Leading up to Brexit, we were looking at four possible trades, described in these two posts:

XAUUSD long and FTSE100/UK100 short

All four trade scenarios showed Blue Box zones which delineated potential turning points that could have turned into trades if there were signs of reversal of momentum.

The “nothing” news: AUDJPY blew through its Blue Box without providing an opportunity for an entry.

The bad news: Two of those trade scenarios created false entries, resulting in two losses.

The good news: Three of those trade scenarios (we took a second entry in XAUUSD) then proceeded to blow beyond our expectations of profitability as the Brexit results came in.

The “Nothing” News Trade

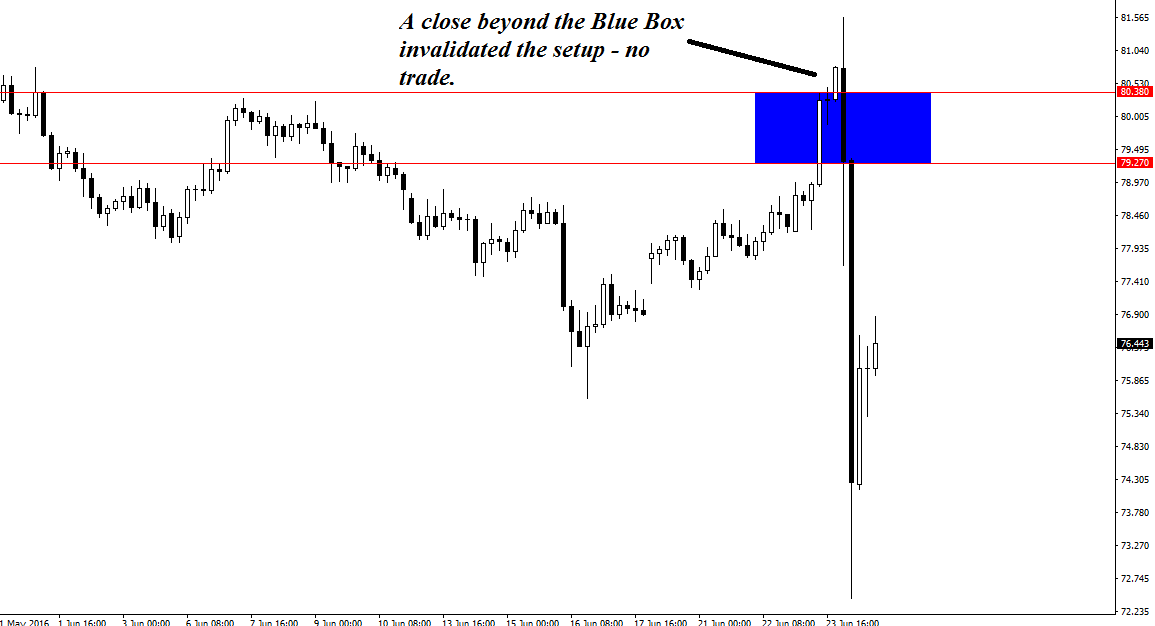

Figure 1 shows the AUDJPY result. Price closed beyond the Blue Box, which invalidated it in our book.

Figure 1: Four-hourly AUDJPY Provided No Trade

The Bad News Trades

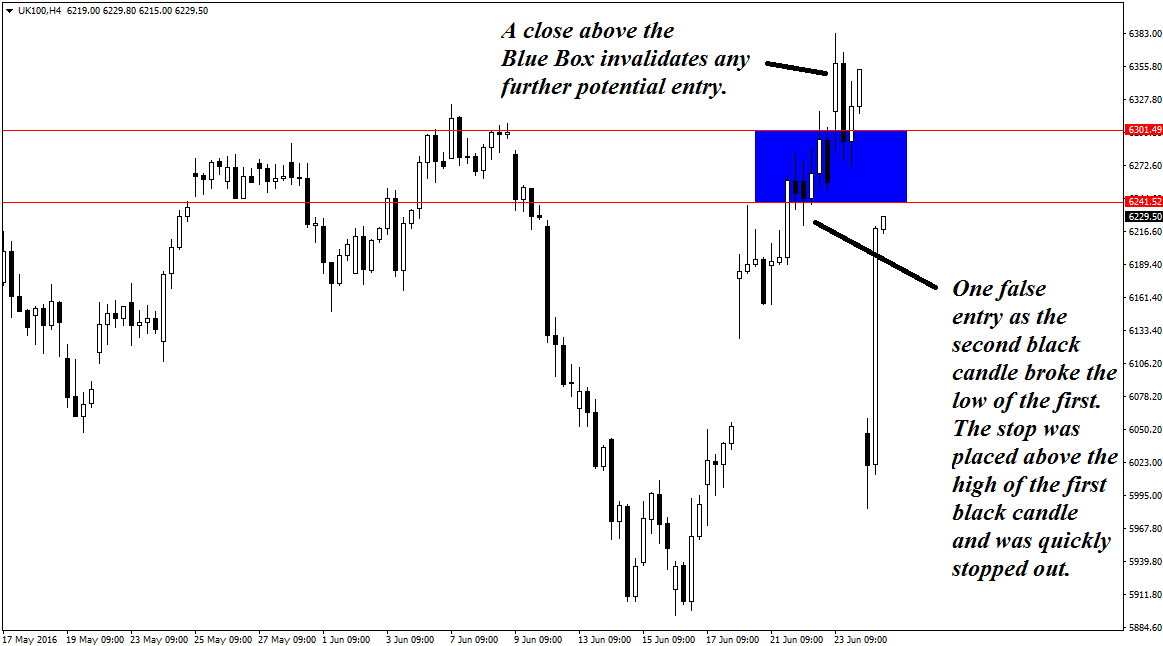

Trade 1. UK100 gave a false entry and one losing trade before it invalidated the Blue Box, shown in Figure 2. It would have been nice to be able to say the short worked, but it did not, and trading rules are trading rules. So much for that – now on to the good part.

Figure 2: UK100 Delivered a Rap on the Wrist

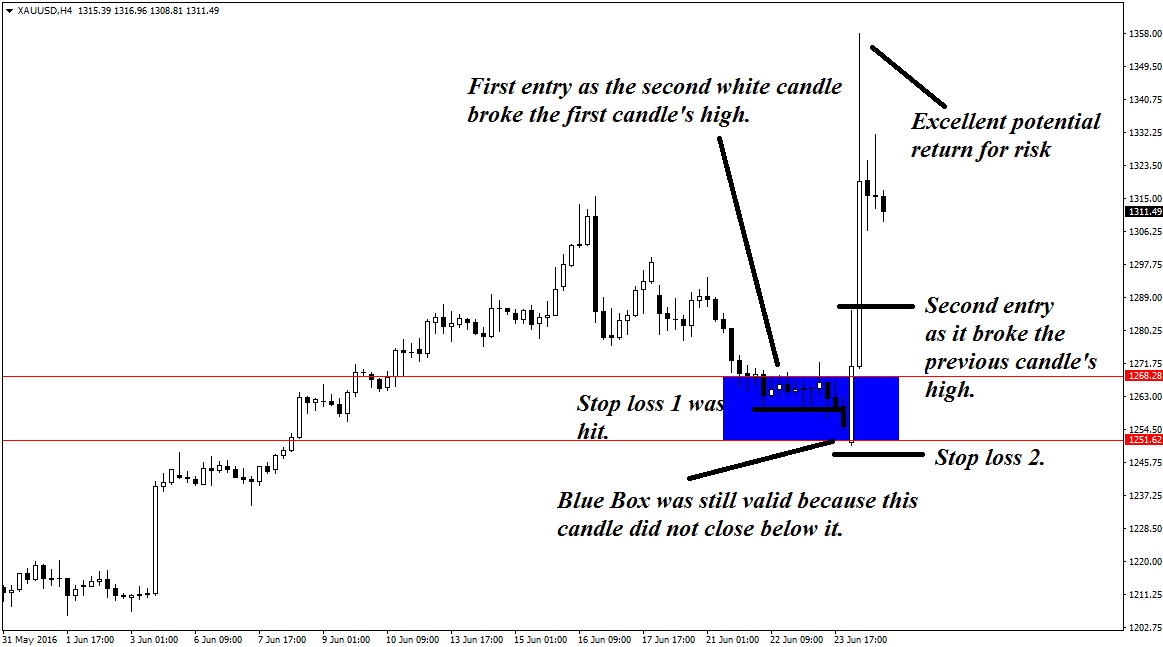

Trade 2. Gold was next in line. XAUUSD fiddled about as the referendum approached, causing us to enter on a false signal that resulted in an initial loss. It is marked as the first entry in Figure 3. However…

Figure 3: Two trades on XAUUSD.

The Good News Trades

Trade 3: Gold went a little lower, but as the results became more and more alarming to those positioned for a “stay” result in the referendum, it made a quick reversal, giving our second entry, also shown in Figure 2. As traders will readily appreciate, there was potential for a lucrative potential gain as the market took flight to the safe haven commodity.

(Note: We generally permit two entries per Blue Box, after which they are invalidated, provided price action does not invalidate them by closing beyond them.)

So much for that. Now for the really good trade.

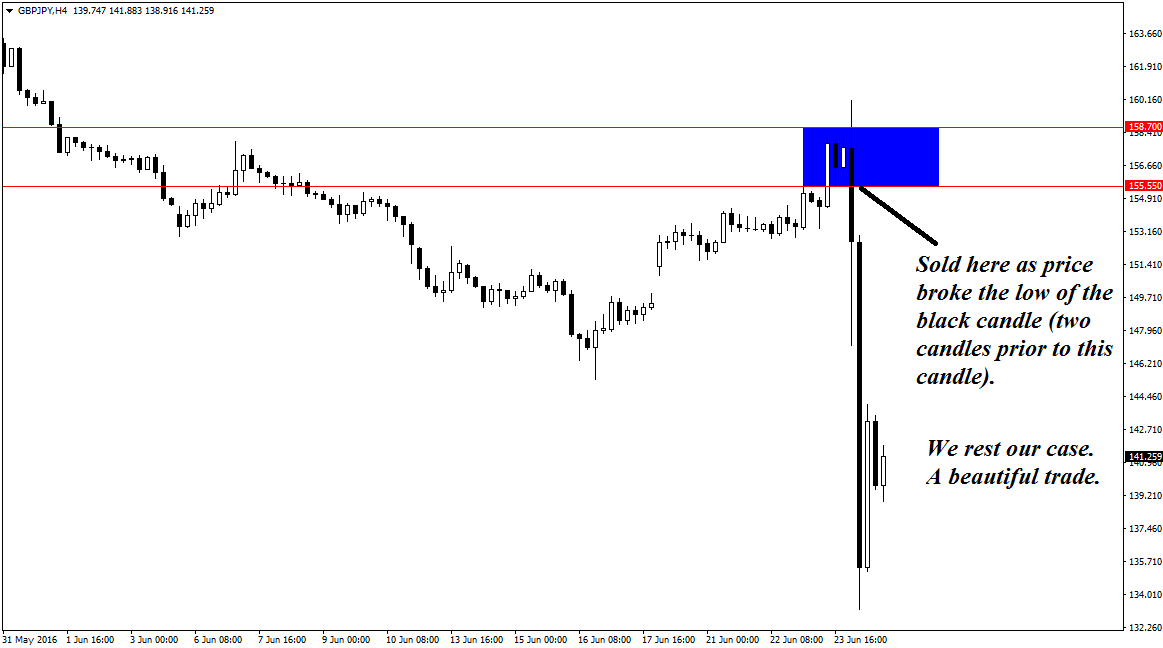

Trade 4: GBPJPY is the trade that really shone this trading campaign. A picture is worth a thousand words. Figure 4 speaks for itself.

Figure 4: GBPJPY’s Spectacular Drop!

Takeaways:

This would be a pointless article if all it did was gloat about the net gains. There are important lessons to be learnt from this:

- You may have an opinion, but trust the price action. I personally did not think Brexit would occur. However, the setups occurred, and the trades were valid. This is an excellent example of having faith in one’s trading system. Yes, it was not perfect – there were two losing trades. However, the two winning ones were more than adequate to offset the losing trades.

- Trading plans must be specific, particularly with regard to exits. For example, some Blue Box traders would already have cashed out today. Others would continue to hold for a bigger move. My personal trading plan would call for a scaling out of some profits, and holding a smaller position for a larger move. If new trends develop from this, as those who focus more on fundamentals would think they must, then there will be new opportunities to add on.

- The third point is worth remembering for the next time a world-shaking event occurs. It is the same point I made in the first article: More money is potentially made by positioning counter to the move that everyone expects. Today’s results erased the move of the entire week and more in a matter of hours. Yes, traders will need to focus on sharpening their abilities in anticipating market turning points, but it can be done, as hopefully this has demonstrated. Real life trading is nowhere near as neat as newer traders would sometimes wish, but it can still be done with a good degree of success.

RISK DISCLOSURE: Trading foreign exchange (FX) and contracts for difference (CFD) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in FX or CFDs you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with leveraged trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD bounces to 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to test 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY drops to test 154.00 on Japan's intervention warnings

USD/JPY extends losses to test 154.00 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone. Focus shifts to more Fedspeak and US data.

Gold price finds buyers again near $2,355 as USD licks its wounds

Gold price is attempting a tepid bounce in the Asian session, having found fresh demand near $2,355 once again. Gold price capitalizes on a softer risk tone and an extended weakness in the US Treasury bond yields, despite the recent hawkish Fed commentary.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.