In short: no speculative positions.

The Winklevoss twins seem to be connected to everything about Bitcoin that has hit the media recently. This is an exaggeration but the brothers have been reported to be working on a new regulated Bitcoin exchange, on a Bitcoin ETF. It turned out that they were beaten to opening the first regulated exchange by Coinbase but the brothers seemed undeterred as they spoke with CNN Money:

They [the twins] predict Bitcoin's market capitalization could easily skyrocket to at least $400 billion, or roughly the combined size of modern day payments companies like American Express (AXP), Visa (V), MasterCard (MA) and Western Union (WU).

But the Internet entrepreneurs are taking it one step further. They believe Bitcoin could one day morph into a gold-like asset class -- or even surpass it.

"If Bitcoin is a better gold or seen as a type of gold-like asset, then it could be in the trillions on a market cap," Tyler Winklevoss told CNNMoney. "We do feel those are very real possibilities."

(…)

The twins believe such an ETF would appeal to gold bugs because Bitcoin, just like gold, can be used as a hedge against inflation. They say Bitcoin is more durable, divisible and affordable than the yellow metal.

"If you like gold, there are many reasons you should like Bitcoin," said Cameron Winklevoss.

These statements seem somewhat optimistic. With a total cap of under $4 billion, Bitcoin is very far from the targets proposed by the twins. The current cap of the currency is about 1% of what the brothers envisage for the cryptocurrency. Is it possible for Bitcoin to overtake part of the credit card and money transfer market? Yes, but Bitcoin getting close in size to the combined market cap of major credit card companies seems highly speculative. Bitcoin could go in this direction but we haven’t quite seen that yet and if it’s to gain market cap, we would argue this would take place over the long term, years rather than months.

Another frequently repeated mantra is that Bitcoin is a kind of “new gold.” This is far-fetched, since Bitcoin has been around for only a couple of year whereas gold’s been around for thousands of years. So, Bitcoin’s track record of an alternative asset is nothing to compare with that of gold. We wouldn’t argue that it’s better than gold. More to the point, it’s simply different.

Having said that, it’s still an interesting alternative asset. For starters, because it doesn’t seem to be influenced very much by the stock or bond markets. Bitcoin can appreciate relatively independently of the developments in other markets, which makes it valuable for diversification.

Also, if it turns out that the Bitcoin ecosystem blossoms and this translates into appreciation, a small (!) position in Bitcoin could favorably influence one’s portfolio.

For now, let’s take a look at the charts.

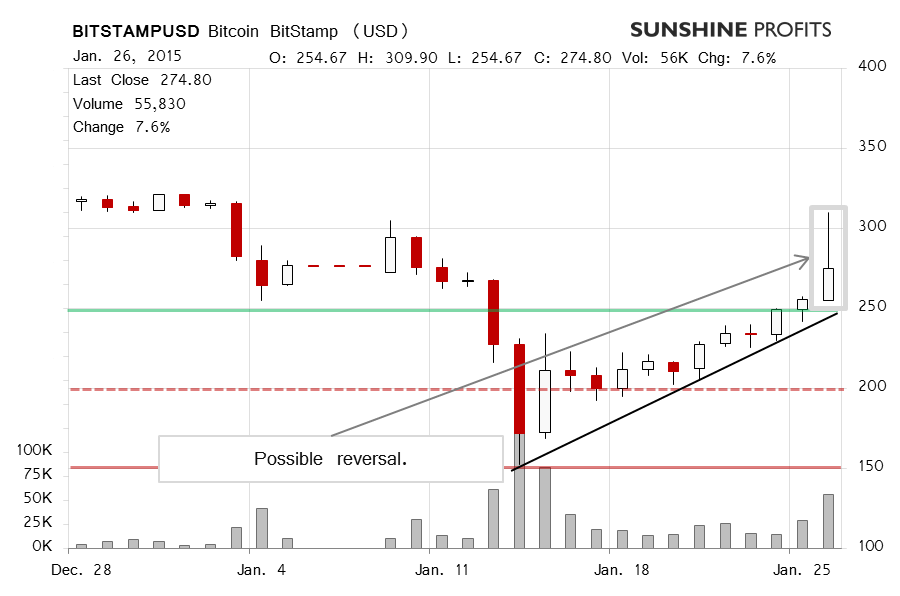

We saw very significant appreciation yesterday on BitStamp. The volume shot up to over BTC55,000. This was the highest level of volume since the violent rebound of Jan. 15 and Bitcoin hit a high of almost $310. At first sight, this was a very strong speculative long signal. But looking deeper, it was possibly more complicated than that. Yesterday we wrote:

Bitcoin went up to above $300 and the volume was also definitely up and relatively significant. Again, this looks like a very bullish development. But there seems to be more to it than just appreciation.

Most notably, Bitcoin has already corrected both on BitStamp and BTC-e from above $300 to around $275. Also, the moves down took place on relatively high volume compared with the moves up. This makes today look like a possible reversal.

At present, our best bet is a reversal and a move back to the possible declining trend line in the proximity of $250. The situation is too unclear to open speculative positions at this time and it looks like there might be more volatility to come. If Bitcoin comes back down below $250, we might bet on the market going down but this is not the case yet.

As a matter of fact, the currency took a dive not only yesterday but also earlier today (this is written around 12:00 p.m. ET), slipping below $250 (solid green line in the chart) and a possible rising trend line (marked in black) at one point. This was a very bearish development since it suggested that Bitcoin might be in for yet another fall.

However, the cryptocurrency has returned to around $260 and above the trend line since then, making the bearish implications somewhat weaker. The volume hasn’t been very weak but at the end of the day it might be lower than yesterday (the day is not over yet, mind).

On the long-term BTC-e chart, the recent breakout above a possible declining trend line is visible. Bitcoin retraced back below this line and below the $250 level (solid green line), but came back above both of them. The move below $250 was a pretty bearish development but the appreciation above this level made the bearish implications a lot weaker.

Currently, the volume levels don’t quite suggest what the next move might be. Our best bet is that Bitcoin might move down again but the fact that the cryptocurrency has held up above $250 suggests a risk of a further move up. The situation in the market is very tense now. We might suggest going short if Bitcoin drops below $250 and this is our best bet. This is not the case just now and a move up is not to be ruled out.

Summing up, the situation is very tense we think it’s best to hold off opening speculative positions.

Trading position (short-term, our opinion): no positions.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.