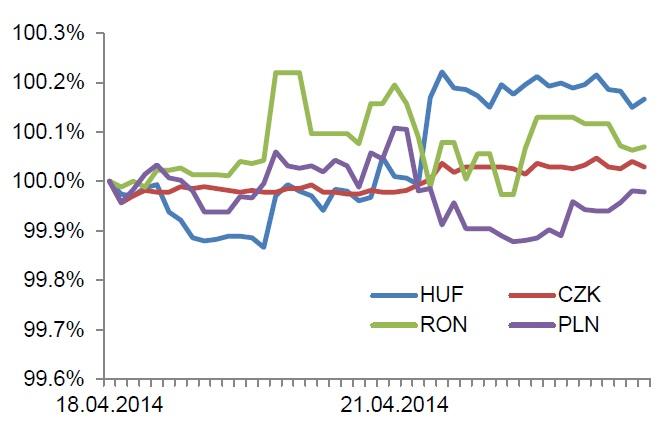

Chart of the Day:

Relative currency performance vs. EUR during the Easter holidays. An increase means weakening against EUR.

Analysts’ Views:

CEE FX: During yesterday’s session, the Hungarian forint stood out as the worst performer amongst CEE currencies. There was no real news behind this development, apart from some worrying news flow regarding the Russian- Ukrainian situation. However, the latter should theoretically affect all CEE currencies and not just the forint.

Traders’ Comments:

CEE Fixed Income: Low activity over the Easter holiday means we have relatively little to report in terms of price movements over the extended weekend. In terms of potentially market moving economic data this week, the calendar looks quite thin. Confidence data may give us the first indication how the real economy is reacting to the crisis in Ukraine and March Retail Sales data in Poland is expected to come in weaker than the prior month according to a survey run by Bloomberg. Weaker economic data would likely amplify the curve flattening trends that have been prevalent across CEE fixed income year-to-date. Positive surprises in the unemployment rate over the last 3 months points to an improving labour market in Poland and the revision to recent GDP data showed a shift towards a larger contribution to growth from domestic demand and, hopefully, a broadening of the recovery. This should bode well for retail sales so if the numbers disappoint, long-dated POLGBs, which have been lagging Bunds and other CEE fixed income markets as of late, may be in for a renaissance. Of the 23 analysts surveyed, the lowest estimate is 4.1% and the highest is at 7.4% vs 7.0% in the prior month. The median estimate is around 5.9% with the distribution skewed to the upside.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.