Bitcoin collapsed like a house of cards on Thursday with prices dipping below $13000, after South Korea announced its plan to ban cryptocurrency trading.

This selling pressure was compounded by recent comments from financial heavyweight Warren Buffet,who warned that “cryptocurrencies will come to a bad end”. With Bitcoin entering the New Year struggling to fully regain its mojo, and bulls simply nowhere to be found this week, could the party be coming to an end?

It is widely known that a candle flickers most violently just before burning out, could this be the story of Bitcoin and most cryptocurrencies this year? Time will tell.

Taking a look at the technical picture, Bitcoin is under noticeable pressure on the daily charts, with prices struggling to keep above $13000 as of writing. Sustained weakness below this level may open a path back towards $12000 and $10000, respectively.

Oil prices jump to multiyear highs

Oil prices have been undeniably bullish this week despite the lingering concerns over the current bull rally running out of steam. WTI Crude ventured to levels not seen since December 2014 at $64 during Thursday’s trading session, after sentiment was uplifted by an unexpected draw in U.S crude inventories in official data on Wednesday.

It is becoming clear that the combination of major supply disruptions, geopolitical risk and growing optimism over OPEC’s supply cuts rebalancing markets, are likely factors behind oil’s impressive

resurgence. While further upside is still on the cards amid the current market optimism, it must be kept in mind that rising production from U.S Shale has the ability to expose oil to downside risks. Taking a look at the technical picture, WTI Crude is unquestionably bullish on the daily charts, with a breakout above $64 opening a path towards $65.60.

Global shares mixed as Wall Street rally cools

Asian stock markets were mostly lower during early trading on Thursday, following Wall Street’s decline overnight. In Europe, shares opened on a mixed note amid the caution, and this sentiment could trickle back down into U.S stock markets later in the afternoon.

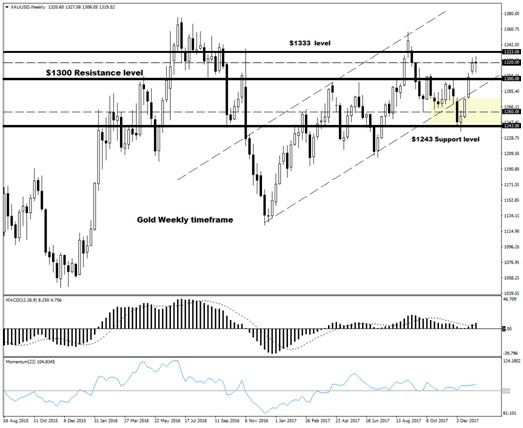

Commodity spotlight – Gold

Gold edged slightly higher on Thursday with prices hovering around $1320 as of writing, thanks to a weakening Dollar.

With the Greenback somewhat shaky and still struggling to gain ground, Gold is likely to remain supported moving forward. Taking a look at the technical picture, the metal still fulfils the prerequisites of a bullish trend on the daily charts. There have been consistently higher highs and higher lows, while the MACD has crossed to the upside. Bulls remain in control above $1300 with a solid breakout, and a weekly close above $1320 opening a path towards $1333.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.