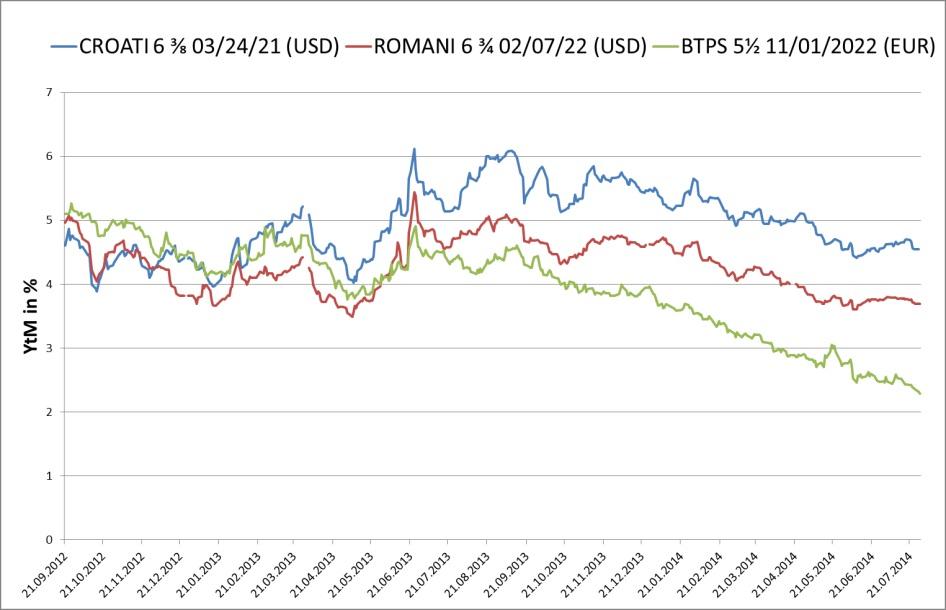

Chart of the Day:

Croatian, Romanian & Italian Bonds: These bonds moved almost in sync for the best part of 6 months from September 2012 to June 2013. Since then, Italy has outperformed. The EURUSD is more or less unchanged over the same period. The yield spread between the BTPS (in EUR) and the ROMANI (in USD) mirrors to a large extent the increase in spread between 10y US Treasuries and German Bunds. Local currency Romanian debt has rallied strongly, especially over the last few weeks folowing its inclusion in the JPM GBI EM Global Diversified Investment Grade Index. If this weeks FOMC meeting and a raft of important US economic indicators, most of all the Non- Farm Payrolls, fail to ignite a wideheld anticipation of a jump in US Treasury yields, then the ROMANI 6.75% 21 may be poised for a leg lower in yield given that the yield on the benchmark 7y UST is 155 bps below Romanian USD denominated debt with a similar maturity.

Analysts’ Views:

RO Bonds: Romania took advantage of strong interest in local debt paper and raised about RON 1.7 bn in two separate auctions. The debt managers sold RON 1 bn in one-year T-bills, while the remaining amount, RON 678 mn, was raised in a new ten-year T-bond issue. The average yields stood at 4.23% for the T-bonds and 1.93% for the T-bills (-59 bps compared to a previous auction held five weeks ago). Low inflation, which renewed expectations of further NBR monetary easing in 2H14, and the latest JP Morgan announcement that it is going to include Romanian bonds in an investment-grade country index, have helped push yields to record lows in recent months. Despite this, we see yields going higher, mainly due to the coming presidential election scheduled for early November and heightened geopolitical tensions in the region. Our 5-year yield call for December 2014 is 4.3%.

CZ Macro: According to their updated economic forecasts, the Ministry of finance expects the 2014 budget deficit to settle at 1.5% of GDP, which is lower than the previous estimate of 1.8%. At the same time, the Ministry increased its GDP forecast from 1.7% to 2.7%, which is close to our own view. The improved deficit outlook and cash management is also reflected in the cancellation of summer T-bill auctions. The decline in the supply on the bond market helps spreads to remain compressed and could even cause a further spread narrowing from current levels. We expect 10Y yields to reach 1.67% at the end of this year, conditional upon an increase in Bund yields.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.