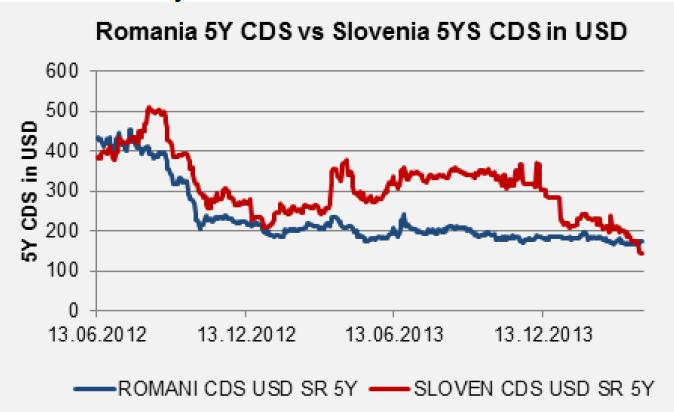

Chart of the Day:

Slovenia: The credit risk premium on Slovenian CDS has fallen below Romania for the first time since mid-2012, as investors display an increasing willingness to fund countries that were on the brink of default not long ago.

Analysts’ Views:

CZ Bonds: According to the MoF, the central government’s debt-to-GDP ratio declined from 43.3% to 43.1% in 1Q14 as the budget surplus went up by CZK 30bn y/y (0.7% of GDP) from CZK 14bn in 1Q13. While the sum of total central government expenditures remained roughly the same in 1Q14 y/y, the surplus rose largely due to an annual increase in VAT and excise tax collection. These Recent figures give a strong reason to hope that the MoF will use the additional liquidity to decrease the issuance activity of new debt, as the total amount of liquid state financial assets adds up to more than CZK 160bn (4.1% of GDP) with available cash resources representing the majority of reserves. Recent developments pose a downward risks to both our general government debt forecast (48.3% of GDP) and the budget balance assumptions (2.6% of GDP) as it cannot be ruled out that the general government debt-to-GDP ratio will even decline for the second consecutive year in 2014 (currently at 46%). Despite the weak supply prospects, we expect some rise in yields until this by year-end (10Y yields are assumed at to reach 2.37% at end-2014).

PL Macro: The current account deficit narrowed to EUR -572mn in February, due to the surplus on the trade balance and the positive balance on current transfers. In the upcoming months, however, we may see some widening, helped by improving domestic demand and accelerating import dynamics. The recovery of the economy should have an impact on the budget deficit as well. As Finance Minister Szczurek commented, the general government deficit should be well below 3.9% of GDP this year (excluding the impact of the pension reform) and below 2.8% next year. Poland should, therefore, meet the EC criteria and exit the EDP next year. Overall, the improvement in the economic situation should support the zloty’s appreciation toward 4.14 (EURPLN) by the end of 2Q14 and further to 4.04 by the end of the year.

Traders’ Comments:

CEE Fixed Income: It looks like we won’t be short of potential market moving events this week with tensions rising in Ukraine, Chinese GDP, EZ inflation, a raft of economic data in Poland and a number of Fed speakers all queuing up to hit the wires ahead of Good Friday.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.