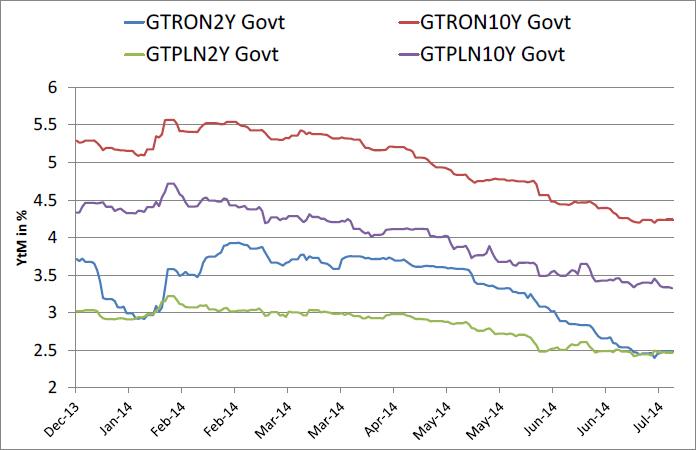

Chart of the Day:

ROMGBs vs POLGBs: The 10y2y Spread in Poland has fallen from 155 bps to 85 bps ytd. In ROMGBs it has risen from 120 bps in May to roughly 180 bps currently. The respective 2y bonds offer the same yield but 10y bonds are roughly 100 bps apart. So is there relative value in 10y ROMGBs? The currencies have displayed a similar performance this year (appreciating slightly vs EUR) but key rates are 100 bps higher in Romania and the NBP is resisting calls to cut further given central bank expectations of a rise in inflation to 1.4% next year whilst the NBR is cutting reserve requirements as CPI continues it’s decent to record low inflation rates. 2y ROMGBs are telling us, the NBR has more cutting to do.

Analysts’ Views:

HU Macro: The GKI-Erste business and consumer confidence index slid to a 6-month low, reaching -3.9 points in July. (In June, the index was still -1.0.) The decline is solely attributable to the decrease of the business confidence indicator, while the index of consumers remained roughly the same for the third consecutive month. As the decline is due to the deterioration in business expectations and not due to the worsening of consumer confidence, the index likely reflects the weakening of industrial expectations already seen for some months now in region-wide (and German) purchasing manager indicators. We think that the central bank will likely find the arguments to slash the policy rate further at tomorrow’s rate-setting meeting, at which the rate can be cut by another 10bp. Our market forecasts remain unaffected by today’s release.

Traders’ Comments:

CEE Fixed Income: Whilst Croatian Eurobonds are under a bit of pressure preceding the expected rating downgrade, domestic bonds are still well bid and the premium on EUR linked domestic bonds vs EUR denominated Eurobonds is shrinking. The spread between Croati22 € and local Eur22s has tightened to only 15 bps from almost 50 bps just one month ago. Serbian paper was under selling pressure last week with yields rising 20 - 25bps on the Eurobonds. The longer end was under the most pressure with Serbia21s now offered at 5.15% (+25bps w/w) but we now expect to see more buyers given that it is hard to find bonds in our region yielding more than 5.00%. Today Romania will re-tap the 7Y residual maturity bond DBN032 with a RON 300 m planned issue amount. Our guidance is for a yield of 3.92% +/- 5 bps.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.