Briefly: we don’t support any short-term positions.

Western Union is discontent with the fact that its ads are spoofed by comparing the firm’s services with the capabilities of the Bitcoin network, we read on CoinDesk:

Western Union has reportedly taken action against a bitcoin spoof of one of its ads, triggering a backlash from proponents of the digital currency.

The parody in question was an image posted on the 'Bitcoin' Facebook page by bitcoin enthusiast Dave Aiello, who also placed it on Reddit. The spoof, which makes a humorous comparison between the price of sending money via Western Union and bitcoin, proved popular among Redditors, who were quick to share the image. (…)

Western Union told Ars Technica that it takes "all brand matters seriously" and takes steps it deems necessary to protect its intellectual property. However, the company's representative did not wish to answer any specific questions on the matter. (…)

In the end, the DMCA notice may end up being a Pyrrhic victory for Western Union, as the spoof in question might have gone unnoticed by the general public had it not been for the controversy.

Vox described it as an example of the 'Streisand effect', a term that describes how attempts to suppress information in the Internet age often have the exact opposite effect: compelling more people to view and publicise the controversial material rather than less.

Western Union might have shot themselves in the foot with this. This is precisely because of the “Streisand effect” – presumably not many people had seen the spoof before it was reported by the company to Facebook. It’s fairly possible that the said image will get a relatively wider audience now, because of the fact that people have taken notice of Western Union’s action.

It seems to us that this might be overreaction on the part of the money transfer firm. It’s probably not because Western Union exactly sees Bitcoin as a huge competitor at the moment but it shows that the company might not be very fond of sharply delivered comparisons of its fee structure with the relatively low costs of Bitcoin transfers.

For now, let’s turn to the charts.

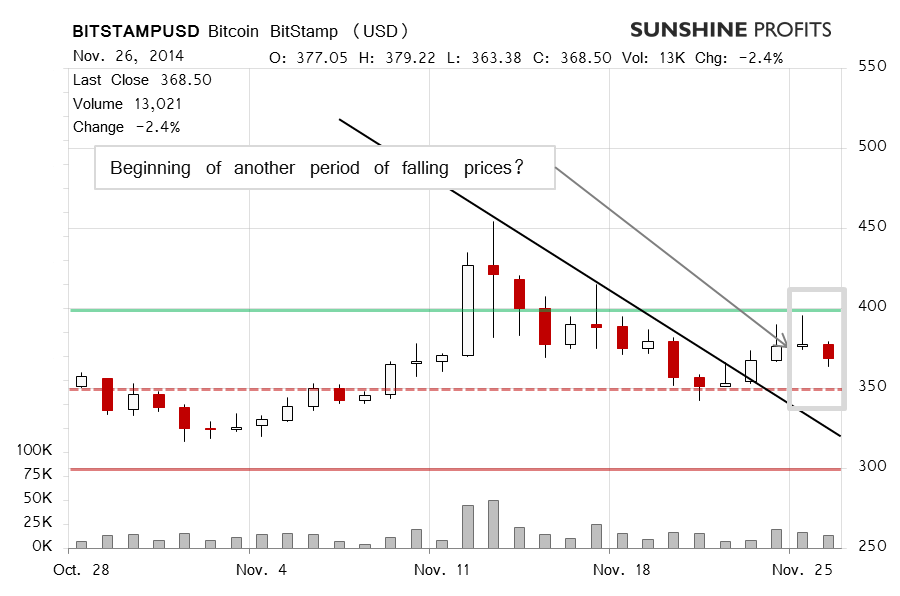

On BitStamp, there was visible downward pressure yesterday. The currency fell below $370 and the volume was still significant. Consider what we wrote yesterday:

We in fact saw a third higher close yesterday but the fact the Bitcoin went up from around $375 to $395 only to decline again on relatively significant (but falling) volume doesn’t inspire too much confidence and we don’t see this as a signal of a further move up starting just now.

This is the case also today as we’ve seen a slight move down (this is written around 10:30 a.m. ET). There are two things to consider while analyzing this. The volume has been visibly lower than yesterday and we have so far seen a move down and a rebound that has almost erased all of the losses. (…) The fact that the volume has been low suggests that this is still not the important move.

As it turned out, a possible bounce to the upside was denied yesterday and, as such the move was not the beginning of a new rally. On the other hand, the volume picked up later in the session (although it still was lower than on the day before). Where does this leave us?

First of all, yesterday was a first stronger decline in a couple of days (looking at the closes). The day before yesterday we saw a move up denied and a close not far from the daily open. These two moves look very much like a possible reversal to the downside.

On the other hand, Bitcoin has gone slightly up today (this is written after 10:00 a.m. ET). The currency appreciated to around $375 before dropping back below $370. Overall, the move has been to the upside but the volume has been relatively low, far lower than in the last couple of days. Taking this into account, today doesn’t seem anything more than an blip, at least not at this point.

On the long-term BTC-e chart, there hasn’t been too much change since yesterday. Bitcoin is still between $350 and $400. If anything, the situation has become more bearish based on the fact that Tuesday looks very much like a local top – it might turn out to be one but it’s still not sure.

Yesterday, we wrote:

(…) Bitcoin might go up to $400 but the two days of moves down (today is still not over, mind) make us more concerned about the possibility of a drop, which suggests that it might be better to wait on the sidelines just a little longer.

Taking into account today’s drop, our yesterday’s comments are even more valid today. Right now, the situation looks more bearish than yesterday, in spite of the move up we’ve seen today. The mixed signals, a possible top behind us but also a possible breakout from the downtrend, prescribe caution at this time. It still is the case that waiting for a more favorable environment to enter shorts or longs might be a good idea.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.