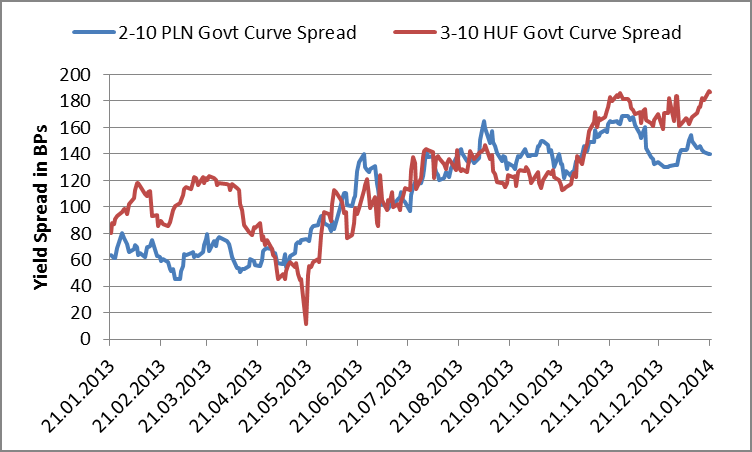

Chart of the Day:

HGB / POLGB Yield Curves: Whilst the MNB prepares to cut once more to shore up a weak Hungarian economy, the NBP is sending signals that it may soon begin raising key rates. The effect of the relatively stronger economy in Poland has not gone unnoticed by investors as the steepening trend in the yield curve starts to turn and longer dated POLGBs outperform similarly dated HGBs.

Analysts’ Views:

HU Rates: We expect the MPC to reduce the policy rate 10 bps to 2.90% today, in line with the council’s more cautious statement published after the latest monetary meeting in December. However, given some rate setters’ dovish comments in the last couple of weeks, reducing the base rate to 2.80% should not come as a major surprise to the market either. Uncertainties surrounding the bottom of the ongoing rate cutting cycle remain and we thus see a downside risk to our forecast of 2.80% as the external market sentiment looks like it will remain supportive for a longer period of time. However, the lower the base rate, the higher the possibility that the forint will weaken considerably in the case of a negative turnaround in global market sentiment. To sum up it, we see upward risk to our EURHUF predictions (currently 300 Q114, 299 Q214 298 Q314 & 297 Q414).

RO T-bonds: The MinFin managed to raise more money than the initial target at yesterday’s T-bond auction maturing in November 2018 (RON 714 mn vs. RON 500 mn). The average yield went down sharply to 4.15%, compared to 4.9% at a similar auction held in early December 2013. Investors put in bids totaling RON 1.9 bn (bid-to-cover: 2.6). After Romania tapped the US market with 10- and 30-year bonds worth USD 2 bn in January, a government official said that the treasury managers were going to issue another bond in the global markets before the end of 1H14. On the secondary market, we see 5-year Tbond yields at 4.30% in March and 4.8% in December 2014.

Traders’ comments:

CEE Fixed Income: Industrial Output & PPI figures are expected to confirm the goldilocks growth without inflation scenario in Poland today, creating perfect conditions for cash corporates. Small wonder then that P4 Sp. z o.o., Poland’s fourth-largest mobile-phone operator, announced its intention to sell a total EUR 870 mn of various bonds just as borrowing costs for high-yield issuers fall to a record low. In the government bond space, ROMGBs continue to roar ahead. The 5y auction met with strong demand yesterday with the average accepted yield coming in 5 bps below expectations at 4.15%, enabling the MoF to issue RON 700 m, 40% more than planned.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.