Chart of the Day:

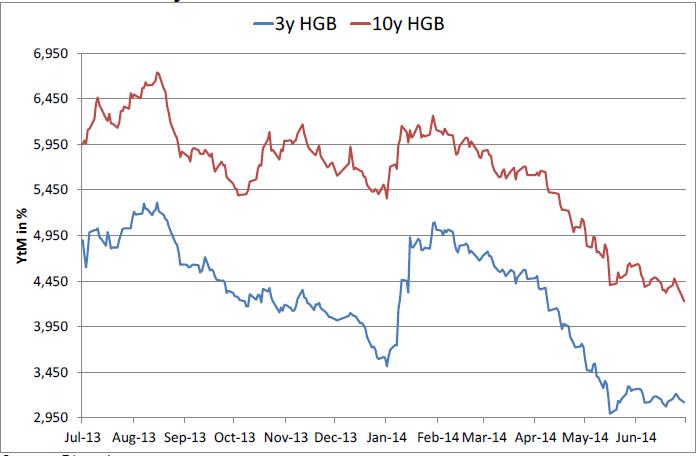

HGB Yield Curve: Whilst yields on shorter dated HGBs are bouncing along historical lows, the drop in yield in 10y HGBs is accelerating.

Analysts’ Views:

HU Rates: The central bank is expected to reduce the policy rate by another 10 bps at today’s meeting, thus lowering the key rate to 2.2%. Benign price developments (inflation stuck in the red) continue to give a reason for further easing, while market sentiment also gives some room for further reductions. (T-bill auctions last week already brought yield levels below 2%). More important than the rate decision itself will be the wording of the MPC press statement after the meeting. The easing cycle is approaching the end (most likely at 2%), and thus, some indication about the end of the cycle may already appear in the statement, similar to comments made by a few rate setters over the previous few weeks. Subsequently, we forecast an increase in 10y HGB yields from here on over the next 12 months and a stable to slightly stronger HUF vs EUR.

RO Bonds: The MinFin re-opened a 10-year T-bond issue with a remaining maturity of less than seven years. Decent demand allowed the debt managers to raise more funds than they had initially planned (RON 557 m vs. RON 300 m). The average accepted yield fell to 3.9%, from 4.13% at the last reopening in mid-June. We continue to see yields going higher towards year-end, mostly based on November's presidential election, the potential break-up with the IMF and (last but not least) the heightened tensions in the region. Our 5-year yield call for December 2014 is 4.3%, commensurate with a drop of more than 4 ppts in price.

Traders’ Comments:

CEE Fixed Income: HGBs roared ahead yesterday, especially the long end. The 3y10y spread is now around 110 bps, down from more than 200 bps in January this year. It seems the MNBs attempts to push excess liquidity out of the short end into longer dated HGBs are meeting with some success. Markets will watch closely to see what kind of sanctions will be imposed by the EU on Russia which will obviously be growth negative and probably unleash some kind of retaliation from Russia but US CPI will be the big data release today. Whilst markets appear incredibly complacent when it comes to geopolitical developments, US inflation has been rising lately and an increase over and above analyst expectations is much more likely to be the catalyst for the increase in volatility that many feel is inevitable once US monetary policy becomes less predictable.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.