In the week after the Brexit referendum result, anxiousness is likely to be common in the markets. Headlines regarding the pound crashing populate the landscape. The most important point to bear in mind, however, is that price relationships move in waves and cycles, and rarely go in a straight line. Even on Friday, the panicked intraday sell-off was balanced by a pullback at the end of the day, as will be seen in Figure 1.

Figure 1: The Pullback on GBPUSD

Does this mean the sell-off was overdone? Unlikely. However, it does mean that traders who wish to profit from this situation would do well to stand back, take a deep breath, and then refocus on the opportunities. What are they? There are many opportunities that could emerge in the current market, but since we shall devote attention the pound in this article as that is one of the currencies in the immediate spotlight.

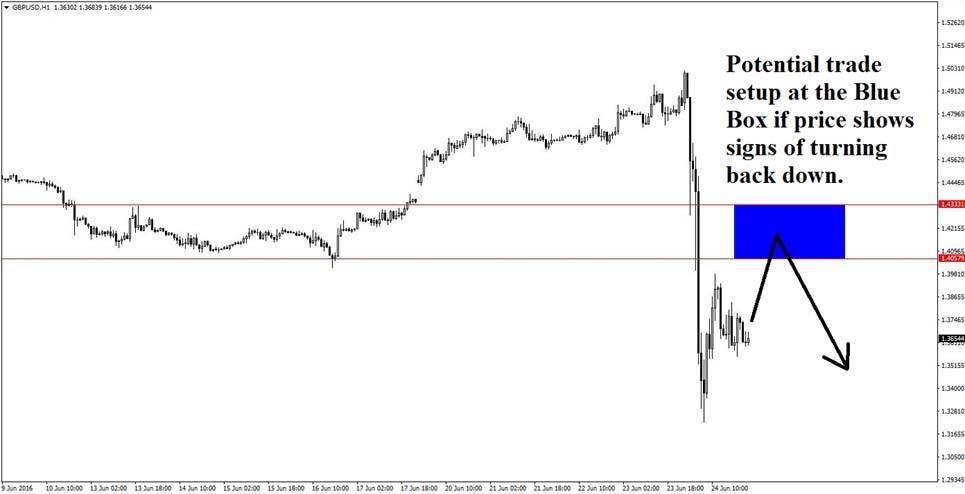

A large portion of what to do will depend on how Monday opens. The best opportunity would be if Cable rose higher to enable new shorts to be entered. Figure 2 shows the appropriate Blue Box zone (1.4057-1.4333) of interest. Traders should not assume that it will automatically turn here, but instead await appropriate trade triggers before entering.

We are particularly interested in the hourly chart formation, and for this timeframe, candlestick reversal patterns such as the bearish engulfing pattern, the pin bar and the bearish piercing pattern would be of interest.

Figure 2: GBPUSD’s Blue Box

What if price continues lower instead? That could prove interesting. There are three potential zones of interest, as shown in Figure 3 below.

Figure 3: Zones of Potential Support

The three zones are:

1.2803-1.2993

1.2088-1.2356

1.0746-1.1208

Traders who believe that the sell-off was overdone might choose to take longs from these zones. However, it is worth bearing in mind that to do so would be to countertrend trade, and thus it would be wise to take most profits quickly, leaving only small positions to run.

RISK DISCLOSURE: Trading foreign exchange (FX) and contracts for difference (CFD) on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in FX or CFDs you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with leveraged trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.